The FTSE100 (LSE: UKX) gained a mouth-watering 3.04% in the prior week and opened positively for the current week. Despite inflationary fears creeping into the market after a surprise output cut of 1.16M barrels per day by OPEC+, bullish traders remained sturdy.

The U.K.’s S&P Global Manufacturing Purchasing Managers Index (PMI) was flat against consensus, and traders interpreted this as positive for the FTSE100, as economic activity remained stable. Traders will be closely monitoring this week’s economic events, with speeches from Bank of England officials today likely to provide some short-term volatility. The U.K.’s S&P Services PMI and U.S. Non-Farm Payrolls will be up next.

Technical

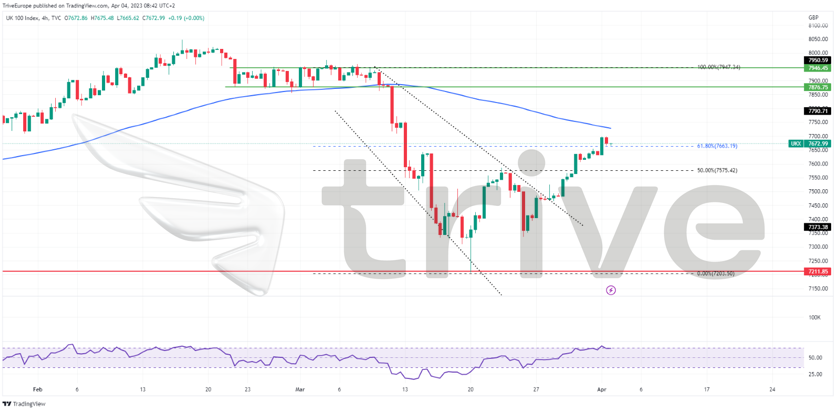

The FTSE100 ended a downtrend with price action breaking above the descending channel pattern and a lower high formed in the downtrend. Support and resistance were established at the 7211.85 and 7876.75 levels, respectively.

With bulls establishing dominance, price action was directed toward the 61.80% Fibonacci Retracement Level after the breakout, with a breakthrough candle closing above the 7663.19 level Golden Ratio. If bullish traders push forward, they will likely aim for resistance at the 7876.75 level.

Alternatively, if bears look to continue the broader downtrend, considering price action is below its 100-day moving average, they could respect the Golden Ratio. A reversal is probable, with the 7211.85 level earmarked as a potential level of interest.

Summary

The week ahead has many curveballs that traders must be on the lookout for. Traders will navigate through the higher inflationary expectations caused by the OPEC+ output cut. In addition, signs of inflation from the U.S. Non-Farm payrolls could induce downside pressures for the Index on the back of higher interest rate expectations and growing borrowing costs.

Sources: Reuters, TradingView