Piece Written by Nkosilathi Dube, Trive Financial Market Analyst

Netflix Inc (ISIN: US64110L1061), the company that sapped the life out of Blockbuster LLC, reported last Wednesday July 19., 2023 its second-quarter earnings, which saw revenues and subscriptions improve year-on-year. Compared to Wall Street expectations, the results were mixed as Netflix outdid earnings forecasts by 15.26% to $3.29 per share, while revenues missed the mark narrowly by 1.20% after landing on $8.19B.

Netflix embarked on a revamping journey of its subscription model late last year as it cracked down on password sharing to introduce paid sharing and ad-supported streaming services. It announced in May that it had extended its paid sharing programme to more than 100 countries, which generate more than 80% of its income.

The second quarter earnings were highly anticipated as investors sought the results of the shift in the subscription-based model. The changes appear to be working for Netflix thus far, as evidenced by the 8% gain in subscriptions recorded in the quarter year-on-year. However, the share price took a knock in afterhours trading as it plummeted nearly 8% due to its Q3 forecast falling short of Wall Street expectations. Netflix forecasts revenues of $8.50B in the upcoming quarter, in contrast to $8.62B that the market expected.

Technische Analyse

After a sharp selloff from the resistance level of $700.99 per share level, Netflix’s share price established a low at the 162.72 per share level midway through 2022 and has since moved north from oversold Relative Strength Index (RSI) conditions at 20.17. The share price crossover above the 100-day moving average in recent weeks validated the stock’s uptrend as it continued to surge with shallow retracements to the downside.

Following the crossover above the 100-day moving average, the share price is closing down on the 61.80% Fibonacci Retracement Golden Ratio at $495.37 per share. The Golden Ratio will likely play a pivotal role in determining market sentiment. A reversal could play out if the Golden Ratio holds as an intermediate resistance within the support and resistance range, given that supply outdoes demand. Optimistic investors could turn to the support level at $162.72 per share as the next point of interest if they intend to buy into the stock at a discount.

Fundamentalanalyse

Despite missing revenue forecasts, the top line was $8.19B, up 3% from $7.97B at the same time last year, primarily due to a 6% increase in the Average Paid Membership. Net income increased to $1.49B from $1.44B, representing a 3.26% gain. Boosting the bottom line was a slight improvement in the streaming service’s operating margin of 250 basis points year-on-year, primarily due to the ongoing cost management, slower-than-projected headcount growth and timing of content spend.

For the third quarter, Netflix said it now expects revenue of $8.5 billion, up 7% from the same period last year. Additional average-paid memberships were cited as the primary cause of the anticipated increase in revenue. Netflix also declared to expect the third quarter’s paid net subscriber additions to resemble the second quarter’s. Meanwhile, Netflix anticipates revenue growth to “accelerate more substantially” in the fourth quarter as measures to stop password sharing gain momentum and advertising revenue rises.

Source: Trive Financial Services Malta Limited – Netflix Inc, Nkosilathi Dube

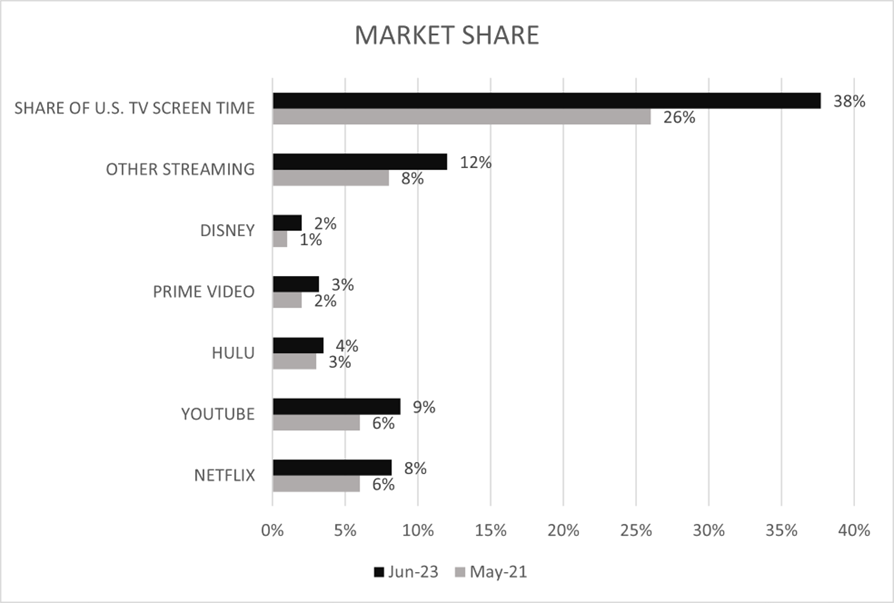

The streaming services market as a percentage of the U.S. T.V. screen time has grown modestly since May 2021, from a quarter of the market share to 38%, as streaming services grow in popularity with multiple new competitors coming to light. Netflix’s share of the streaming services market has also increased by 2% to 8%, although falling behind Youtube, which grew by 3% to reach a market share of 9%. More growth could be expected in years to come as T.V. consumers shift from the more traditional forms, such as Cable and Broadcast, to Streaming services.

