Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

This week, Walmart Inc. (ISIN: US9311421039) has taken the spotlight with a remarkable feat. With a determined climb, its share price scaled new heights, inching ever closer to a notable 10% year-to-date return. This ascent was crowned by the unveiling of second-quarter earnings that bore the hallmark of resilience and strategy. As the foremost U.S. retail giant, Walmart delivered a performance that modestly exceeded Wall Street’s predictions, underscoring its steadfast grip on the consumer market.

With revenues totalling a substantial $161.63 billion, subtly surpassing projections, the spotlight shone even brighter on the $1.84 earnings per share, defying expectations by an impressive 7.84%. The driving force behind these unexpectedly robust profits emanates from the unwavering vigour of American consumers’ spending, with their economic pulse propelling Walmart’s positive trajectory. The tale extends beyond domestic shores, as the international arm of the corporation echoed its best quarterly performance in recent memory.

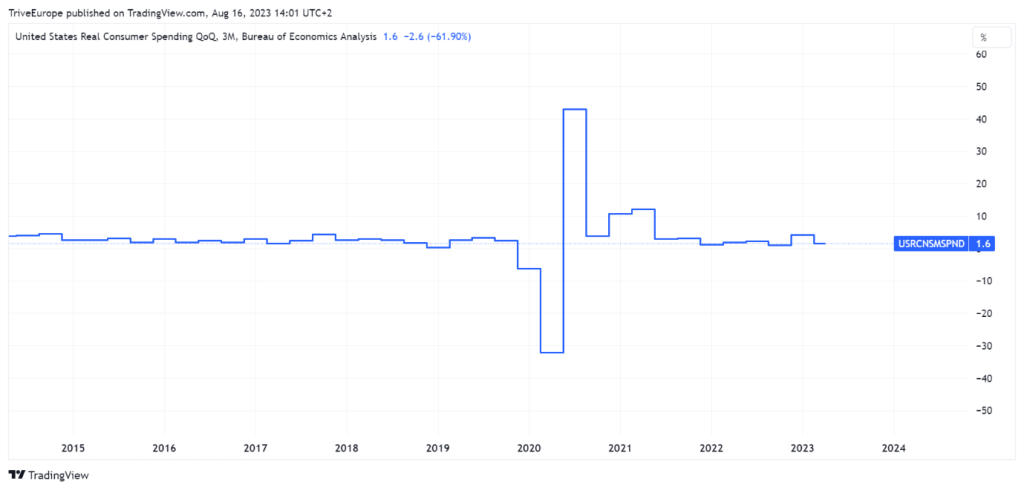

The retail landscape has transformed against the backdrop of inflation’s steep rise and the burden of high-interest rates. Consumers, in response, have recalibrated their spending habits, gravitating towards more essential goods. The era of quantitative easing during the pandemic, which once flooded consumers with spending power, now resides in the rearview mirror. In this evolving scenario, Walmart’s unyielding sales stand tall, fortified by its positioning in the Fast Moving Consumer Goods sector – a realm where affordability and consumer resilience interlace.

Source: Trive – Bureau Of Economic Analysis, Nkosilathi Dube

Technische Analyse

Walmart’s share price has woven a compelling narrative throughout 2023, orchestrating a steady uptrend that artfully unravelled the previous year’s losses. This transformative journey gained momentum as the stock transcended its 100-day moving average in March, igniting a resolute upward trajectory toward unprecedented heights.

However, this bullish ascent encountered a temporary detour during a two-week retracement. Yet, just as doubts emerged, a surge in upside momentum forged a pivotal support platform at $145.01 per share, underscoring the stock’s resilience.

However, a sharp weekly decline from its all-time high etched a resistance frontier at $162.78 per share, delineating a challenge to the prevailing optimism. The nuanced interplay of technical levels entered the spotlight as the 50% Fibonacci Retracement price level at $153.89 per share emerged as a point of intrigue. This level’s recent history as an upside pivot lends it a potential significance should downside momentum persist. The rhythm of trading volumes as the price approaches might cast a telltale signal: a decrease hinting at fading downward thrust, potentially heralding a reversal.

As investor sentiment sways, Walmart’s sterling earnings and robust full-year guidance possess the potential to conjure a shift in favour of its stock. In this evolving tale, optimism blooms, painting a scenario where the $162.78 per share level takes on heightened importance, a coveted waypoint for investors should momentum align with their bullish aspirations.

Fundamentalanalyse

Walmart’s recent quarterly performance has emerged as a showcase of resilience and growth, reflecting the retail giant’s adept manoeuvring amidst a complex economic landscape. With consolidated revenue climbing an impressive 5.7% to reach $161.6 billion, the company’s adept navigation of changing consumer behaviour and market dynamics is evident. This upward trajectory was mirrored in operating income, which rose by 6.7% to $7.3 billion, a notable positive shift from the previous year. This triumph translated into a robust Gross Profit margin increase, up 50 basis points to 24%, underscoring the company’s ability to optimize its operations.

