Analysis by Nkosilathi Dube, Trive Financial Market Analyst

Investors were likely left with mixed emotions following Dell Technologies Inc’s earnings for the first quarter of its 2024 fiscal year. The third largest global computer company by market share left its earnings expectations in the dust, with a 53.06% beat taking earnings per share to $1.31. Revenues followed suit, although modestly beating Wall Street expectations by 3.21% to $20.92B.

However, the company’s internal performance is a far cry from last year, with most key income statement metrics pointing lower for the quarter, year-on-year. PC Sales have declined from their pandemic peak as work-from-home induced electronics demand has subsided, leaving major computer companies fretting as demand is unlikely to reach similar levels. With a challenging economic backdrop characterised by high-interest rates and more prudent consumer and business spending, Dell’s share price is likely to feel the pressure as earnings remain subdued. Will Dell’s share price find light at the end of the tunnel?

Technische Analyse

According to Dell Annual Results, 2022 was a horror show for Dell investors as rising interest rates eroded share price performance, leading to a 28.40% loss for the year. A descending channel pattern characterised the downtrend from 2022, with the share price trading below the 100-day moving average, validating the downturn.

However, bullish investors seem to have come out of hiding, as the share price is up 13.08% year-to-date (TradingView pricing at market open on the share). A breakout above the descending channel pattern on high volumes kickstarted the market’s search (breakout occurred in the week of the 21st of November 2022 and again on the 3rd of January 2023) for a higher value and a potential uptrend. Support and resistance were established at the $36.00 and $51.00 per share levels, respectively.

If upside momentum goes unchallenged at present levels, the $51.00 per share level probably would be earmarked as a point of interest. In contrast, if the share price continues to move south, a decline in volumes to the downside could validate a potential reversal imminent as downside momentum subsides.

Fundamentalanalyse

Dell’s revenues fell for a third consecutive quarter, indicating weakness in the broader market environment. On a year-on-year basis, revenues declined a staggering 20% to $20.92B. It was quite a gloomy quarter for the company as revenues were down across all major segments. The client solution unit, which services the consumer and enterprise PC market, saw revenues plunge 23%, while revenues in the infrastructure solutions unit, which houses servers, networking hardware and storage devices, fell 18%.

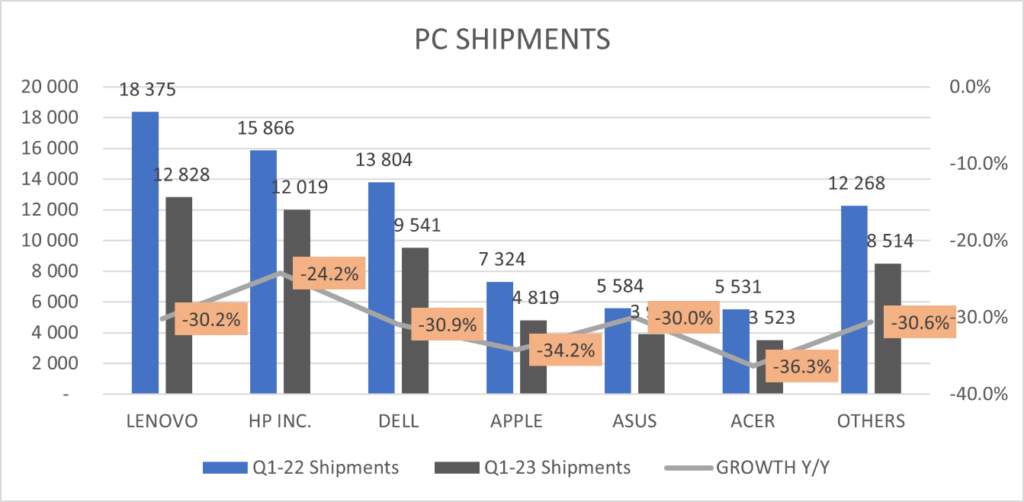

As publicly known the PC market has generally been subdued by shifting consumer sentiment. Due to high-interest rates, non-discretionary purchasing power has been eroded, while business IT spending is also shifting towards a tighter budgeting process. The overall market PC shipments fell 30% for the quarter, year-on-year, with Dell’s shipments down 30.9%.

