Piece written by Nkosilathi Dube, Trive Financial Market Analyst

Last week, Tesla Motors Inc. (ISIN: US88160R1014) made headlines for its electrifying quarterly results, which featured its highest-ever revenue, production, and delivery figures. The pioneer in electric vehicles (EVs) managed to generate earnings above Wall Street projections despite the challenging macroeconomic backdrop, marked by rising inflation, high-interest rates and strained consumer spending.

The company beat earnings and revenue projections by 14.78% and 2.91%, as earnings reached $0.91 per share on revenues of $24.93B. Despite beating forecasts and posting record results on many levels, operating margins dropped as the effects of the price-cutting measures prevailed, sending the share price plummeting 7.59% for the prior week. For April through June, Tesla recorded its lowest overall gross margin in 16 quarters at 18.2% and its lowest operating margin in at least five quarters at 9.6%.

TradingView, Nkosilathi Dube – Trive Financial Market Analyst

On a year-to-date basis, Tesla has outperformed the tech-heavy NASDAQ100 (NDX) index by a mile [MLFI1] after gaining 140.54%, compared to the NDX’s 42.01%. Driving the share price higher was the hype surrounding developments in Artificial Intelligence, which Tesla will be incorporating into their production lines and Self Driving technology. In addition, Tesla’s deliveries beat expectations, boosting market sentiment and increasing the share price. What lies ahead for the EV king?

Technische Analyse

Tesla Inc. began the year on a high note as its share price hit a low and rose as confident, upbeat investors drove it higher. The stock price, which has increased 140.54% year to date, has broken out of the descending channel pattern that represented the downtrend for the majority of 2022. It is currently in an uptrend. The uptrend was further validated by the break over the 100-day moving average during the week of June 12th, 2023.

Support was established at the swing low of $152.37 per share, while resistance at the $313.80 per share level established the last major swing high of 2022.

If downside volumes decline as the share price approaches either Fibonacci Levels, usually could be seen by investors as the wearing out of downside enthusiasm, with a reversal potentially imminent. In contrast, a high volume breakout above the 23.60% Fibonacci Retracement level at $264.62 per share could be understood as the presence of upside momentum building up. Resistance at the 318.80 per share level may serve as a point of interest to the upside.

TradingView, Nkosilathi Dube – Trive Financial Market Analyst

Fundamentalanalyse

Tesla recorded its best-ever production and delivery figures for the quarter after producing 479,900 vehicles and delivering 466,140, corresponding with an 86% and 83% growth from the same quarter last year, respectively. Due to the continuous ramp-up of its new plants and the robust performance of the Shanghai and Fremont plants, Tesla produced a record number of vehicles in Q2.

The upbeat deliveries translated into a record quarterly top line that stopped shy of the $25B mark, landing on $24.93B, up 47% year-on-year. However, the automotive revenue wasn’t the only one to experience a strong surge, as Tesla’s remaining segments saw positive developments in the quarter. Energy generation and storage revenue was up a staggering 74% to $1.51B, while Services and other revenue was up 47% to $2.15B.

However, from a profitability standpoint, Tesla did worse than the prior year’s quarter as operating income declined by 3% to $2.40B, resulting in a weaker operating margin of 9.6%, down 493 basis points over the same period. The cost-cutting measure implemented this year to boost demand led to a reduced Average Selling Price. In addition, operating expenses were up 21% year-on-year, primarily due to larger expenses driven by the Cybertruck’s ongoing development, Artificial Intelligence and other large projects.