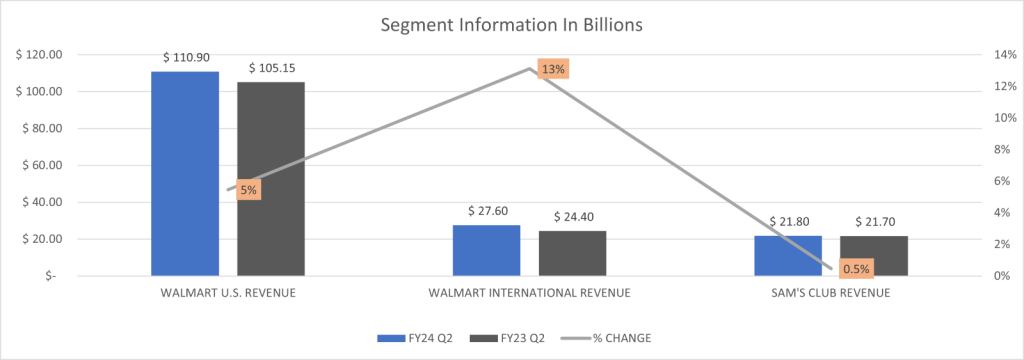

The true crescendo, however, was Walmart’s impressive 53% surge in net income for the fiscal second quarter, amounting to a formidable $7.89 billion compared to $5.15 billion in the prior year. Walmart’s U.S. division was a standout performer in this ensemble, with revenues leaping 5.4% to $110.9 billion, an accomplishment that spurred a substantial 7.6% growth in operating income to $6.1 billion. The division’s sustained growth was fuelled by a 2.9% increase in transactions and a 3.4% rise in average ticket size, alluding to the retailer’s effective strategies in consumer engagement.

While grocery and health & wellness led the U.S. sales charge, general merchandise exhibited a minor dip. Yet, the digital arena was a beacon of Walmart’s innovative prowess. E-commerce in the U.S. division soared by 24%, buoyed by robust pickup & delivery services and advertising initiatives. The company’s advertising segment, Walmart Connect, mirrored this success with a notable 36% growth in sales.

This quarter, the international division’s triumph shone particularly bright, with net sales surging 13.3% to $27.6 billion. This was attributed to standout performances from Walmart Mexico, China, and the Indian eCommerce arm, Flipkart. Notably, positive traffic trends spanned across all international markets, culminating in a 14.1% growth in operating income to $1.2 billion.

The resilience of the Walmart conglomerate extended to Sam’s Club, albeit with a more tempered growth rate. Despite a 30 basis point retreat to $21.8 billion in net sales, the wholesale division made strategic inroads, bolstering its market share in grocery and general merchandise. This was fortified by an 18% increase in e-commerce activity and a striking 33% surge in advertising.

Source: Trive – Walmart Inc, Nkosilathi Dube

Emanating from this dynamic performance is a buoyant guidance that contrasts starkly with its peers. This optimistic outlook reflects Walmart’s leveraging of its low-cost reputation to entice consumers and bolster online spending. The company’s expanded full-year projection echoes its confidence in an enduring consumer base, tempered by global market complexities. The third quarter is anticipated to witness a 3% growth in revenue and a 1% boost in operating income, while the full fiscal year is set to see net sales surge by 4% to 4.5%, paralleled by an operating income expansion of 7% to 7.5%.

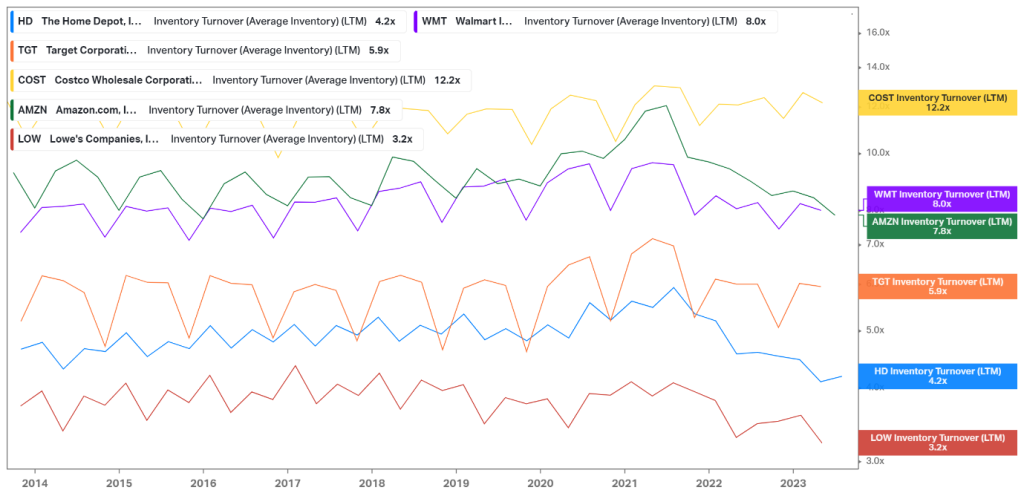

Source: Trive –Koyfin, Nkosilathi Dube

Walmart’s impressive inventory turnover exemplifies its retail prowess, outpacing most rivals. This is a result of their Fast Moving Consumer Goods strategy, driving swift sales of budget-friendly products. Aligned with industry norms, the second half of the year carries the mantle of peak sales, showcasing Walmart’s efficiency in managing seasonal patterns while maintaining its inventory efficiency.

