Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

In a resounding testament to the resilient nature of the travel industry, Airbnb Inc’s (ISIN: US0090661010) second-quarter earnings have surged, painting a vibrant post-pandemic comeback on the global travel canvas. Marking the ninth consecutive quarter of surpassing expectations, the company stands at the cusp of a promising growth trajectory, riding the rising tide of renewed travel enthusiasm after a subdued 2020.

With travel and tourism regaining momentum, Airbnb’s earnings have responded positively. Metrics such as Nights and Experiences Booked and Gross Booking Value have harmoniously soared, signalling a steadfast resurgence. Wall Street’s predictions were overtaken by a remarkable 21.92%, as earnings climbed to $0.98 per share, while revenues of $2.48 billion gracefully exceeded estimates by nearly 3%.

Airbnb’s second-quarter performance showcases a net income margin of 26%, the highest ever for this period. This achievement is backed by robust fundamentals and strategic prowess, underlining the company’s strengths in adapting to dynamic market landscapes. Furthermore, a historical record of net active listings added throughout the quarter exemplifies Airbnb’s dedication to nurturing a thriving host community.

Technische Analyse

A remarkable 59% surge year-to-date paints a compelling picture of the company’s response to heightened travel demand and robust earnings performance. The shift in trajectory follows a period of a descending channel pattern, a trend that found validation after the initial peak in Q1 2021.

This year’s upside momentum broke free from the confines of the channel pattern, marking a pivotal point as a support level solidified at $103.55 per share. However, the ascent encountered resistance at $154.95 per share, prompting a temporary pullback. Currently trading at the 38.20% Fibonacci Retracement level, the company’s stock stands at a crossroads, waiting for the echoes of its stellar Q2 earnings to reverberate through investor sentiment.

Should confidence in Airbnb’s earnings persist, the $135.32 per share mark, or the 38.20% level, could serve as a buoyant stronghold. For optimistic investors, the $154.95 per share level emerges as a beacon of interest, a testament to the potential rewards of steadfast momentum. In contrast, a downward tilt could usher in the 61.80% Golden Ratio, where bargain-seeking traders might be drawn to a further discounted entry.

Fundamentalanalyse

Airbnb’s second-quarter performance unveils the resurgence and robustness within the travel industry. At $2.5 billion, the company’s revenue resonates with an 18% surge over Q2 2022, underscoring the unwavering strength of travel demand. This remarkable growth is anchored in the soaring metrics of Nights and Experiences Booked, supported by stable Average Daily Rates (ADR).

Net income surged to $650 million in Q2, marking an impressive $271 million increment from the previous year. This formidable leap finds its roots in the interplay of top-line growth, astute cost management, and accrued interest income. The quarter’s net income margin of 26% stands as a beacon, marking a historic second-quarter high and spotlighting Airbnb’s mastery of fiscal efficiency.

Airbnb’s prowess extends to its discipline in cost management, with Q2 Adjusted EBITDA soaring to $819 million, a 15% rise from Q2 2022. This reflects a business model that thrives in growth and remains steadfast in maintaining a lean and efficient cost structure.

