The JPMorgan USD Emerging Markets Bond iShares – EMB ETF (ISIN: US4642882819) tracks the performance of an index comprised of U.S. Dollar denominated emerging market bonds. It exposes its holders to primarily government bonds issued by emerging market nations and has sovereign debts of over 30 emerging market economies in the single fund.

The EMB ETF plummeted 22.44% in 2022 as central banks worldwide went on a tightening cycle to fight off growing inflation with rate hikes. The ETF lost a significant portion of its value due to the inverse relationship between bond prices and interest rates. Given that the bond market saw interest rates surging, already issued bonds lost value as new bonds were issued with more attractive interest rates; hence the EMB ETFs fall from grace. Will emerging market bonds find favour in the near future, with rates now seemingly at a peak?

Técnicos

The EMB ETF price dropped below its 100-day moving average in late 2021 and has never looked back. As the price continued to move in a downtrend, the gap between the price and the 100-day moving average widened, indicating that the ETF was under immense selling pressure, as represented by the prolonged period that the Relative Strength Index spent in oversold levels. Support and resistance were established at the $77.56 and $90.10 levels, respectively.

After exiting the descending channel pattern to the upside, bullish investors took the EMB ETF only as far as the resistance level at the $90.10 level before being met with excessive supply. A rejection of resistance is ongoing and has led the ETF to the 50% Fibonacci Retracement level at the $83.85 level on declining volumes, suggesting that bearish momentum is likely weakening. If bullish investors pile into the market and outdo bears, a reversal could play out, leaving the ETF exposed to the upside, with the $90.10 level likely earmarked as a point of interest by bullish investors.

Alternatively, if a breakdown below the 50% Fibonacci Retracement level ensues on high volumes, the EMB ETF could be led lower, with the support level potentially enticing bearish investors to stay the course. Bullish investors could look to enter the market at the $77.56 level if downside volumes begin tapering off, suggesting weaker bearish momentum.

Fundamentales

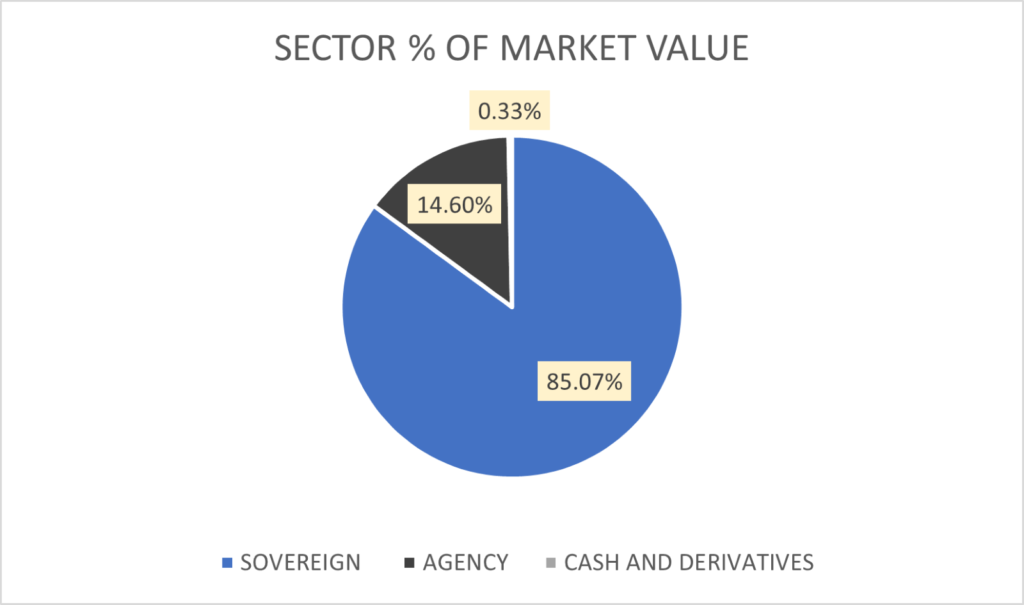

The EMB ETF mainly comprises sovereign bonds, which make up 85.07% of the $15.06B of Net Assets as of April 30 2023. Agency bonds follow, with nearly 15% of the composition, along with cash and derivatives, which make up a negligible amount of the total net assets of the ETF. Given that interest rates have been on the rise, emerging market sovereign debt is probably out of favour due to the availability of newer bonds with higher rates and better quality bond offerings in the developed world.

The EMB ETF is highly exposed to Mexico, Saudi Arabia, Indonesia and Turkish bonds, which comprise just over a fifth of the total net asset holdings. Among the emerging market economies, China is the stablest of them all, considering that it is a high-growth economy competing for first place with the U.S. economy.

