Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Caterpillar Inc. (ISIN: US1491231015), the global leader in construction and mining equipment manufacturing, has turned heads on Wall Street with its second-quarter performance that exceeded all expectations.

The company delivered an impressive earnings per share of $5.55, surpassing estimates by a substantial 21.33%. Moreover, its top-line revenue, reaching $17.32 billion, slightly outpaced estimates by 5.19%. This achievement can be attributed to increased sales in its construction and mining equipment sectors, signifying Caterpillar’s upward trajectory.

This success builds on a positive first-quarter report, highlighting the company’s consistent financial strength. Caterpillar’s remarkable second-quarter results and promising guidance have instilled newfound confidence in investors, resulting in a surge in the company’s share price to reach an all-time high. Impressively, the share price has already seen a 17.48% increase year-to-date, positioning the company for its fifth consecutive year of market value growth.

Technische Analyse

Caterpillar’s stock has embarked on an upward trajectory, buoyed by a robust performance in the year’s first half. The stock soared to unprecedented heights, surpassing the prior resistance at $266.04 per share, establishing this level as a newfound support. The swift ascent towards an all-time high can be attributed to the 61.80% Fibonacci Retracement Golden Ratio, which initiated the move after a retracement from the resistance level, solidifying $200.00 per share as a substantial major support.

Should the positive momentum persist, investors will likely turn their attention towards the $314.74 per share level, as indicated by the 23.60% Fibonacci Extension. Conversely, the $266.04 level may act as a formidable barrier in the event of a pullback. However, breaching this level could draw interest from discerning buyers eyeing the $200.00 per share mark. The market’s response reflects a collective optimism in Caterpillar’s performance.

Fundamentalanalyse

Caterpillar Inc. has delivered an exceptional second-quarter performance, reporting a staggering 22% surge in sales and revenues, totalling $17.3 billion. This significant boost was propelled by increased sales volume and favourable pricing trends, primarily driven by heightened demand for its construction equipment. The company’s strategic approach, including heightened dealer inventory and amplified direct customer sales, played a pivotal role in this success.

The Construction segment experienced a notable 19% surge in sales, marking an increase of $1.121 billion. This growth was fuelled by amplified sales volume and advantageous pricing, particularly in North America. Despite a slight dip in sales volume, Latin America saw a partial offset through favourable pricing. In the EAME region, heightened sales volume and beneficial pricing contributed to the surge, while sales in the Asia/Pacific region remained steady.

In the Resource Industry sector, Caterpillar witnessed an impressive 20% surge in total sales, equating to a remarkable $602 million increase. This upswing was primarily attributed to well-executed pricing strategies and an uptick in sales volume. Consequently, the sector’s profit experienced a substantial boost of $385 million, marking a remarkable 108% increase, albeit offset by heightened material costs.

The energy and transportation segment also witnessed a commendable 27% rise in sales, propelled by surging demand for engines and turbines. This upswing underscores the robust demand for Caterpillar’s construction equipment, even amidst material cost hikes and associated price increases. A significant driver of this heightened demand is the U.S. government’s monumental infrastructure investments through the $1 trillion package enacted in 2021.

Additionally, increased expenditure by miners, meeting the escalating demand for essential minerals like lithium and rare-earth minerals for electric vehicles, has further bolstered sales of mining machinery. This trend is anticipated to persist, fuelled by elevated U.S. infrastructure spending. However, concerns about labour and material availability remain a factor to watch in the thriving construction sector.

Caterpillar’s financial prudence is evident in its return of $2.0 billion to shareholders through strategic share repurchases and dividends in the quarter. Furthermore, their operating profit margins have seen a substantial increase, rising to 21.1% in Q2 2023 compared to 13.6% in Q2 2022. Earnings per share for Q2 2023 reached $5.67, marking a significant surge from $3.13 in Q2 2022.

With the company anticipating robust demand from the construction and mining sectors, full-year operating margins are poised to reach the upper end of previous projections. This demonstrates Caterpillar’s adaptability and resilience in capitalizing on key economic drivers, showcasing their pivotal role in the global construction and mining industries. These robust financials have spurred a surge in Caterpillar’s share price to an all-time high, reflecting investor confidence and setting the stage for sustained growth in the market value.

