Airbnb Inc (ISIN: US0090661010) shed an eyewatering 14% in pre-market hours despite experiencing a constructive quarter with most of its key metrics pointing upwards. Driving the negative sentiment over the company’s future was downbeat expectations for the next quarter’s Nights and Experiences Booked. Airbnb forecasts that bookings will slow compared to revenue growth, leaving investors fretting over the company’s future performance.

However, Airbnb’s earnings were very encouraging, as Nights and Experiences Booked hit a record high with over 120 million. The company is now twice its size before the pandemic on both Gross Booked Value and revenue basis, with a much healthier profitability and cash flow.

Airbnb’s share price has been subdued in recent years, despite making a minor recovery in the past few months. A rapid tightening cycle within the U.S. economy saw interest rates surge, growing borrowing costs and hampering growth prospects with higher discount rates compounding on the downward pressures. The share price shed nearly half its value in 2022 but has begun a recovery process with nearly half of the losses erased.

Technical

From a technical standpoint, Airbnb’s share price has been in an unchallenged downtrend as bearish investors reined in on the stock, causing the market structure to form a descending channel pattern. The price currently trades below its 100-day moving average and has recently begun recovering losses. Support and resistance were established at the $82.00 and $145.00 per share levels, respectively.

The market is seemingly beginning to accept Airbnb as a “Buy”, given its 48% leap year-to-date. Investors looking to participate in the action could be better placed buying into the stock at a discount, considering that most of the upside ground has already been covered. With the price trading at the descending channel’s resistance, a pre-market rejection of the level sent the share price lower. The 61.80% Fibonacci Golden Ratio is a level of interest, with demand outweighing supply, given the recent jolt in the share price from the level. Bullish investors could look to the Golden Ratio for a long opportunity depending on their risk appetite.

Alternatively, a further leg down is probable if the share price breaks below the Golden Ratio at $106.56 per share. Therefore, bullish investors could look for possible entries nearer to the support level. If downside volumes decline towards support, the market could be preparing for a reversal, with fewer participants taking an interest in the downside price action.

Fundamental

Fundamentally, Airbnb’s internal operations and performance were mint in the first quarter of 2023, taking it to double its size from the pandemic.

Boosted by robust travel demand, solid growth in the Nights and Experiences Booked, and a stable Average Daily Rate, Revenues surged 20% to $1.8B from the same period a year ago.

The upbeat revenue performance edged Airbnb’s net income towards its first Q1 profit, with $117M realised, improving by $136M from the first quarter of 2022. The company produced $1.6B in Free Cash Flow for the quarter, up 32% year-over-year. The Trailing Twelve Month Free Cash Flow hit a record of $3.8B as a result. Airbnb is much better equipped to deal with short-term obligations and fund expansion organically.

Cementing the upbeat performance for the quarter was a 19% improvement in the Gross Booking Value (GBV), which landed on the $20.4B mark for the quarter. The enhanced GBV was, in turn, driven by a 19% increase in Nights and Experiences Booked to 121.1M, with growth witnessed in all regions. Brazil and Germany have become the two fastest-growing markets as Airbnb’s expansion efforts have proved fruitful.

Airbnb’s active listing (supply) expanded by 18% compared to the first quarter of 2022. Double-digit supply growth was realised across all regions and market types. The fastest growth came from North and Latin America, thanks to increased travel demand. In addition, cross-border nights booked surged 36% in Q1 2023 compared to the same period a year ago. Cross-border booking growth was stimulated by encouraging recovery in the Asia-Pacific as nights booked increased 40% year-over-year.

After discounting for future cash flows, Airbnb’s fair value was $147.25 per share, a price level slightly above its technical resistance of $145.00 per share. 31% of upside gains could be realised from the current price if bullish investors pile into the market to send the price to its fair value.

