Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Taiwan Semiconductor Manufacturing Company (TSMC), which projected a 10% decline in sales for 2023 on Thursday and indicated investment spending at the low end of projections ($32-$36B), claims that the demand for chips, which are used in everything from automobiles to cell phones, has been impacted by the global economic distress, characterised by high inflation, rising interest rates and lower consumer confidence.

Despite the high demand for artificial intelligence (AI) and its supremacy in the production of AI chips, the largest chip manufacturer in the world asserted that market weakness has been more widespread than anticipated due to the slower-than-anticipated recovery of the global economy.

The company reported a 23.3% fall out on its bottom line, year-on-year, the first drop in four years, while revenues dropped by 13.7%. Its share price is down 5.25% for the week, and with the U.S. chipmaker’s earnings results around the corner, what should investors expect?

Source: Trive Financial Services Malta – TradingView, Nkosilathi Dube

Despite the weak earnings and forecast by the biggest chipmaker in the world, the S&P Semiconductor SPDR ETF – XSD (ISIN: US78464A8624), which tracks the performance of the U.S. based S&P Semiconductor Select Industry Index, has impressively outperformed the broader U.S. market represented by the S&P500 (SPX) nearly twofold. The hype surrounding Artificial Intelligence and its promising future sent investors into a buying frenzy, sending U.S. semiconductor and tech stocks soaring.

Technische Analyse

The XSD has been in a firm uptrend since forming a bottom in the final quarter of 2022 and trading within an ascending channel pattern.

The crossover above the 100-day moving average in the week of 15 May 2023 validated the uptrend, following the market’s rejection of the $173.53 level that coincided with the ascending channel pattern’s lower trendline, subsequently creating a support level. The high at $250.82, established at the beginning of 2022, prior to the selloff induced by steep inflation and interest rates, forms a resistance level, which the market has been closing down on diligently.

Following the release of the TSMC’s downbeat forecasts, negative sentiment crept into the market at the ascending channel’s upper trendline or resistance. Bearish sentiment could prevail, given that U.S. chipmakers report weak earnings in upcoming weeks. Optimistic investors could look to the ascending channel’s lower trendline as a point of interest for discounted pricing. In contrast, a high volume breakout above the pattern could expose the XSD to further upside possibilities, with the Fibonacci Extension level providing potential resistance levels. The next likely point of interest to the upside could be the 50% Fibonacci Extension level at $246.19.

Fundamentalanalyse

During the Covid-19 lockdowns, demand for cell phones and laptops increased significantly, prompting PC and smartphone manufacturers’ heavy buying of chip inventories. With consumers making fewer purchases of these items due to higher inflation and interest rates, those businesses are currently struggling with excess inventories, and high-end memory prices subsequently decreased by 50% in the past year.

According to research data analytics provider Canalys, the global smartphone market shrank 11% in the second quarter compared to a year earlier, marking the sixth straight quarter of declines. This aligns with the most recent projections from Gartner Inc., which expects the global semiconductor revenue to decrease by 11.2% in 2023. The market reached $599.6 billion in value in 2022, marking a minuscule 0.2% increase over 2021.

Overview of U.S. Semiconductor Companies

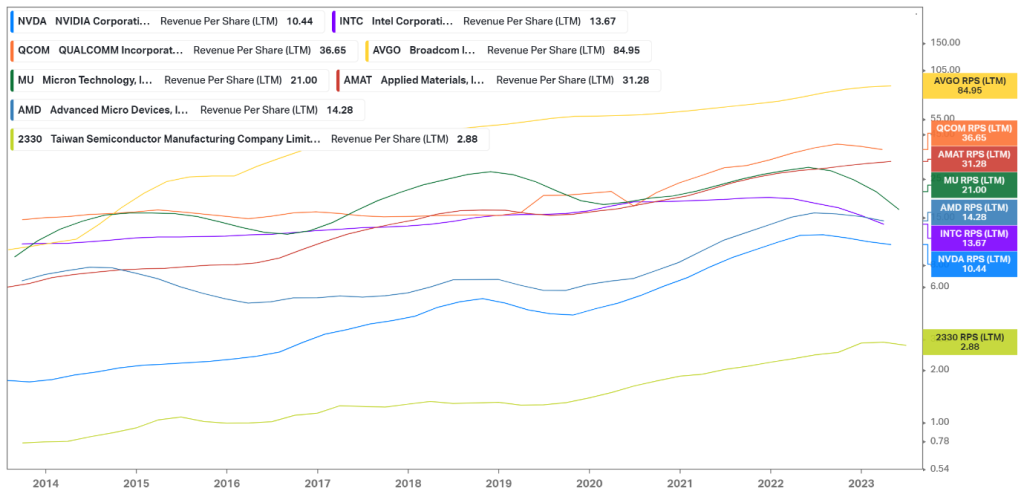

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

The above illustration depicts the top U.S. semiconductor revenue per share compared to TSMC’s. A rising revenue per share (RPS) over time indicates that each share has a greater claim to revenues. It assists in calculating the productivity per share of an organisation. Over the past ten years, American chipmakers have generally increased their productivity, resulting in higher revenue per share. Broadcom – AVGO (ISIN: US11135F1012), which has the highest revenue per share, which is more than twice the amount of its nearest rival, is one of the most remarkable firms on this criteria. Broadcom is the company that generates the most sales per share owned in the sector.