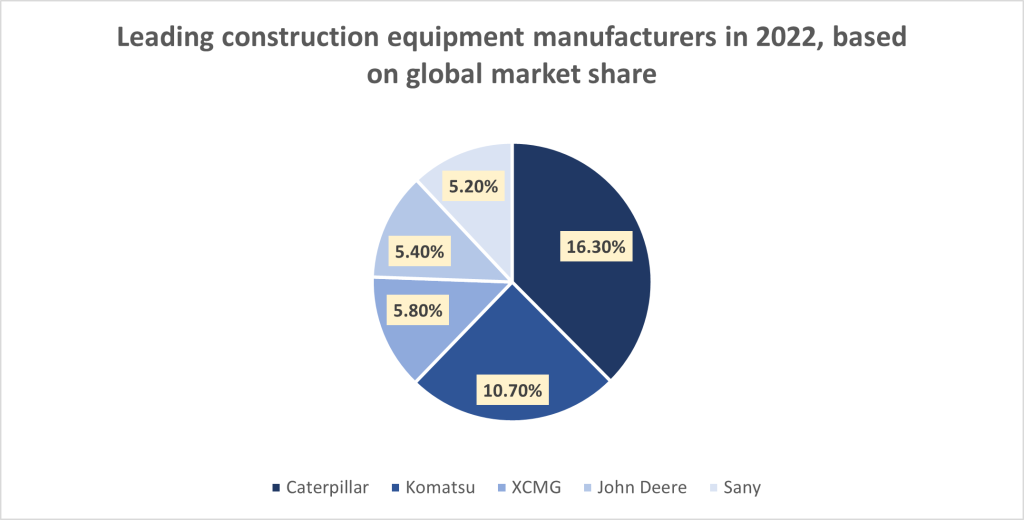

Source: Trive – Statista, Nkosilathi Dube

Caterpillar’s supremacy in the construction sector is underscored by its commanding 16.30% market share in construction equipment. This dominance is starkly evident when compared to its nearest U.S. rival, Deere & Company, which holds a significantly smaller market share of 5.40%. This sizable disparity, nearly three times less than Caterpillar’s share, highlights the company’s unrivalled position in the industry. Such a substantial market share not only attests to Caterpillar’s product quality and customer trust but also affords the company significant influence and competitive advantage, further solidifying its leadership in the construction equipment market.

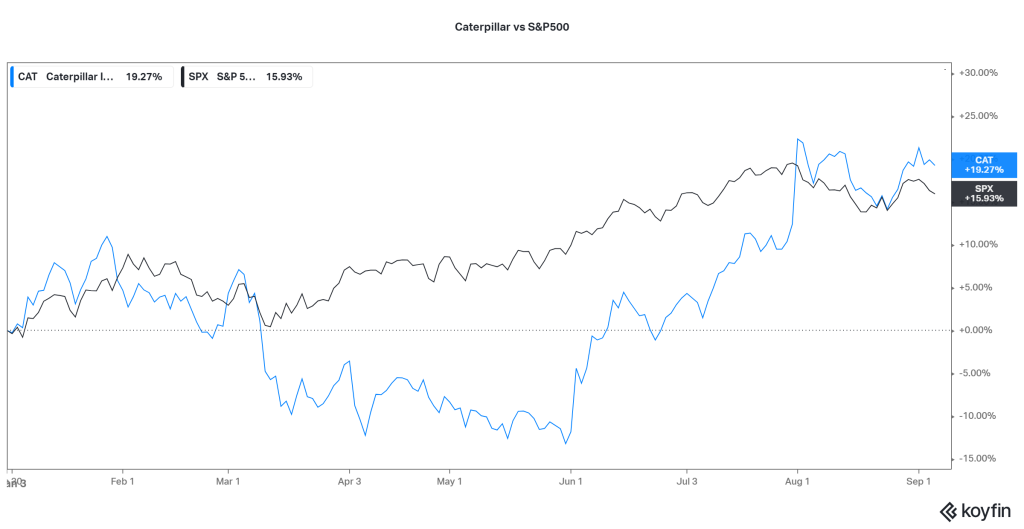

Source: Trive – Koyfin, Nkosilathi Dube

Caterpillar’s stock has shown impressive performance on a year-to-date basis, surpassing the broader market represented by the S&P 500. With a notable gain of 19.27% thus far, investors have shown a strong preference for Caterpillar’s stock. Interestingly, despite initial underperformance compared to the index for most of 2023, Caterpillar’s shares established a turning point midway through the year, demonstrating significant growth. This upward trajectory is indicative of renewed investor confidence and suggests an optimistic outlook for the company’s future performance.

