Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Visa Inc. (ISIN: US92826C8394), a leader in the global payments industry, recently unveiled its robust third-quarter performance amidst a shifting market landscape. After registering its fourth consecutive week in decline, Visa’s trajectory was set against a backdrop of heightened interest in safe-haven assets, triggered by a surge in bond yields reminiscent of a decade past.

The company’s quarterly earnings report, surpassing Wall Street expectations, showcased a resilient foundation. With revenues at $8.12 billion, exceeding estimates by 0.73%, and earnings per share at $2.16, 2.15% higher than projected, Visa demonstrated its prowess in a dynamic financial environment.

Underpinning this performance was a steady uptick in consumer spending, propelling growth in payments volume and processed transactions. Notably, the tailwind of cross-border volume further buoyed Visa’s standing, driven by a resurgence in travel and summer tourism. A key takeaway lies in Visa’s correlation with the broader market, epitomized by the S&P500 index, moving hand in hand. Despite this synchronicity, Visa’s year-to-date gain of 10.33% marginally trails the S&P500’s 10.60%, prompting a closer examination of the factors shaping its market positioning.

Source: Trive – TradingView, Nkosilathi Dube

Técnicos

Visa’s stock performance in 2023 has been marked by a notable uptrend, characterized by its trading pattern within an ascending channel above the 100-day moving average. Recovering all of the losses incurred in 2022, which amounted to 4.13%, the stock appears poised to break a two-year streak of setbacks.

A crucial support level emerged at $216.14 per share, solidified after a retest of the 100-day moving average and the lower boundary of the ascending channel. A surge in demand outstripped available supply, propelling the share price to its highest point in over two years. However, at $250.06 per share, sellers established a formidable resistance, initiating a four-week decline.

Currently, Visa’s share price is at a pivotal juncture, facing the 61.80% Fibonacci Retracement Golden Ratio. If optimistic investors successfully defend this level, focus will likely shift towards the $250.06 per share mark as a potential destination. Conversely, a significant volume-driven breakdown below the Golden Ratio could signal further downside potential. In such a scenario, savvy investors may be drawn to the $216.14 per share level as an attractive point of interest.

Fundamentales

Visa Inc.’s fiscal third-quarter performance showcases a robust and resilient financial picture, reflecting its continued dominance in the payment technology industry. GAAP net income for the quarter reached an impressive $4.2 billion, marking a substantial 22% increase over the prior year, with earnings per share standing at $2.00, a 25% year-over-year growth. These results underscore Visa’s ability to generate solid returns for its shareholders.

One of the key drivers of Visa’s stellar performance was the growth in net revenues, which reached $8.1 billion, a 12% increase year-over-year, with growth witnessed across all the company’s segments. The services and data processing revenues, the top two contributors to the top line, grew by 15% each, to $3.7 billion and $4.2 billion, respectively, highlighting Visa’s vital role in facilitating secure and efficient transactions worldwide.

Source: Trive – Visa Inc, Nkosilathi Dube

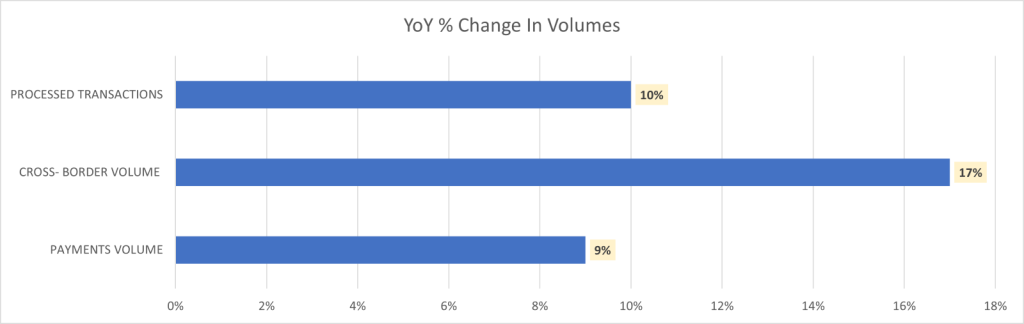

The impressive expansion in payment volume, cross-border volume, and processed transactions fuelled the top-line growth. Payments volume for the quarter ending March 31, 2023, saw a significant 10% increase, while the quarter ending June 30, 2023, registered a 9% increase on a constant-dollar basis. Notably, cross-border volume surged by an impressive 17%, contributing to international transaction revenues that grew by 14% to $2.9 billion.