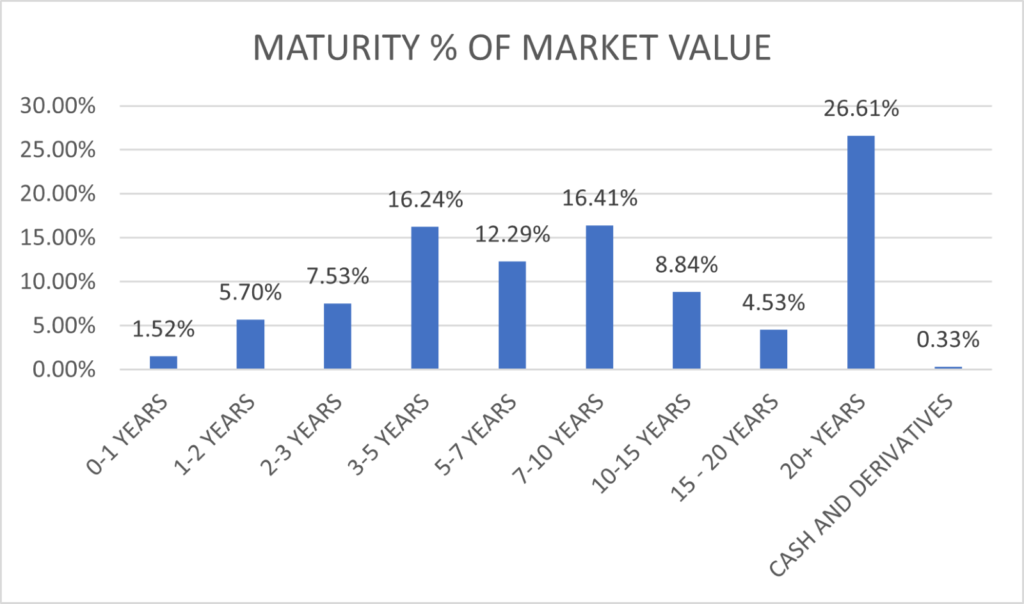

Over a quarter of the holding is exposed to 20+ year bond maturities, with the next most popular holdings allocated between the 7 and 10-year maturity and the 3 and 5 years maturity, making up 16.41% and 16.24% of the total net assets, respectively. Therefore, The EMB ETF is heavily skewed toward longer-term maturities, which tend to be more sensitive to interest rate changes due to their exposure to greater quantities of coupon repayments. The value of the ETF has been eroded due to the skew towards long-term maturities.

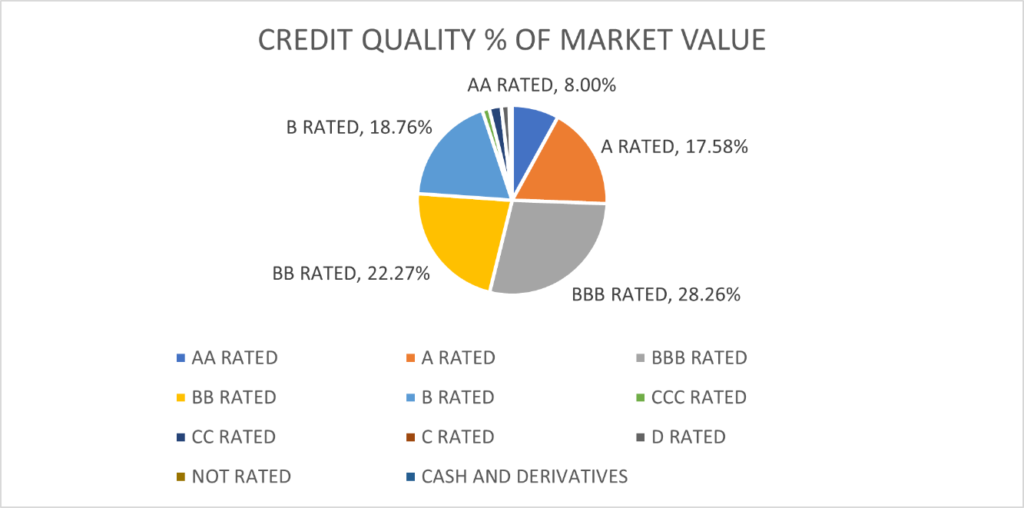

The EMB ETF is highly exposed to below-investment-grade bonds, classified with ratings of BB or below. Nearly half of the holdings, 45.83% of the market value, is in the below-investment-grade category, potentially leaving the ETF exposed to excess risk as a fair chunk of it also falls under junk status.

Resumen

The EMB ETF is heavily skewed toward lower-quality bonds, making it a relatively risky investment considering that interest rates are reasonably high and could be lifted even further to fight inflation. Investors will likely be cautious in placing funds into it and potentially consider buying the ETF at a steep discount. Support at the $77.56 level will likely be the most attractive point to long, given that the level has a history of excess demand over supply.

Sources: Ishares, Financial Times, Reuters, TradingView