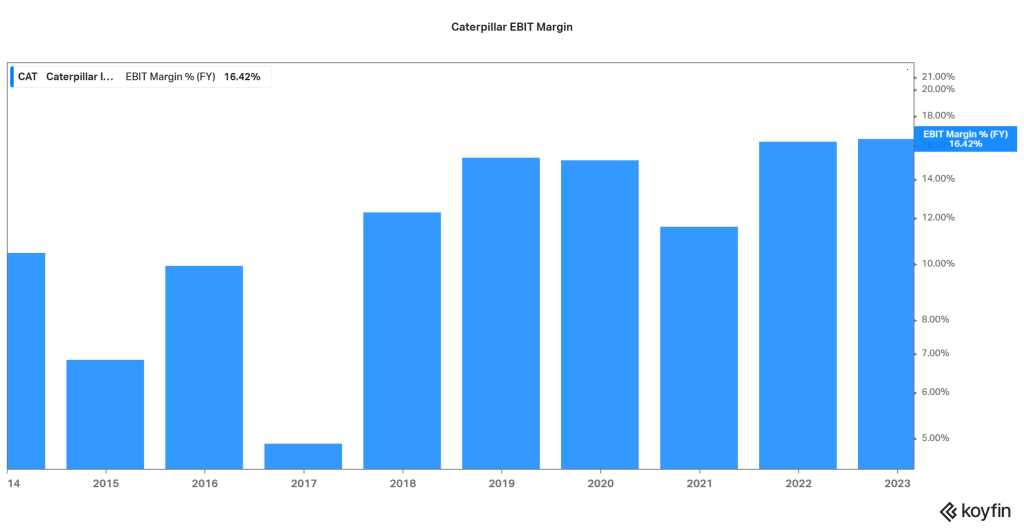

Source: Trive – Koyfin, Nkosilathi Dube

Caterpillar has demonstrated a commendable track record of sustained profitability over the last decade. Despite a significant dip in profitability in 2017, the company promptly recovered and has consistently achieved robust EBIT margins, consistently surpassing the 10% benchmark. This resilience underscores Caterpillar’s adeptness at navigating challenges and reinforces its position as a financially sound and stable entity in the market.

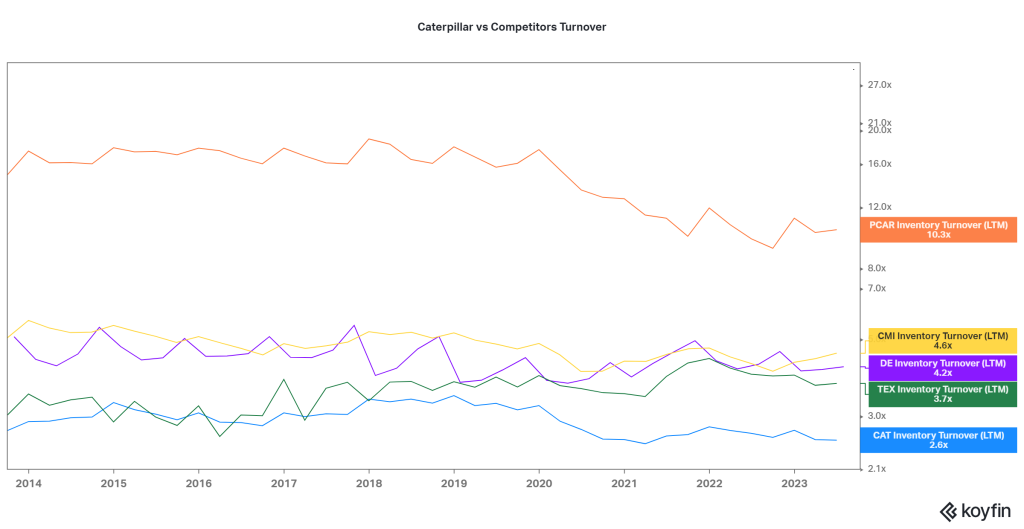

Source: Trive – Koyfin, Nkosilathi Dube

Caterpillar distinguishes itself in the industry with a unique inventory turnover rate of 2.6×, notably lower than its prominent peers. This divergence can be attributed to the specialized nature of Caterpillar’s business. As it manufactures heavy machinery and equipment, Caterpillar operates in a sector with longer sales cycles, necessitating extended periods for negotiations and finalizing contracts. Moreover, the high unit value of their products sets them apart from fast-moving consumer goods, leading to a naturally lower frequency of sales and, consequently, a slower inventory turnover rate. While this may seem atypical compared to peers, it aligns with Caterpillar’s strategic focus on delivering high-quality, specialized equipment.