Source: Trive Financial Services Malta Limited Technology Manufacturer Shipments Analysis

With revenues down 20%, it had a knock-on effect on the remainder of the income statement as operating income and net income fell 31% and 46%, respectively, to $1.1B and $0.6B. Dell’s cost management success saw costs decline 6% year on year but was not enough to offset the decline in the operating and net incomes.

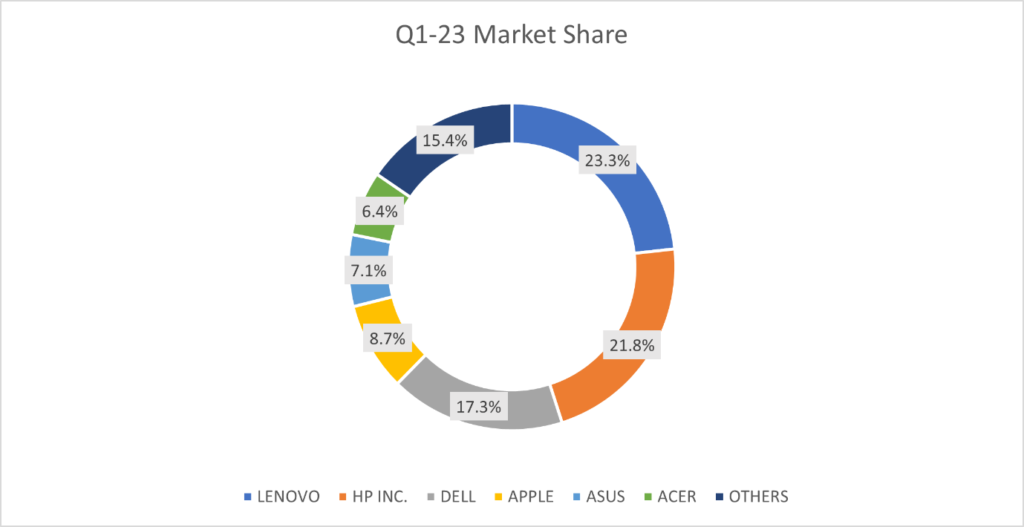

As of the first quarter of 2023, Dell’s market share of PC Shipments was 17.3%, slightly down from 17.5% in the quarter a year ago. Dell holds a relatively chunky piece of the market, with its next competitor taking up only half of its market share.

Source: Trive Financial Services Malta Limited Technology Manufacturer Market Share Analysis

Dell’s outlook was downbeat, further weighing on the share price outlook, as the company expects IT spending to remain weak due to high inflation and interest rates, along with slowing economic growth. Revenues are expected to be between $20.2B and $21.2B, but down 21.6% for the second quarter, year-over-year.

Among its main competitors, Dell falls into the lower end of profitability. Dell has an EBIT Margin of 5.45% and falls short of the competition by some margin. The company’s earnings capability has been relatively stable over the past ten years but does not provide investors enough to approve its earnings quality over the competitors.

After discounting for future cash flows, Dell’s fair value was derived at $51.00 per share. The fair value falls dead on the technical resistance level and leaves 12% room for upside gains.

Zusammenfassung

Dell will likely face more headwinds in the coming months as the likelihood of a recession picks up steam while steep interest rates keep consumer and business spending in check. However, a strong innovation commitment through Artificial Intelligence and Cloud services could help shore up revenues. The $51.00 per share level could be a long-term point of interest, given that the macroeconomic conditions shift to support the struggling industry and business.

This material (whether or not including any opinion) is provided for information purposes only and does not take into account any individual’s personal circumstances or investment objectives. Nothing contained in this material is or should be considered to be financial, investment or other advice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.