Piece Written by Nkosilathi Dube, Trive Financial Market Analyst

Amid a challenging economic landscape plagued by global inflation and soaring interest rates, Amazon.com (ISIN: US0231351067) emerged as a beacon of success in its second quarter of 2023. The e-commerce giant delivered an impressive display of resilience, reporting upbeat earnings that exceeded Wall Street estimates.

Amidst a backdrop of consumer spending uncertainty, Amazon’s revenues experienced remarkable year-over-year growth, showcasing its ability to adapt and thrive in the face of adversity. Surpassing all expectations, the company reported earnings of $0.65 per share, leaving analysts in awe with an astounding 83.66% beat while raking in an astonishing $134.38 billion in revenue – a 2.20% jump beyond projections.

Amazon’s unwavering commitment to refining its services, streamlining its delivery process, and effective cost-cutting measures played pivotal roles in its operational and financial triumphs. By expertly navigating the turbulent economic landscape, the company turned a profit, fuelling positive growth in its bottom line.

A key driver of Amazon’s outstanding performance was its unwavering dedication to customer satisfaction. Shipping its widest selection of goods to U.S. Prime members at record-breaking speeds, the company now offers free Same-Day or One-Day Delivery on countless popular items, solidifying its position as a leader in customer-centric e-commerce.

Technische Analyse

Amazon’s share price has seen an impressive resurgence, soaring 65.80% year-to-date, indicating a remarkable recovery from the setbacks of 2022’s market downturn. After seven years of consistent gains, the stock faced its first negative year but has since displayed strong signs of resilience and upside momentum.

A significant support level was established at $81.44 per share, serving as a firm foundation for the uptrend. As optimistic investors piled in, the share price broke out of the descending channel pattern and surged above the 100-day moving average, indicating a shift in sentiment and a potential reversal of the bearish trend.

With resistance at the $146.16 per share level now within reach, a positive reaction to the company’s upbeat earnings results could propel the stock further. A high volume breakout beyond this level may open the gates to additional upside potential. Notably, the $164.98 per share level stands as a key point of interest, aligning with the 38.20% Fibonacci Extension level, adding further significance to this price target.

However, cautious optimism is warranted, as the Relative Strength Index (RSI) suggests overbought conditions, which could lead to a potential reversal. Should a downturn occur, the $102.45 per share level serves as an important support, having previously provided a shallow retracement after the breakout above the descending channel pattern.

Fundamentalanalyse

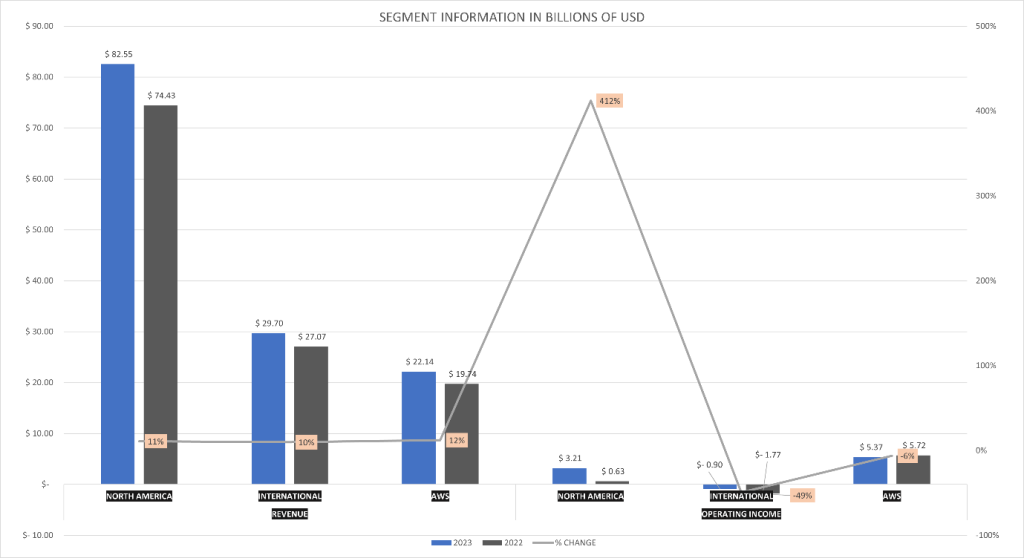

Amazon’s second-quarter performance showcased remarkable growth and resilience, as the online retail giant reported a surge in revenue driven by strong performances across all segments. With revenue jumping by 11% to a staggering $134.4 billion compared to the same period last year, Amazon demonstrated its prowess in navigating an evolving economic landscape.