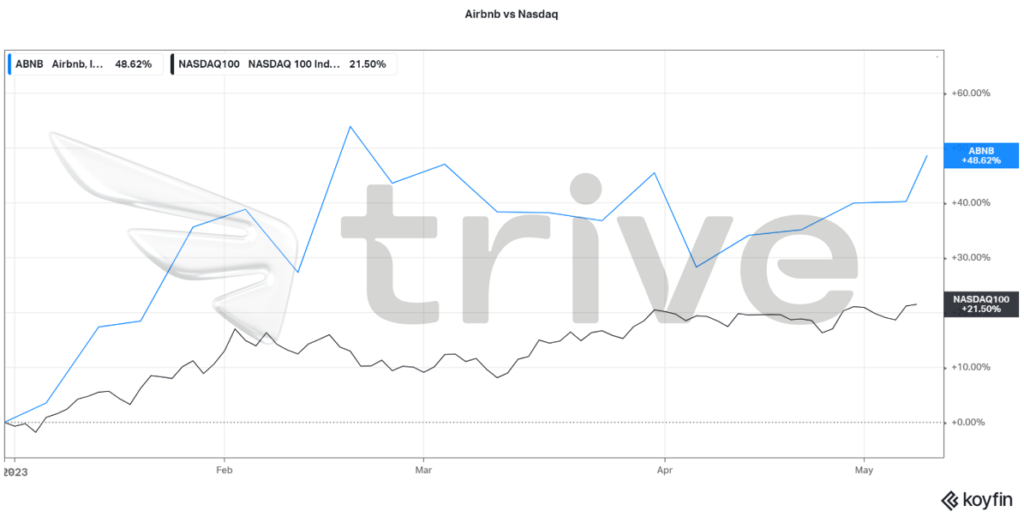

Airbnb’s share price has enjoyed a fruitful year-to-date, with the stock up 48.62%, outperforming its broader index, the Nasdaq100, which has only added less than half the amount in the same period. Investors could have been buying into the stock due to its highly discounted price or because it still offers strong growth potential, given its positive performance in the quarter.

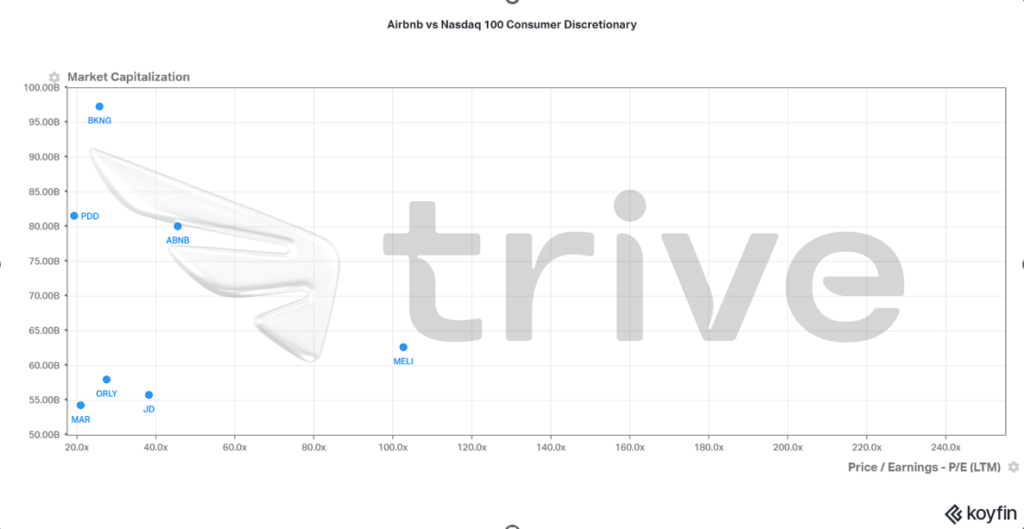

Airbnb still offers one of the best growth stock pickings within the Nasdaq100 Consumer Discretionary Sector of companies with a market capitalisation between $50 and $100B. The company stands out among the crowd with a Price Earnings ratio of 45.5×.

Summary

Panic selling took over the stock as the downbeat announcement from Airbnb followed upbeat earnings. However, this does not fully represent the current health of Airbnb’s financials and operations. Considering that growth was achieved in all active regions, combined with a more extensive listing of properties worldwide and still going, Airbnb’s growth factor is still at play. The share price could gain once all the dust settles, leaving the fair value of $147.25 per share probable.

Sources: Airbnb Inc, CNBC, Reuters, Moneyweb, TradingView, Koyfin