Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Apple (ISIN: US0378331005), the tech giant and most valuable company in the world, has recently navigated a rollercoaster ride in the stock market. Despite surpassing Wall Street’s earnings projections for two consecutive quarters and achieving an all-time share price pinnacle in July, a sudden retreat by investors ensued.

In September, reports emerged of a potential ban on Apple iPhones for Chinese government workers, leading to a staggering $200 billion loss in market value. China, a linchpin for Apple, contributing 18% of its revenue and standing as its third largest market, magnifies the significance of this development.

However, a twist in the tale occurred when China’s Ministry Of Foreign Affairs swiftly responded, denying the existence of laws or regulations prohibiting the purchase and use of foreign brand phones like Apple’s. This episode unfolded amid an escalated Tech War between China and the U.S., culminating in a nearly 12% decline in Apple’s share price from its peak.

However, amidst this turbulence, a glimmer of positivity emerged with the launch of the iPhone 15, which outperformed its predecessor, the iPhone 14, by a notable 10% in unit sales, according to Wedbush. These twists and turns paint a vivid narrative of Apple’s resilience in the face of geopolitical fluctuations and its unwavering pursuit of innovation.

Técnicos

Apple’s stock trajectory unveils a promising uptrend, evident in its position above the 100-day moving average. A breakout from the constraining descending channel pattern affirms this upward momentum. The pivotal shift occurred upon surpassing the $176.11 per share threshold, which has transitioned from resistance to a sturdy support level.

However, the ascent met resistance at the $198.23 per share mark, catalysing a downturn spurred by regulatory pressures emanating from China. The critical question now rests on the resilience of the $176.11 support level. If upheld, it could beckon investors towards a landscape of potential gains.

Conversely, a substantial volume-induced breach beneath this level could signal a bearish sentiment, prompting attention to Fibonacci Retracement levels as intermediate support markers, notably the 50% and 61.80% levels. Given that diminishing downside volume accompanies the share price as it nears these levels, it could hint at a possible reversal. Should optimism reclaim the reins, aspiring investors may set their sights on the peak at $198.23 per share.

Fundamentales

The tech giant disclosed a quarterly revenue of $81.8 billion, marking a marginal 1% decline compared to the prior year. The decline was chiefly driven by a 4% dip in the products division, resulting in $60.58 billion in revenue.

Within the products segment, flagship product iPhone sales decreased by 2% to $39.67 billion. iPad sales suffered a significant setback, plummeting by 20% year-on-year to $5.80 billion, while Mac revenue dropped by 7% to $6.84 billion. These figures underscore a challenging market environment for key hardware products.

Despite the dip in iPhone sales, a positive trend emerged – a growing number of users switching from Android to iPhones, particularly in China. This shift bodes well for Apple’s market share and underscores the strength of its brand appeal.

In contrast, Apple’s Services division demonstrated robust growth, offsetting the overall decline. This segment, encompassing subscriptions, streaming, warranties, advertising, and payments, showed an impressive 8% year-on-year growth, following a 5.5% uptick in the prior quarter. The company effectively monetised its active base of 2 billion devices, with over 1 billion paid subscriptions significantly contributing to this positive trend. This surge in services revenue reached an all-time high, reflecting Apple’s success in diversifying its income sources and capitalising on its extensive user base.

Net income saw a modest increase, edging up by 2.26% from the same quarter the previous year, totalling $19.88 billion. This improvement was largely attributed to a better gross margin, rising by 126 basis points year-over-year to 44.52%. The products division played a pivotal role in driving this enhancement, indicating Apple’s efforts to optimise its hardware profitability.

Earnings per diluted share for the quarter stood at $1.26, demonstrating a commendable 5% increase from the previous year. However, investors remained watchful of Apple’s cautious outlook for the September quarter, anticipating a 1% year-over-year reduction in sales, with projected gross margins falling between 44% and 45%.