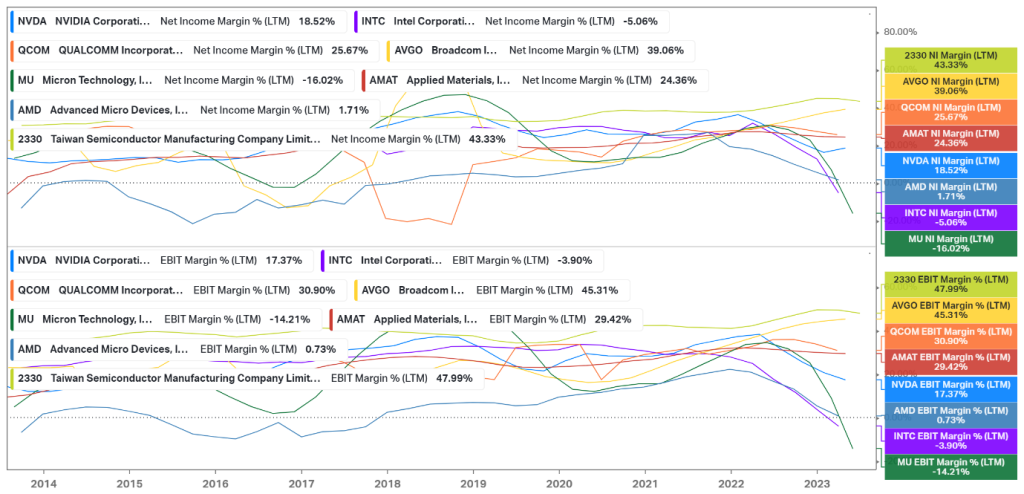

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

From a profitability perspective, Broadcom yet again stands out among the rest of the U.S. chipmakers, with the highest operating income and net income per unit of sales at 45.31% and 39.06%. Broadcom is the most operationally efficient company among the U.S. chipmakers as it generates higher levels of earnings before interest and tax, albeit only falling behind the biggest chipmaker in the world, TSMC. The company is able to generate higher income on each sale and could be an attractive option for investors coming out of the earnings school of thought.

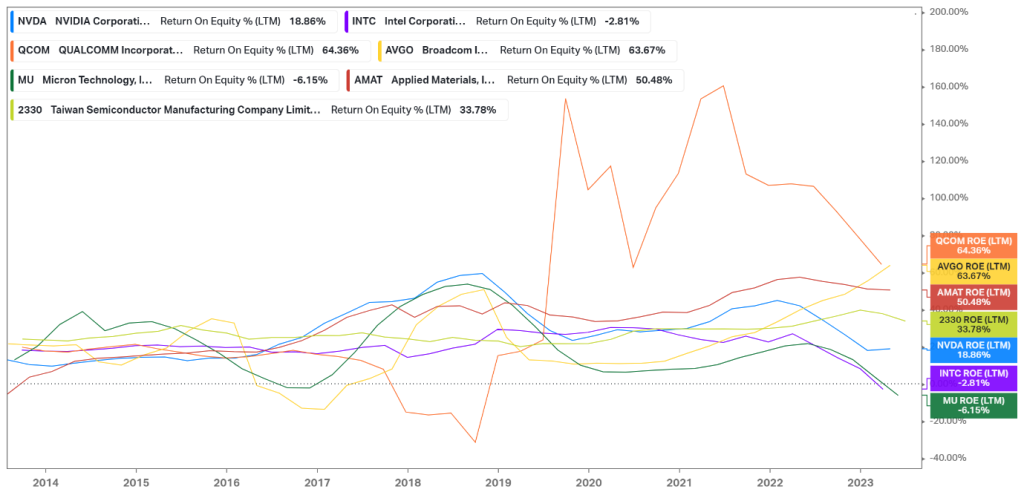

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Putting aside Qualcomm Incorporated’s – QCOM (ISIN: US7475251036) erratic market returns, Broadcom leads the way in its returns on equity (ROE). ROE is regarded as a barometer of a company’s profitability and how efficiently it produces profits on its equity investment. With a 63.67% ROE, Broadcom stands out among the rest. Applied Materials – AMAT (ISIN: US0382221051) follows closely behind and is a relatively decent business as it also produces decent revenues per share and income per unit of sales, designating it as a high-quality business from an operational efficiency and profitability standpoint.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

The price-to-sales ratio reveals the market’s valuation for each dollar of a company’s sales. Nvidia Corporation (ISIN: US67066G1040) stands out with the highest valuation perceived by the market. The market is willing to pay 43.5× per unit of its sales, making it a relatively overvalued company compared to its U.S. competition. The most undervalued stock in the industry is Intel Corporation – INTC (ISIN: US4581401001); however, given its negative net income margin and return on equity, its low valuation is likely justified, as weak earnings fail to attract investors.

Zusammenfassung

By 2030, it is expected that the global semiconductor market will be worth a trillion dollars and is positioned for a decade of expansion. With U.S. interest rates targeted at slowing down the economy now nearing the end of their hiking cycle, the business and consumer environment will likely return to normal at the onset of a Fed Pivot. Valuations will probably continue to move north in the long term, with the integration of Artificial Intelligence in day-to-day activities likely taking precedence and boosting the demand for high-end chips. The blip in TSMC’s earnings is likely temporary and shouldn’t leave investors agonising.

Sources: Taiwan Semiconductor Manufacturing Company, Gartner, Canalys, KPMG, Deloitte, McKinsey & Company, State Street Global Advisors, Financial Times, Visual Capitalist, Reuters, CNBC, TradingView, Koyfin