Koyfin, Nkosilathi Dube – Trive Financial Market Analyst

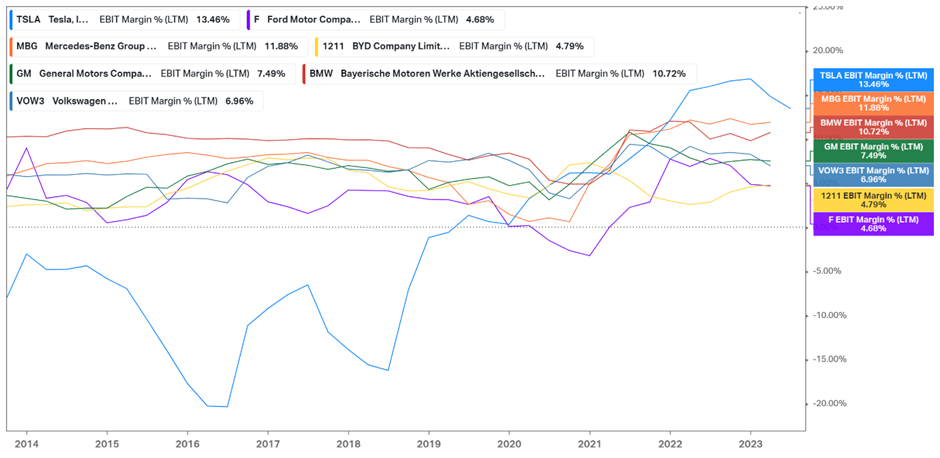

Tesla remains an attractive company relative to its U.S. and European counterparts as it produces more income per unit sold on an operational level. With a 13.46% Earnings Before Interest and Tax margin, its closest competitor falls 150 basis points behind, indicating that the EV giant is operationally superior to its automaker competitors as it produces more income per dollar of revenue.

Koyfin, Nkosilathi Dube – Trive Financial Market Analyst

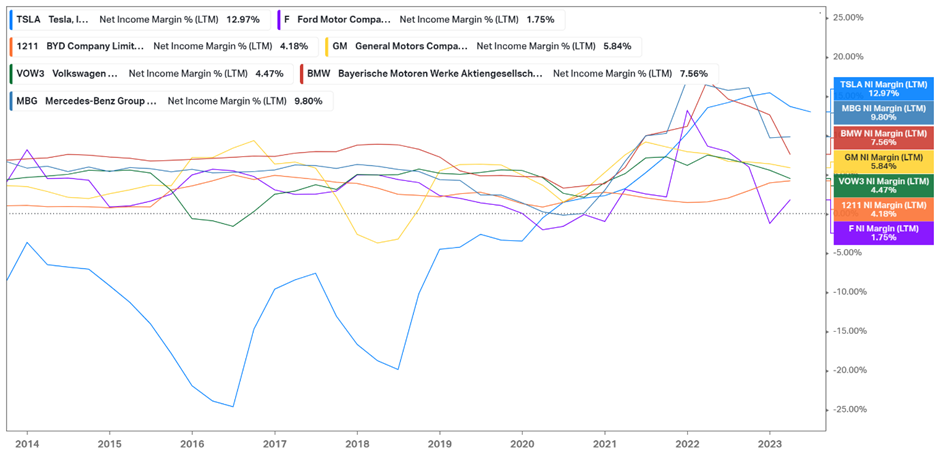

Furthermore, on the bottom line level, Tesla outshines the rest of the industry as it is the most profitable, with a Net Income Margin of 12.97%, over 300 basis points above its closest competitor, Mercedes-Benz Group. Tesla is far superior to its competitors at converting each unit of sale into a profit, a factor that could attract investors in search of outstanding earnings within the industry.

