Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

As the US CPI report approaches, the greenback takes a step back from its recent six-month highs, leaving traders on the edge of their seats, pondering the future of interest rates. While September seems like a certainty for a rate pause, the November decision dangles precariously in the balance, with the CME FedWatch Tool shining a spotlight on a 56.1% chance of another hike—a significant uptick from just a month ago at 33.9%. The reason behind this uptick is the resilient US data that staged a coup, reshaping the financial landscape and stirring the pot of uncertainty.

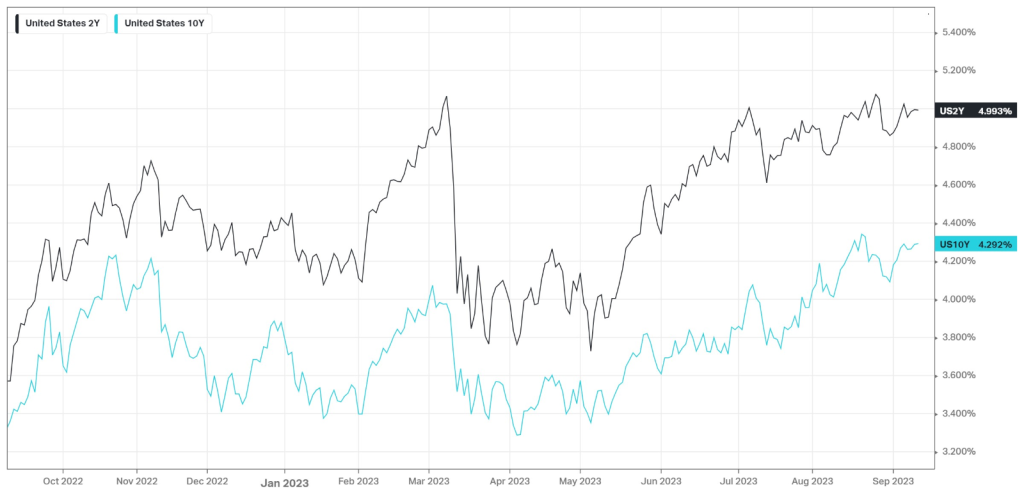

All eyes are fixated on the impending inflation data on Wednesday, where expectations are for an increase in the year-over-year figure from 3.2% to 3.6%. Lately, as the US data stood its ground, treasury yields surged, illustrated below by the steadily rising US 2-year and US 10-year treasury yields over the past year, painting a picture of a tightening monetary environment. But, despite the roaring yields and a robust US dollar, gold stands as an unwavering sentinel. The SPDR Gold Shares fund (NYSE Arca: GLD) has delivered a respectable 5.17% return over the past year, a testament to its enduring safe-haven charm, lurking persistently in the minds of traders as they navigate this financial whirlwind.

Technical

On the 4H chart, a downtrend bottomed mid-August, after which a steady uptrend has reversed some of the losses. With the 25-SMA (green line) recently pushing through the 50-SMA (blue line), the short-term momentum tilts to the upside, but the 200-SMA (orange line) still looms higher, suggesting that sellers are not far away.

A recent breakdown at the dynamic support of the ascending channel has found support at the daily pivot point of $178.34. If the price moves below this pivot point, a longer-term correction could see a test of support at $177.65 before reaching $177.20 (S2). At this level, the sustainability of the channel breakdown could be confirmed, opening up a path toward lower support at $175.78.

However, volumes have been declining, suggesting the selling pressure could be waning, leaving the opportunity for a retest at the channel breakdown level at $179.32, the 50% Fibonacci retracement from the mid-August bottom, which is also close to the resistance at $179.49 (R2). If the price moves above this level, the Fibonacci golden ratio at %180.36 could come into play as the upside continues toward $180.99.

Summary

Despite surging treasury yields and a resilient US dollar, gold has held its ground. The SPDR Gold Shares fund could react to the US inflation report on Wednesday, where a softer-than-expected rise in inflation could catalyse an influx of buyers, potentially pushing the price up to $180.36. However, if inflation remains sticky, there could be some challenging terrain ahead, with the selling pressure potentially dragging the price toward $177.20.

Sources: Koyfin, Tradingview, CME Group