Source: Trive – Visa Inc, Nkosilathi Dube

It’s important to mention that Visa’s prudent management is evident in its controlled operating expenses, which decreased by 1% over the prior year despite some increased personnel expenses. This effective cost management helped support the company’s profitability.

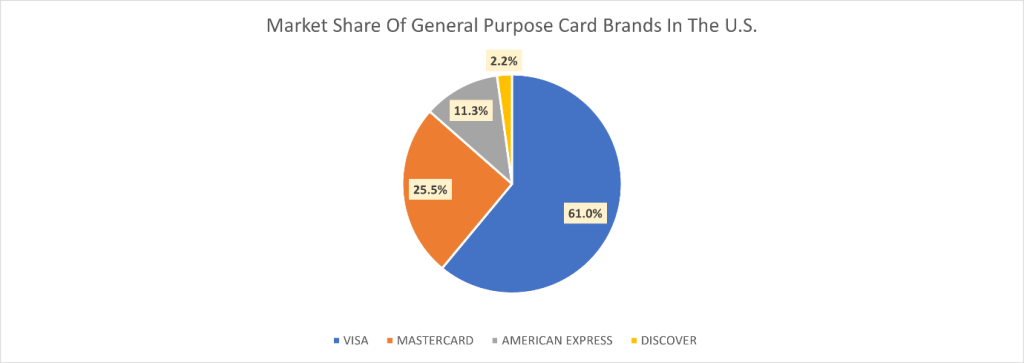

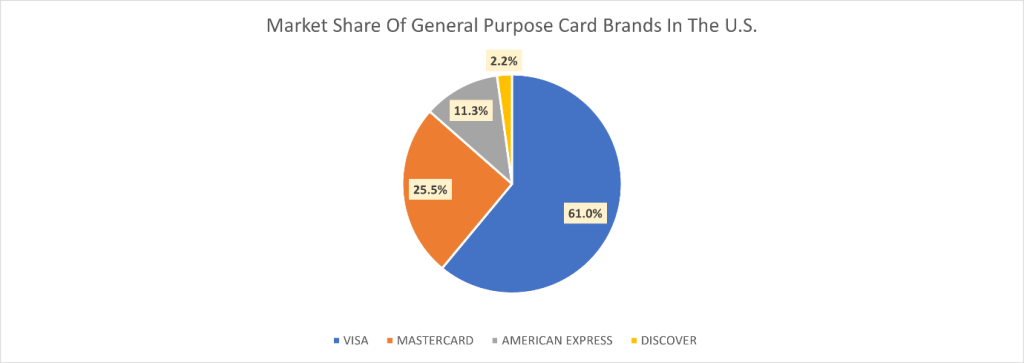

Mastercard Inc (ISIN: US57636Q1040) stands as a global powerhouse in the payments industry, claiming the second-largest card network in the U.S. and representing over a quarter of all payment card purchases, as reported by Nilson Report. At present, the company boasts a market capitalization of $368.50 billion, demonstrating its immense value in an evolving cashless society.