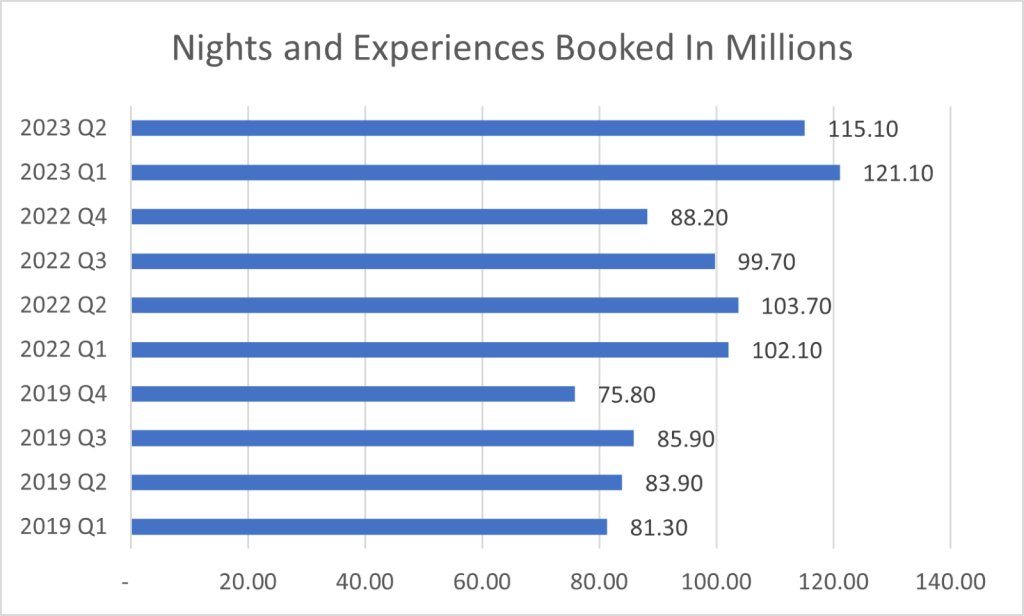

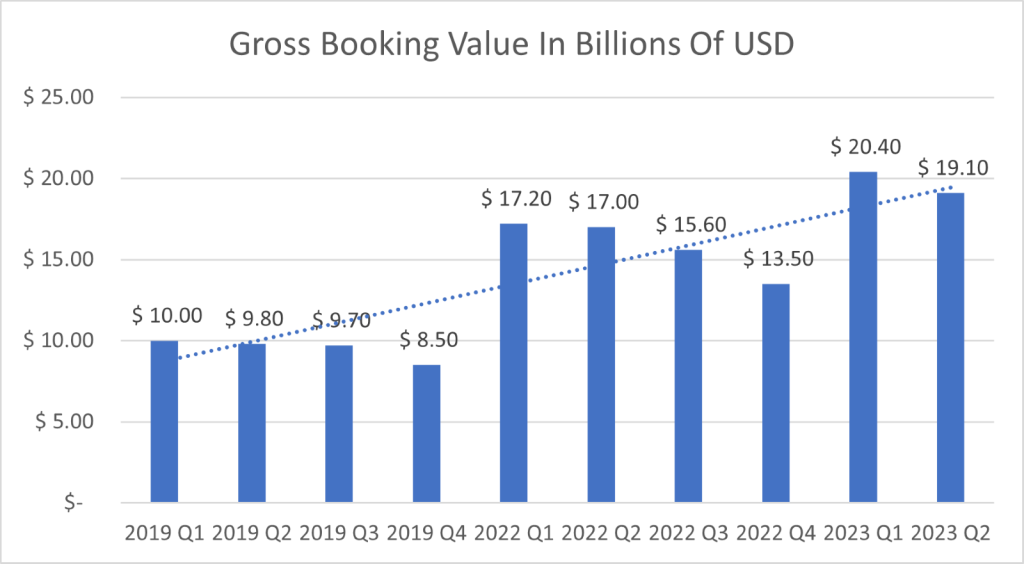

The healthy quarter was further highlighted, with Nights & Experiences Booked surging by 11% in Q2 2023, yielding $115 million compared to the prior year. Growth blanketed all geographies, harmonizing with a 13% year-over-year climb to $19.1 billion in Gross Booking Value (GBV). This resonates with the potent fusion of increased bookings and stable ADR.

Airbnb’s stage of growth is illuminated by the impressive 19% year-over-year surge in active listings, reflecting the resonance of the platform across diverse geographies, segments, and price ranges. Crossing the 7 million total active listings threshold, Airbnb achieved an unprecedented feat, adding more net active listings than in any previous quarter in its history.

Global expansion is crowned by double-digit supply growth across all regions, where Asia Pacific and Latin America emerge as leaders with exponential growth rates. This momentum seamlessly intertwines with cross-border travel’s meteoric ascent, illustrated by a remarkable 16% growth in cross-border nights booked, a phenomenon that underscores the global community’s renewed zest for exploration.

