Berkshire Hathaway (ISIN: US0846707026) reported its earnings in what is now dubbed as the “Woodstock For Capitalists”. To the delight of its investors, the company reported $3.69 earnings per share and $85.39B in revenue, beating Wall Street Expectations by 3.01% and 2.41%, respectively.

The stock price is up nearly 5% year-to-date, and with first-quarter earnings upbeat, the company’s stock price is likely lining itself up for an 8th consecutive year closing in the green. However, the U.S. economy is showing signs of fragility, with weakness in the labour market and manufacturing activity prompting fears of a probable recession ahead. With Berkshire Hathaway’s stack of blue-chip holdings, will its stock price survive a mild recession?

Technical

With a minor gain, Berkshire Hathaway’s share price survived 2022’s heavy selloff caused by surging interest rates and a growing appetite for risk-off investments. The stock recouped all of its losses in the year and maintained an uptrend in the latter part, with price trading above its 100-day moving average while establishing an ascending channel pattern. Support and resistance were formed at the $293.57 and $360.37 per share levels, respectively.

Bullish investors have had the final say for most of 2023, despite the stock opening the year with bearish investors applying pressure. With the share price now trading near the ascending channel pattern, investors will likely be gauging whether a reversal or continuation will play out.

A high volume breakout above the ascending channel pattern could signal the market’s intention to perform a leg up. Bullish investors could either take a long opportunity on the breakout or on a retracement back towards the pattern, depending on their risk appetite.

Alternatively, if a reversal ensues, bullish investors could look to take a long position at the ascending channel’s support or where downside price action and momentum fizzle out, validated by declining volumes. The $360.37 per share level will likely be the next point of interest for bullish investors.

Fundamental

Berkshire Hathaway’s top line could be described as healthy after surging 21% to $85.4B from the same period a year ago. Helping boost the top line was improved revenues in the company’s reported revenue segments, Insurance and Railroad, Utilities and Energy, which leapt 7.8% and 83%, respectively. In addition, gains from investments and derivative contracts landed at $35B, aided mainly by gains in the company’s most considerable exposure to Apple Inc (ISIN: US0378331005)

Like clockwork, the top line’s positive performance filtered through the Consolidated Statements Of Earnings. Operating earnings, which encompasses earnings from the company’s wholly-owned businesses, totalled $8.07B in the quarter, up 12.6% from $7.16B a year ago. On the other hand, net earnings more than quadrupled, ending the quarter six times higher than the same period a year ago at $35.3B from $5.6B.

It doesn’t end there! Berkshire Hathaway is more than well-equipped to meet its short-term obligations and fund investments organically, with cash holdings sitting on a mind-boggling $130.6B, up from $128B in the fourth quarter of 2022.

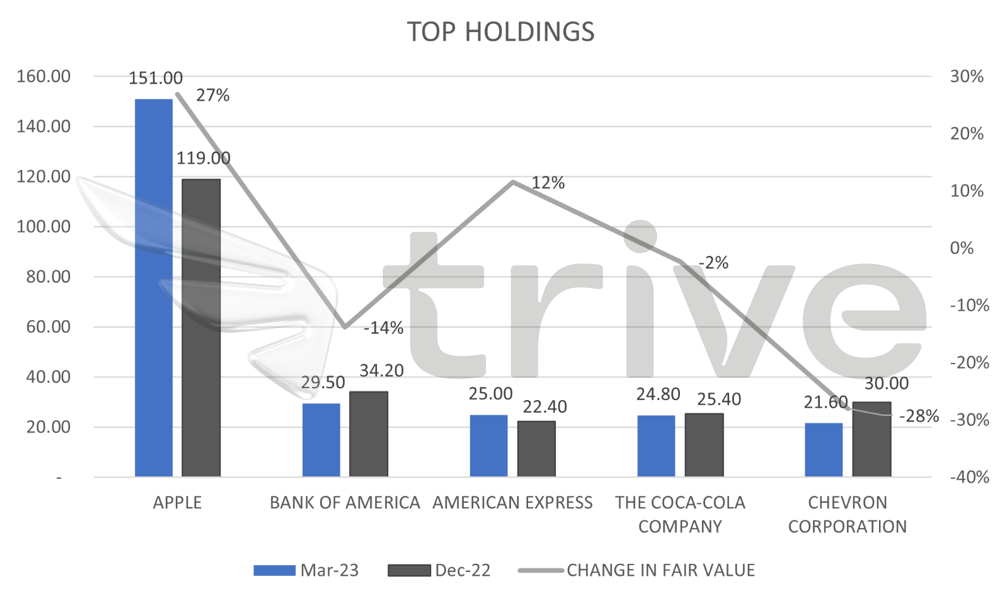

Interesting Fact! Approximately 77% of Berkshire Hathaway’s aggregate fair value is concentrated in five companies, as depicted below. Apple represents the company’s highest exposure to a single stock, followed by financial services companies, with Bank of America (ISIN: US0605051046) and American Express (ISIN: US0258161092) next in line. Apple is the best-performing company within the top five holdings after gaining 27% since December 2022. The Financial Services stocks within the top five holdings, on the other hand, suffered a 2% loss on aggregate as the Banking Sector took a knock from the failures of some high-profile regional banks.