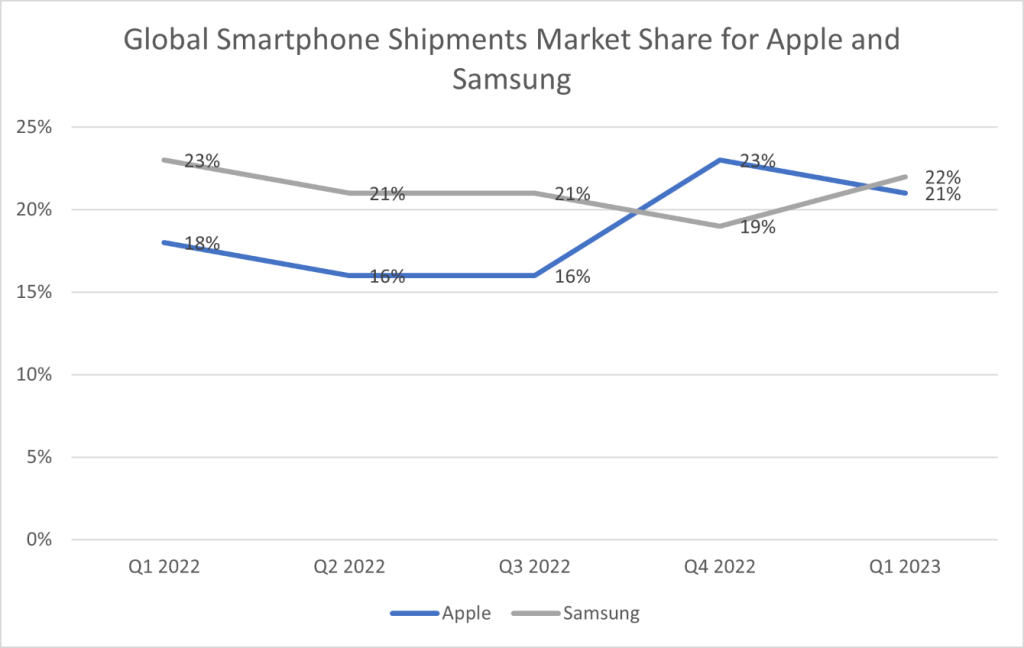

Source: Trive – Counterpoint Research, Nkosilathi Dube

In the global smartphone industry, Apple and Samsung engage in a closely contested rivalry for market share. As of 2023, Apple holds a slightly lower share at just above 20%, while Samsung leads with 22%. Apple’s temporary ascendancy in Q4 2022 highlights the intense competition within the smartphone market, where industry leaders constantly strive for supremacy through innovation and strategic moves.

Source: Trive – Apple, Nkosilathi Dube

When assessing Apple’s financial performance, it’s clear that the company faces stiff competition in the market for its hardware offerings. However, its adeptness in capitalising on its extensive and loyal user base to boost service revenue demonstrates both its adaptability and a smart diversification approach. This strategic shift towards services established reliable and recurring income sources to counterbalance the fluctuating nature of hardware sales. While the products division contributes a larger portion of the revenue and experiences seasonal surges, particularly during the first quarter due to holiday demand, the services division stands out as the dependable foundation of the business, showcasing consistent stability and resilience.