Source: Trive – Koyfin, Nkosilathi Dube

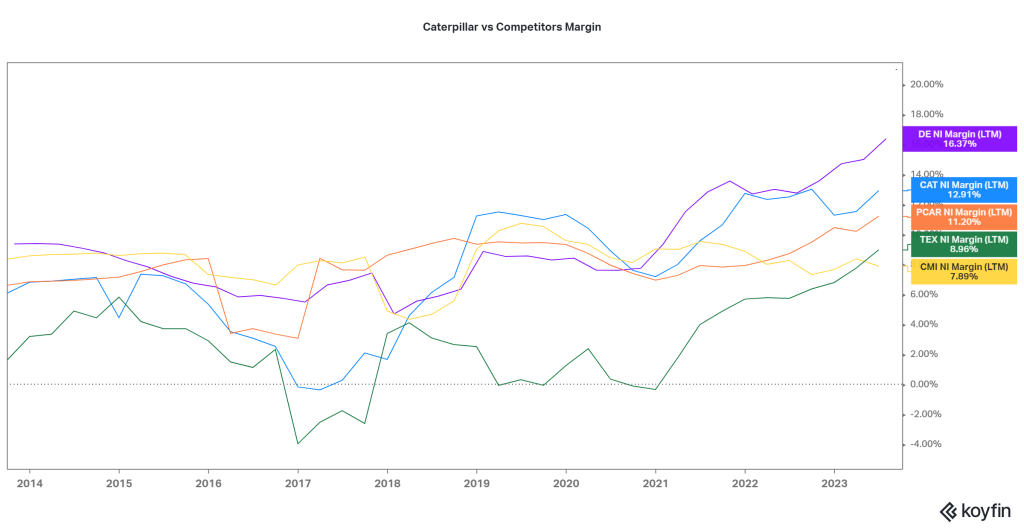

Although Caterpillar’s inventory turnover falls behind its peers, it distinguishes itself in profitability compared to its peers. Boasting a robust Net Income Margin of 12.91%, it trails behind only Deere & Company. This signifies Caterpillar’s adeptness at converting sales into profit, a vital measure of financial health. Moreover, the company’s consistent growth in profitability over the past decade underscores its potential as a steadfast, returns-driven stock. This sustained upward trajectory in profitability augurs well for Caterpillar, positioning it as a reliable player in the competitive market landscape.

Source: Trive – Koyfin, Nkosilathi Dube

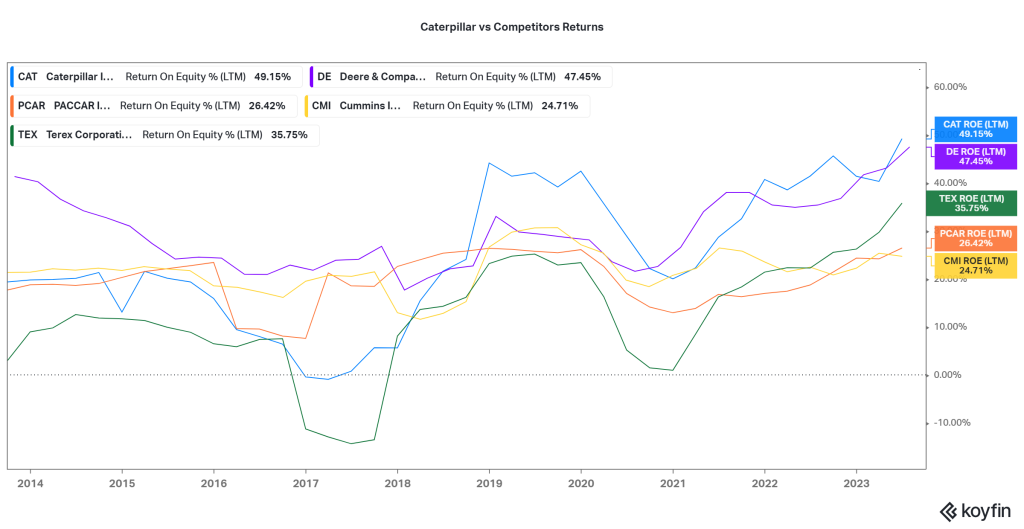

Caterpillar Inc. distinguishes itself prominently in the realm of returns when compared to its peers. With an impressive 49.15% return on equity (ROE), Caterpillar emerges as the leader in this critical metric. This signifies the company’s exceptional ability to generate profit from shareholders’ investments, showcasing its efficient utilization of equity capital. The consistent trajectory of healthy net income margins over the past decade has significantly contributed to this remarkable ROE. Caterpillar’s prowess in delivering robust returns underscores its financial acumen and solidifies its position as a standout performer in the industry. Such proficiency in capital utilization is pivotal in sustaining long-term growth and value creation.

After discounting for future cash flows, a fair value of $305 per share was derived.

Zusammenfassung

Caterpillar’s dominant market share, steady profitability, and exceptional return on equity solidify its position as a global leader in construction and mining equipment manufacturing. This financial prowess underscores its resilience and positions Caterpillar for sustained growth, highlighting its pivotal role in the construction and mining industries.

Sources: Caterpillar Inc, Reuters, Wall Street Journal, CNBC, Statista, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with Trive Financial Services Malta Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.