Koyfin, Nkosilathi Dube – Trive Financial Market Analyst

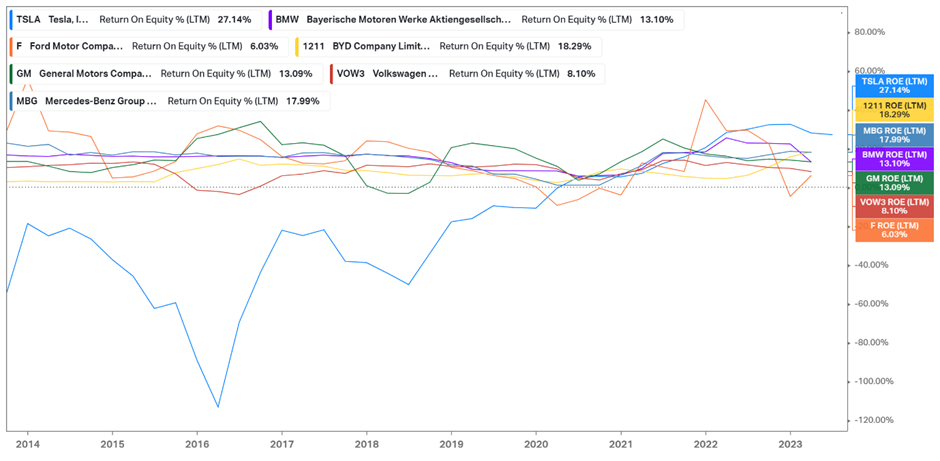

Finally, among the automakers, including the EV and legacy manufacturers, Tesla stands out as the most fruitful company, with a Return on Equity of 27.14%, which crushes its competitors.

In order to achieve its goal of future growth, Tesla will concentrate on cost reduction, the creation of new products that will support future expansion, R&D investments, better financing alternatives for vehicles, ongoing product improvement, and the creation of free cash flow. The business projects that it will produce about 1.8 million vehicles in 2023, exceeding the long-term 50% Compounded Annual Growth Rate (CAGR).

Counterpoint, Nkosilathi Dube – Trive Financial Market Analyst

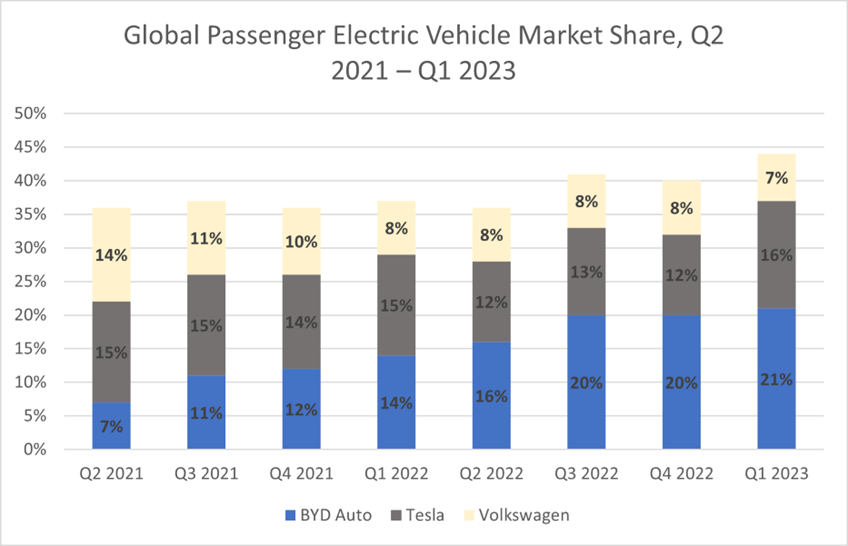

As of the first quarter of 2023, Tesla held a market share of 16% of the EV market, making it the second biggest EV manufacturer in the world. It lost its leading position to BYD Group in 2022, which now holds a market share of 21%. More than 10 million electric vehicles were sold globally in 2022, according to the latest edition of the IEA’s annual Global Electric Vehicle Outlook, and sales are projected to increase by another 35% this year to reach 14 million. According to the most recent IEA (International Energy Agency) predictions, this fast growth has resulted in an increase in the share of electric cars in the entire auto market from 4% in 2020 to 14% in 2022 and is expected to reach 18% this year.

After discounting for future cash flows, a fair value of $302.00 per share was derived.

Zusammenfassung

With the advent of Chinese and European automakers into the EV business, Tesla will likely encounter stiffer competition. Already, the Chinese firm BYD Group has surpassed Tesla to claim the title of the best-selling EV maker. However, given its pioneering position and the significant advancements already achieved in artificial intelligence and self-driving technology, Tesla is likely to continue to lead in this space.

Sources: Tesla Inc, Reuters, CNBC, International Energy Agency, Counterpoint, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.