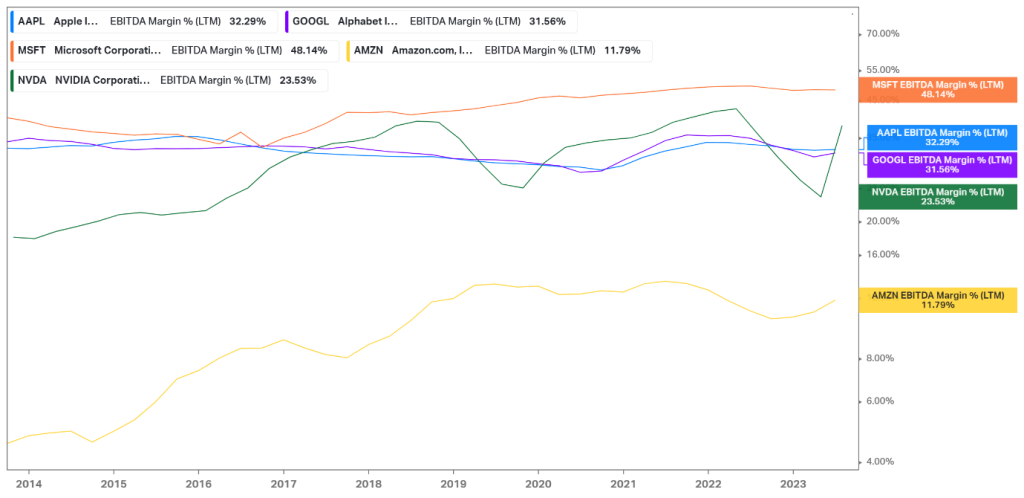

Source: Trive – Koyfin, Nkosilathi Dube

Apple’s profitability shines brightly in the tech industry, boasting an impressive EBITDA margin of 32.29%. This metric surpasses the average of its key tech competitors by a notable margin, standing at 29.46%. A higher EBITDA margin signifies that Apple is effectively converting a larger portion of its revenue into operating profit before accounting for interest, taxes, depreciation, and amortisation. This indicates a robust operational efficiency, enabling Apple to maintain a healthy bottom line. Such a strong performance underlines Apple’s exceptional financial management and operational prowess, setting it apart as a leader in the competitive tech landscape.

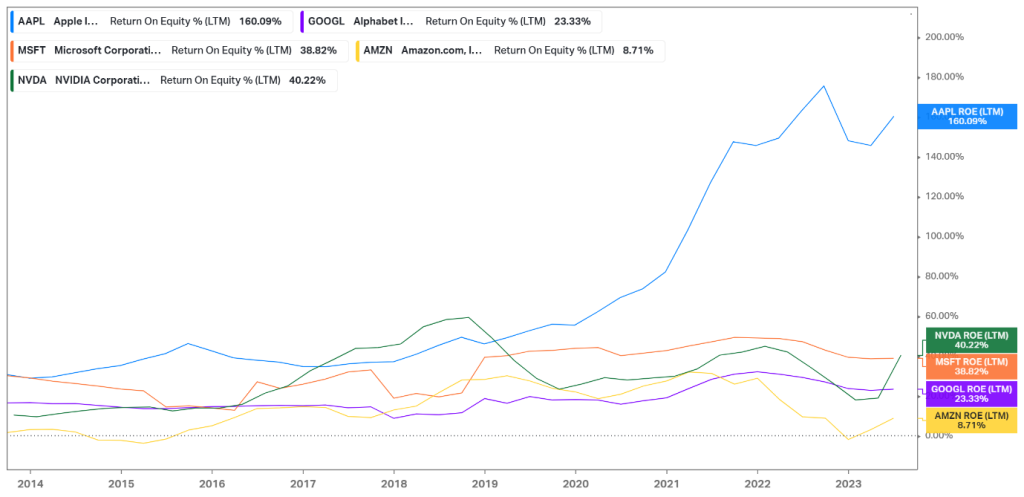

Source: Trive – Koyfin, Nkosilathi Dube

Apple stands out for its remarkable profitability in the realm of tech stocks. What truly sets Apple apart is its extraordinary return on equity, reaching an impressive 160.09%. This places Apple firmly at the pinnacle among its tech counterparts, showcasing its unparalleled capacity to deliver exceptional returns to its shareholders. This strong financial performance attests to Apple’s solid business tactics and inherent strength in the fiercely competitive tech industry.

After discounting for future cash flows, a fair value of $202.55 per share was derived.

Resumen

Apple’s journey in 2023 has been a testament to its resilience and adaptability in the ever-changing tech landscape. Despite facing challenges, including regulatory pressures and market fluctuations, Apple’s strategic prowess and innovative product launches have kept it at the forefront. Its robust financials, including an impressive EBITDA margin and a staggering return on equity, underscore its strong position in the industry. With a fair value of $202.55 per share, Apple remains a cornerstone in the world of tech.

Sources: Apple Inc, Reuters, CNBC, Wedbush, TradingView, Koyfin