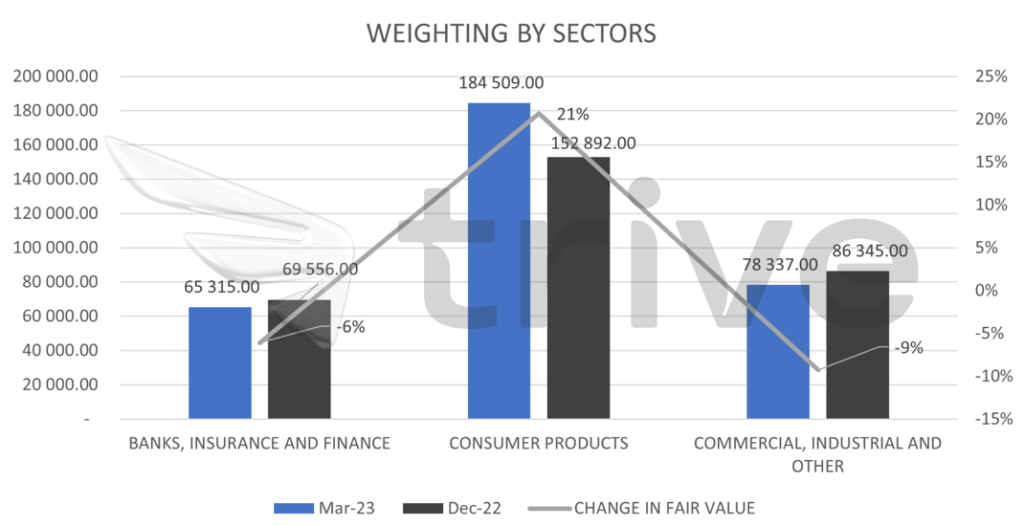

Further expanding on the analysis of assets under management, Berkshire Hathaway’s investment in financial services stocks is down 6% from the end of 2022, further reflecting the cracks and weakness within the sector. On the other hand, consumer products have performed significantly well after gaining nearly a quarter of their value since December 2022, as depicted below.

Berkshire Hathaway’s fair value was $357.94 per share after discounting for future cash flows. The share price currently trades at an 8.56% discount to fair value, leaving room for some decent upside gains.

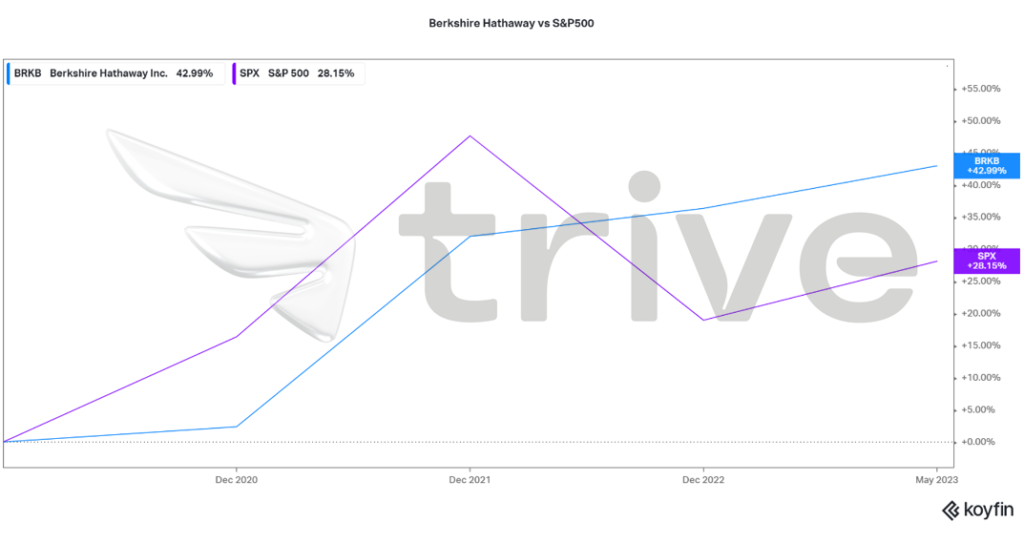

Berkshire Hathaway represents a healthy investment alternative to the broader S&P500, given it is a top-ten business within the index by market capitalisation. The stock has outperformed the broader index by over 10% in three years, suggesting that the company’s investment holdings have been of better quality than the S&P500 by returns.

Summary

Berkshire Hathaway has refined the art of investing and has only experienced seven years of negative share price performance in its nearly 27 years of listing. Given the healthy blue-chip nature of its investment, alongside the growth aspect of the likes of Apple Inc, the company’s stock price is likely to experience favourable growth, further driven by the high quality of its management, which could attract more investors. The fair value of $357.94 per share is likely, with the all-time high not far ahead, at $360.37.

Sources: Berkshire Hathaway Inc, CNBC, Reuters, CNN, TradingView, Koyfin