The standout performer in Amazon’s portfolio was the Amazon Web Services (AWS) segment, witnessing an impressive 12% year-over-year growth to $22.1 billion, contributing significantly to the top-line expansion. The North America and International segments also demonstrated robust performances, growing by double digits – 11% to $82.5 billion and 10% to $29.7 billion, respectively. Amazon’s advertising services emerged as a powerful revenue driver, with a noteworthy 22% growth, propelling revenues to $10.7 billion compared to a year ago.

Source: Trive Financial Services Malta – Amazon.com, Nkosilathi Dube

The company’s strategic cost-cutting measures implemented in the previous year bore fruit, as evident from the soaring operating income, more than doubling to $7.68 billion compared to $3.32 billion the previous year. AWS played a significant role, accounting for a remarkable 70% of the operating income. Additionally, Amazon’s net income experienced a remarkable turnaround, with the online retail giant posting a profit of $6.75 billion, a stark contrast to the $2.03 billion loss suffered a year ago, primarily attributed to a valuation markdown of $3.9 billion in its stake in Rivian.

Amazon’s upbeat guidance for the current quarter further proves its optimistic outlook. Sales are expected to grow between 9% to 13% year-over-year, reaching an impressive range of $138.0 billion to $143.0 billion, showcasing the company’s ability to maintain consistent growth. Operating income is also projected to experience substantial growth, with expectations ranging from $5.5 billion to $8.5 billion, a substantial leap from $2.5 billion in the same quarter of 2022.

The significant headcount reduction of 4% to 1.46 million highlights the company’s focus on improving profitability and efficiency. Furthermore, the derived fair value of $154.00 per share, factoring in future cash flows, provides investors with valuable insight into the company’s potential growth and valuation.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Amazon’s share price has delivered an impressive performance, surpassing the tech-heavy NASDAQ100 index (NDX) with a remarkable year-to-date gain of 65.80%, outpacing the NDX’s 39.48% growth. The stock’s positive correlation with the index reinforces its significance as the fourth-largest company by market capitalization, comprising nearly 6% of the index’s weighting. This robust performance reflects Amazon’s resilience and dominance in the tech sector, making it an appealing choice for investors seeking strong returns in the current market climate.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

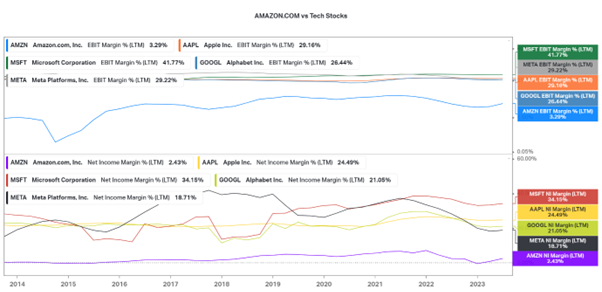

Amazon’s profitability lags behind other mega tech stocks listed on NASDAQ, with Earnings Before Interest and Tax margin at 3.29% and Net Income Margin at 2.43%, significantly below the sector average. This can be attributed to the company’s strategic low-pricing approach, which bolsters market share but leads to narrower margins compared to its tech peers. While this strategy may create barriers to competition, investors seeking higher profitability levels might be deterred by the company’s comparatively lower margins.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

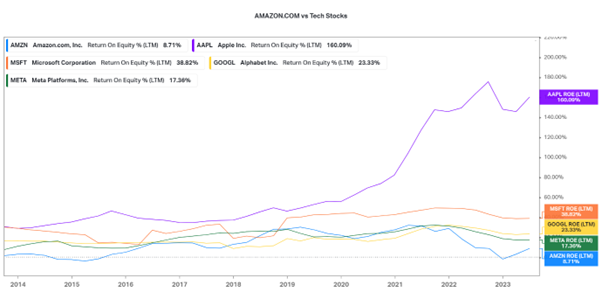

Amazon’s profitability, as reflected by its Return on Equity (ROE), faces challenges compared to its tech counterparts due to its low pricing strategy. With an ROE of 8.71%, nearly twice lower than its closest competitor, the company’s stable yet relatively subdued performance may warrant careful consideration for investors seeking higher returns on their equity investments.

Zusammenfassung

Overall, Amazon’s second-quarter performance paints a picture of a resilient and adaptive company, reaping the rewards of strategic decisions and continuing to dominate in the digital commerce space. Its ability to navigate challenges and deliver strong financial results positions Amazon as an enticing investment prospect for those seeking exposure to a powerhouse in the e-commerce industry. With the incorporation of Artificial Intelligence on the horizon, its fair value of $154.00 per share could materialize.

Sources: Amazon.com Inc, Reuters, CNBC, Visual Capitalist, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.