Analysis by Nkosilathi Dube, Trive Financial Market Analyst

With a 5.55% gain in market value year-to-date, Caterpillar Inc (ISIN: US1491231015), the top manufacturer of construction and mining machinery worldwide, is headed towards a fifth consecutive year of gains. The share price created an all-time high in January as the market shifted to a risk-on sentiment on the back of growing expectations of a Fed Pivot due to a potential recession in 2023 in light of the steep interest rate environment. However, the stock retreated from the peak as rate hikes took full effect, supporting the Greenback at the expense of risk assets.

Caterpillar’s first-quarter earnings have since helped it regain investors’ favour, as earnings and revenues beat Wall Street expectations by 29.12% and 5.04%, respectively. The industrial giant recorded earnings of $4.91 per share, while revenues reached $15.86B, producing a better bottom-line outcome than its last quarter of 2022.

Technische Analyse

After escaping from the clutches of bearish investors, Caterpillar’s share price crossed above the 100-day moving average to exit a descending channel pattern. Bulls took control of the stock and established an all-time high in the week of the 23rd of January 2023, forming resistance at the $266.04 per share level. A sharp downturn followed as bears found their feet, with the price retreating only to find support at the 50% Fibonacci retracement level at $205.60 per share.

With the share price pointing higher, further upside gains are likely, as the Relative Strength Index transitions from oversold to overbought levels. Optimistic investors will likely chase down resistance at the $266.04 per share level.

In contrast, if upside volume begins tapering off, it could indicate weakening upside momentum, making a reversal imminent. If the share price reverses, optimistic investors will likely be in contention to buy into the stock at a discount, making the $213.32 per share level at the 50% Fibonacci Retracement the next significance level. However, if bearish momentum prevails, bullish investors could look to the $205.60 per share support level or the 61.80% Fibonacci Retracement Golden Ratio for long opportunities, given that downside volumes decline as the price approaches either level, to signal the wearing out of bearish momentum.

Source: TradingView – Nkosilathi Dube

Fundamentalanalyse

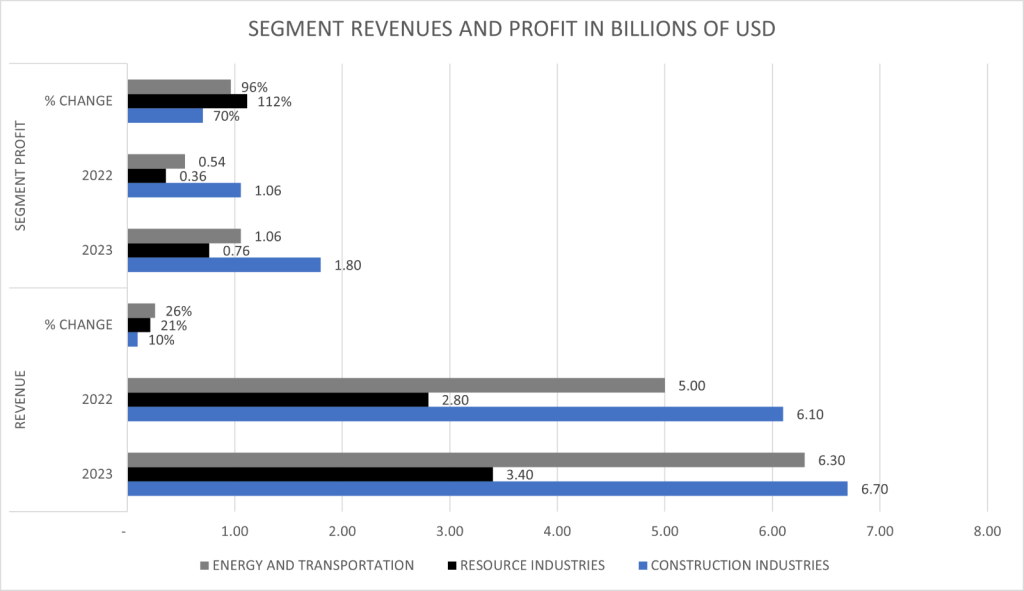

In the first quarter of 2023, sales increase was observed throughout the three major segments, namely, the Construction industries, Resource industries, and Energy & transportation. Sales and revenues increased by 17% to $15.90B from the first quarter of last year to this year, principally due to favourable effects from price realisation and sales volumes. Currency effects were partially responsible for offsetting the growth.

Following suit with the topline’s performance, operating income increased 47% to $2.73B year-over-year, partly as a result of a higher average selling price per unit and rising sales volume. The effects of the company’s Longwall division being sold off and higher manufacturing expenses, which primarily represented higher material costs, somewhat offset the growth.

Source: Caterpillar Inc – Nkosilathi Dube

The main driver of revenue growth was the Energy & Transportation segment which saw revenue surge 26% to $6.30B from $5B the quarter a year ago. Within the industrial subsegment, growth was principally driven by increased sales across every segment, while rail services and marine and international locomotives witnessed growth in global transportation. This was followed by the Resource Industries segment, which saw revenues grow by just over a fifth to $3.40B due to improved pricing year-on-year.

The primary driver of bottom-line growth was the Resource Industries segment, whose income doubled to $0.76B, while the remaining segments, the Energy & Transportation and Construction Industries, experienced a staggering 96% and 70% growth in their respective bottom lines. An increase in infrastructure spending in the United States helped to raise profit in the first quarter by keeping order books filled and reducing the impact of rising expenses. Excavators, bulldozers, and trucks made by the machinery manufacturer saw an increase in demand due to infrastructure legislation from the Biden administration that boosted expenditure in the construction industry.

As drilling activity increased in tandem with higher oil and gas prices, its energy customers—who are dealing with outdated equipment and limited production capacity—also placed additional orders for components and engines.

Source: Caterpillar Inc – Nkosilathi Dube

The adjusted operating profit margin for Full Year 2023 is anticipated to be in the upper half of its target range. Sales are expected to rise in the second quarter of 2023 compared to the first, as is typical for seasonality. In addition, it anticipates that the adjusted operating profit margin will be lower due to normal seasonality than in the first quarter of 2023.

The market has highly favoured Caterpillar shares over a year, as the stock is up 44.58% from July 2022, just over three times the return of the broader market, represented by the S&P500 (SPX). Due to the company’s leading position and vast reach within different parts of the global market, investors have been confident in its ability to generate earnings for them.

Source: Koyfin – Nkosilathi Dube

According to a report by Business Insider, Caterpillar, one of the world’s largest consumers of steel, uses 15 million pounds of steel weld wire per year to produce its machines. Due to its high exposure to steel prices, a key factor to consider, Caterpillar’s share price seems to correlate negatively to steel prices. The recent decline in steel futures (COMEX: HRC) has seen a surge in the share price as it likely reduces the costs associated with the production of its mainstream products, thereby boosting profitability.

Source: TradingView– Nkosilathi Dube

After discounting for future cash flows, a fair value of $275.00 per share was derived.

Zusammenfassung

The investment community’s main concern over Caterpillar’s post-first quarter earnings was a flat order backlog compared to recent quarters, which analysts consider could be a sign that equipment purchases are slowing down. If the second quarter earnings and sales on the 2nd of August weaken against expectations, it could apply downside pressure to the share price. However, with the global economy seemingly nearing the end of one of the steepest monetary tightening cycles in history, economic growth could be on the horizon and create opportunities for the share price to converge with its $275.00 per share fair value.

Sources: Caterpillar Inc, COMEX, Reuters, CNBC, Business Insider, TradingView, Koyfin