Source: Trive Financial Services Malta Limited – Netflix Inc, Nkosilathi Dube

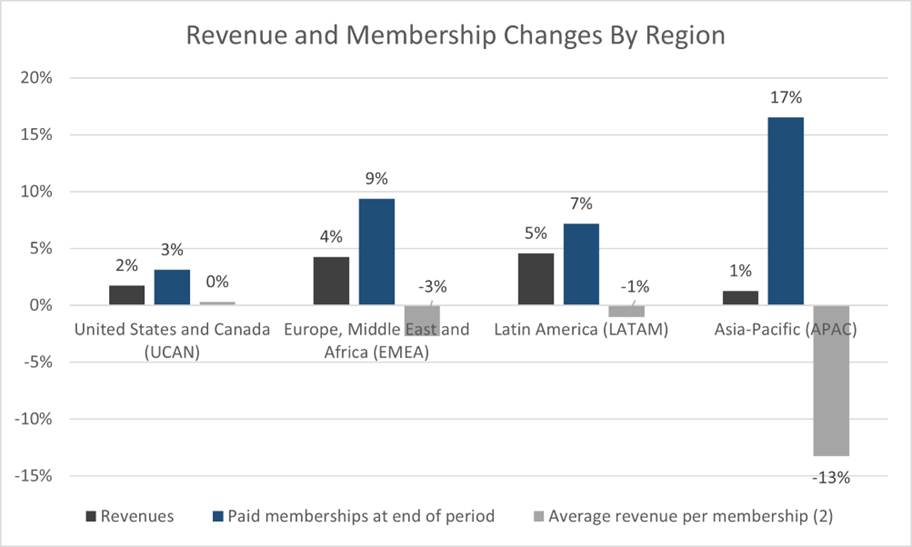

The most notable source of revenue growth was the Latin America region, followed by Europe, the Middle East and Africa, which saw revenues grow by 5% and 4%, respectively. In contrast, the Asia-Pacific region was the main highlight regarding growth in Paid Memberships at the end of the quarter. Paid membership in this region grew 17%, by 5.7M, although the Europe, Middle East and Africa region saw the most additions in paid memberships, with 6.8m, making it the region with the most paid members outright, at 79.8M, followed by the United States and Canada with 75.6M.

Source: Trive Financial Services Malta Limited – Koyfin, Nkosilathi Dube

Among the leading U.S. streaming services companies, Netflix’s profitability towers above the rest with a Net Income Margin of 13.22%. The next closest competitor is Disney (ISIN: US2546871060), while the remainder are far off with negative net income margins. Investors searching for solid earnings among streaming services companies could look to Netflix as it remains highly profitable relative to its competitors.

Source: Trive Financial Services Malta Limited – Koyfin, Nkosilathi Dube

Netflix forecasts it will have $5B of Free cash flows at the end of the third quarter, compared to $3.5B previously forecast, due to reduced spend on the back of a writers and actors strike. However, at present, it remains in a relatively strong position compared to its competitors as it has higher levels of liquidity to meet short-term obligations or fund expansion, with free cash flow of $4.26B, which pales in comparison to its nearest competitor.

Source: Trive Financial Services Malta Limited – Koyfin, Nkosilathi Dube

On a year-to-date basis, Netflix’s share price has outperformed the tech-heavy and broader market index, represented by the NASDAQ100 (NDX) and S&P500 (SPX), respectively. With a 61.69% gain in 2023 so far, the NDX tracks behind with a gain of 44.67%, while the SPX is a far cry at 18.91%. The hype surrounding the developments of Artificial Intelligence has been the main driver of positive tech stock performance, and Netflix has been a beneficiary.

After discounting for future cash flows, a fair value of $499.00 per share was derived.

Zusammenfassung

Given that the shift in the subscription model has proved fruitful so far, it may be a leading indicator of the potential top-line and subscription performance yet to come. If Netflix can sustain growth in both metrics, its share price will converge with the $499.00 per share level.

Sources: Netflix Inc, Reuters, CNBC, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.