Source: Trive – Statista, Nkosilathi Dube

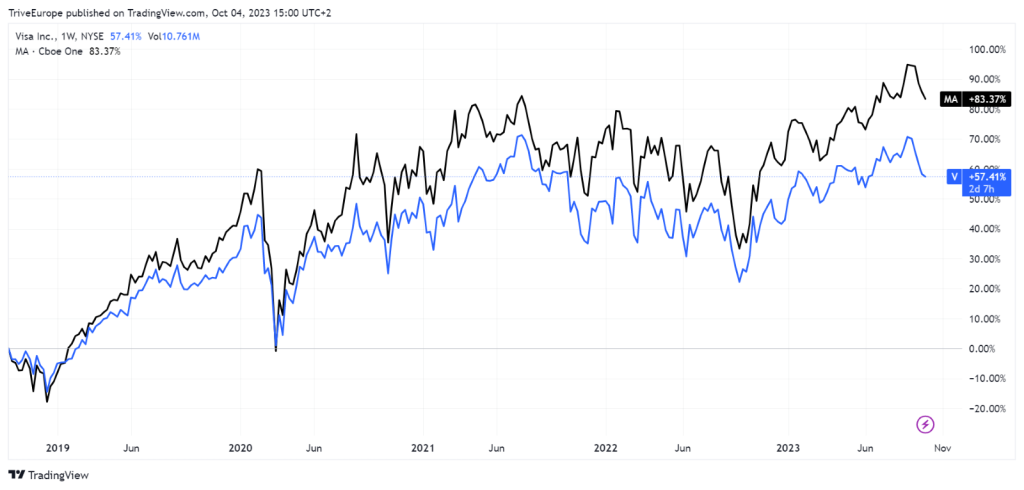

Over the past five years, Mastercard’s shares have experienced an impressive nearly 100% surge. Mastercard achieved a remarkable 10-year compound annual growth rate (CAGR) of 20% in earnings between the post-financial crisis and pre-pandemic periods, surpassing the S&P market’s high single-digit earnings growth. Although Visa leads in card circulation, net revenue, and market share through purchase transactions, Mastercard has outperformed Visa in stock performance over the last five years, with an 83.37% gain compared to Visa’s 57.41%.

Source: Trive – TradingView, Nkosilathi Dube

Some analysts attribute Mastercard’s accelerated top-line growth and acquisitive approach contribute to its position in the international market. The company is also seen as potentially reaching Visa’s margin in the future, buoyed by strategic partnerships. A significant advantage for Mastercard lies in its robust international presence. Visa’s acquisition of Visa Europe in 2016 and 2017 led to substantial efforts to modernize operations, creating an opportunity for Mastercard to surge ahead in Europe.

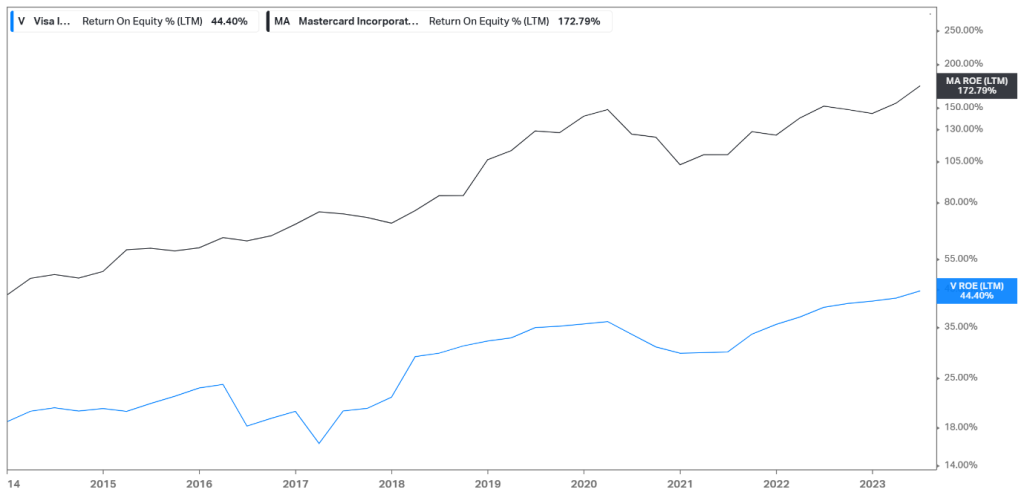

Mastercard’s impressive return on equity (ROE) of 172.79% significantly outshines Visa’s 44.40%. This substantial disparity underscores Mastercard’s exceptional ability to generate returns for its shareholders. The higher ROE for Mastercard suggests that investors may be drawn to the company for its potential for greater returns on their investment compared to Visa. This preference for higher return potential is a key factor contributing to Mastercard’s superior growth in the market.

Source: Trive – Koyfin, Nkosilathi Dube

After discounting for future cash flows, Visa’s fair value was derived at $247.15 per share.

Resumen

In summary, Visa’s third-quarter performance demonstrates its ability to navigate and thrive in a dynamic financial landscape. With strong earnings growth, expanding revenues, and prudent cost control measures, Visa remains a key player in the global payments industry, reaffirming its status as a reliable and fruitful investment choice amid intensified international competition.

Sources: Visa Inc, CNBC, Statista, TradingView, Koyfin