Looking ahead, Airbnb’s optimistic forecast sets its sights on a revenue range of $3.3 billion to $3.4 billion for Q3 2023. This anticipated growth of 14% to 18% year-over-year echoes the company’s capacity to leverage its strengths in navigating dynamic landscapes and capitalizing on resurging travel trends.

Source: Trive – Airbnb Inc, Nkosilathi Dube

Source: Trive – Airbnb Inc, Nkosilathi Dube

Airbnb’s trajectory paints a compelling story of resilience, with growth spanning pre-pandemic to post-pandemic eras. The surge is unmistakable: Gross Booking Value leapt by 95% in Q2 2023 compared to 2019, while Night and Experiences Booked rose 37% over the same period. This data reaffirms Airbnb’s ability to adapt and flourish amidst evolving landscapes.

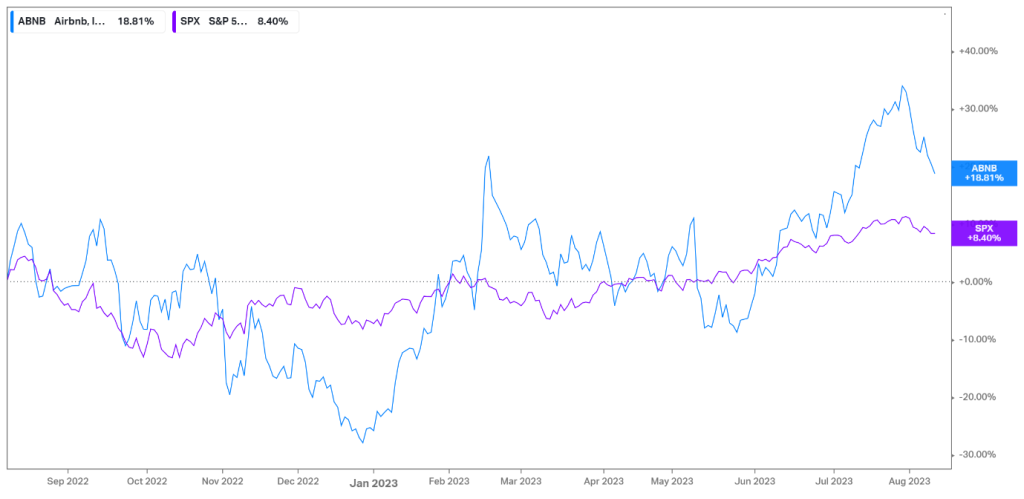

Source: Trive – Koyfin, Nkosilathi Dube

Once shadowed by pandemic-induced lockdowns, Airbnb’s shares have transformed in the post-pandemic era. As global travel gathers momentum, so do the company’s revenue and earnings. After hitting a low in Q4 2022, its stock has ascended on renewed investor faith, notably outpacing the S&P500 Index, embodying the revival of confidence and growth potential.

Source: Trive – Koyfin, Nkosilathi Dube

While Airbnb’s profitability is appealing, with EBIT and Net Income Margins at 21.55% and 25.31%, respectively, it lands in the mid-range compared to hotel giants like Marriott International. Traditional hoteliers maintain the upper hand in profitability, marking a nuanced interplay of Airbnb’s innovative model against the established strengths of conventional hospitality.

After discounting for future cash flows, a fair value of $156.00 per share was derived.

Zusammenfassung

Amid a post-pandemic travel renaissance, Airbnb’s soaring Q2 earnings of $2.5 billion, coupled with impressive metrics like Nights and Experiences Booked and robust Gross Booking Value growth, underscore its resilient evolution. With a strategic net income margin of 26%, Airbnb’s fiscal mastery is evident, albeit trailing traditional hotel giants. Its adaptive journey shines as it balances innovation against the established strengths of hospitality. Given that the post-pandemic era is in full swing, the $156.00 per share fair value could materialize in the medium to long term.

Sources: Airbnb Inc, CNBC, Reuters, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.