Analysis by Nkosilathi Dube, Trive Financial Market Analyst

McDonald’s Corporation (ISIN: US5801351017) has been on a roll after gaining 12.17% market value year-to-date. Despite concerns about a slowing global economy and a potential recession this year, the company’s first-quarter earnings showed no signs of slowing.

Earnings per share beat Wall Street expectations by a staggering 12.68% to $2.63, while revenues exceeded expectations more modestly by 5.60%, landing on $5.9B. The multinational fast-food corporation posted a first-quarter net income of $1.8B, up from $1.1B in the same period last year. The boost in year-on-year financial performance comforted its investors as earnings remained resilient in the face of high-interest rates and constrained consumer spending. Will McDonald’s share price continue in its upward trajectory?

Technische Analyse

McDonald’s share price has taken the route higher with a steep rise on a year-to-date basis, undoing 2022’s losses in the process. The stock trades in an ascending channel pattern, above its 100-day moving average, validating the uptrend. The rejection of the ascending channel’s upper trendline formed a resistance level at the $299.08 per share level. Bears took the share price only as far as the 61.80% Fibonacci Retracement Golden Ratio, which coincides with the ascending channel’s lower trendline.

Bullish investors lurked at the Golden Ratio and pounced on the level as soon as the share price approached it. A reversal is now in progress, with optimistic investors likely in contention to take the share price further north, probably with the $299.08 per share resistance level in mind.

However, risk-averse investors could be in contention to buy into the stock at a discount to the current price. If the share price finds difficulty surpassing the resistance level, it could signal the build-up of bearish pressure. A reversal could occur from the resistance level, leaving investors with opportunities to go long at one of the Fibonacci Retracement levels. The most likely point of interest will be the Golden Ratio, given its indication of demand outweighing supply. If volumes decline to the downside, it could indicate an imminent reversal, with bearish pressures subsiding.

Fundamentalanalyse

McDonald’s posted $5.9 billion in net sales, up 4%. Same-store sales increased 12.6% across the board for all three of its divisions. Higher menu prices and additional traffic drove same-store sales in its native market. For the third straight quarter, McDonald’s U.S. traffic increased, defying the industry trend of declining traffic as menu prices climb. Fast-food restaurants like McDonald’s have historically done well in uncertain economic times as customers switch to their less expensive options.

Even though McDonald’s has increased menu pricing by a low double-digit percentage since last year to protect margins as costs rose, its meals have remained more affordable than those of its rivals. According to data firm Numerator, the average cost of a McDonald’s visit was $7.77 for the 12 months ending March 31, which was cheaper than its nearest burger competitors, Burger King and Wendy’s Company (ISIN: US95058W1009), and most other fast-food brands.

McDonald’s also saw stronger-than-expected sales outside of the U.S. The company’s internationally operated markets, which include the UK, France, Germany, and Australia, outperformed the forecast of an 8.5% increase in same-store sales as global comparable sales rose 12.6%.

China and Japan are part of its international developmental licenced markets sector, outperforming forecasts for same-store sales of 10.5%. McDonald’s officials reported that sales have increased in China, where the company’s zero-Covid policy was lifted in December.

Executives from the corporation reiterated their predictions for a mild recession in the U.S. this year during the earnings call. They anticipate a more challenging climate in Europe, but one that is better than the second half of 2022.

After discounting for future cash flows, McDonald’s fair value came in at $313.24 per share.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

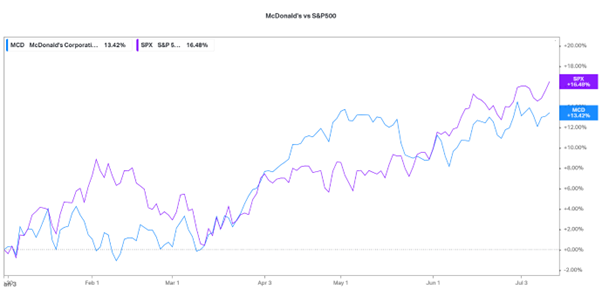

McDonald’s share price is cyclical, as it is sensitive to economic cycles. In addition, its correlation with the broader stock market represented by the S&P500 (SPX) is positive. The stock moves in tandem with the SPX but has fallen short by a minor margin on the year-to-date return.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

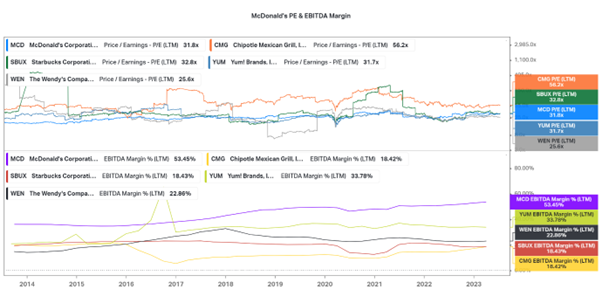

Among the prominent food retailer companies in the U.S., McDonald’s P.E. falls in the mid-range of the Price Earnings multiples. Investors are relatively willing to pay for a unit of the company’s earnings, but not nearly as much as they are willing to pay for earnings in Chipotle Mexican Grill (ISIN: US1696561059) or Starbucks Corporation (ISIN: US8552441094). However, from a profitability perspective, McDonald’s leads the way with an EBITDA Margin of 53.45%, far beyond its closest competitor, Yum! Brands (ISIN: US9884981013).

Zusammenfassung

Due to the high-interest rate environment, which reduces purchasing power, consumer spending has been an ongoing concern for retailers and consumer discretionary businesses. Since interest rate hikes are probably nearing an end, consumer spending will likely increase as borrowing costs fall, boosting sales at consumer discretionary companies like McDonald’s in the medium to long run. The $313.24 fair value will probably be reached when a Fed Pivot commences.

Sources: McDonald’s Corporation, Reuters, CNBC, Numerator, StreetAccount, TradingView, Koyfin