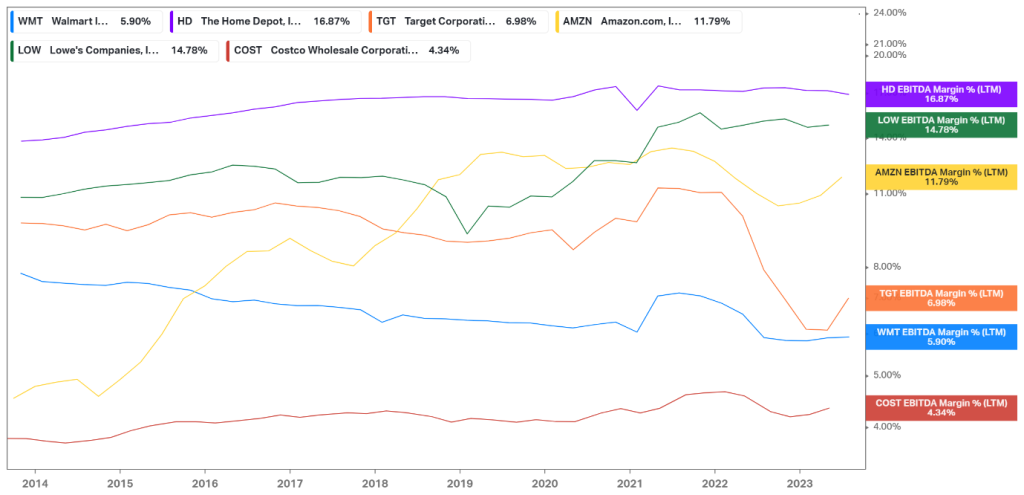

Source: Trive –Koyfin, Nkosilathi Dube

Walmart’s EBITDA Margin, though trailing behind some discretionary retail counterparts due to its economical consumer approach, shines with consistency. The company’s steadfast sales, unfazed by economic cycles, underscore its ability to maintain stability amidst market fluctuations, reflecting a strategic balance between cost-consciousness and reliability.

Source: Trive –Koyfin, Nkosilathi Dube

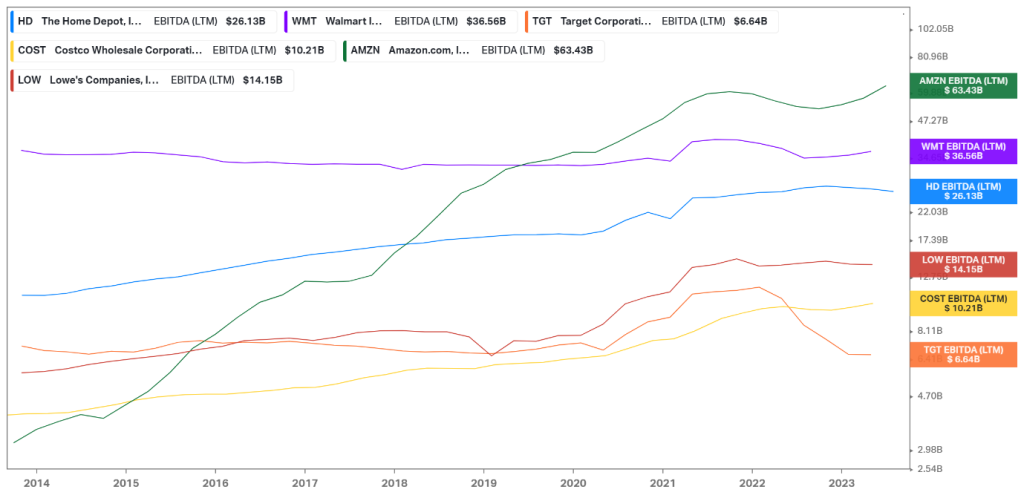

Walmart’s EBITDA unveils a paradox: while its EBITDA margin trails some peers, its earnings ascend to an impressive peak. With a towering $36.56 billion EBITDA, it stands second only to Amazon.com Inc (ISIN: US0231351067). This dualistic prowess exemplifies that robust earnings can emerge from both low margins and market penetration.

After discounting for future cash flows, a fair value of $166.00 per share was derived.

Zusammenfassung

Walmart has sustained its sales despite the deterioration of consumer spending on Big-ticket items over the past few quarters. Due to its necessity product strategy, sales will likely remain resilient, promoting the possibility of healthy earnings in subsequent quarters. If so, the $166.00 per share value could become the stocks next destination.

Sources: Walmart Inc, Bureau of Economic Analysis, Reuters, Dow Jones, McKinsey, National Retail Federation, Statista, CNBC, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.