With Assets Under Management (AUM) closing in on the $10 Trillion mark, BlackRock Inc (ISIN: US09247X1019), the largest Asset Manager in the world, manages more than the gross domestic product of all the countries in the world, excluding the U.S. and China.

BlackRock’s quarterly earnings beat Wall Street Expectations marginally, reaching $7.93 per share against the $7.78 forecast. Revenues, on the other hand, missed the mark faintly, with $4.243B reported against the $4.251B estimate.

BlackRock gained from the turmoil in the banking sector after generating net inflows of $110B from $86B a year prior. The growth in net inflows is a sign of the industry’s confidence in BlackRock’s overall portfolio and stability, which could benefit the mammoth business on an ongoing basis, even through future financial shocks.

As depicted in the above illustration, BlackRock’s share price moves in tandem with the S&P500, indicating a positive correlation with the index. 2022 was a particularly challenging year for equity valuations due to the steep interest rates put in place by global central banks to fight off stubborn inflation. A downtrend ensued. However, a recovery is on track and could potentially see stocks and indices return to pre-pandemic levels.

Technical

BlackRock’s share price has structurally shifted into an uptrend following price action breaking out of a descending channel pattern. Support and Resistance were established at the $505.21 and $786.35 per share levels, respectively.

A retracement from the resistance level sent BlackRock’s share price plunging toward the 61.80% Fibonacci Retracement Golden Ratio before being met by demand outweighing supply, near the $612.61 per share level. If bullish investors look to nudge the share price higher, the next probable level of interest could be the $786.35 per share level.

Alternatively, if bearish investors weigh on the share price, the next probable level of interest for long positioning would be support at the $505.21 level. If price action approaches either the Golden Ratio or support on declining volumes, it could signal the market’s lack of enthusiasm in lowering the share price further, potentially validating upside price action from either level.

Fundamental

BlackRock’s topline suffered a 10% loss year-on-year for the quarter to $4.2B, subject to subdued performance fees in the investment advisory, administration fees and securities lending, which saw revenues decline by $331M. In addition, the impact of dollar appreciation and subdued markets, particularly in the stock market, fed into the headwinds BlackRock faced.

Despite recording a drop in expenses of 4%, driven by lower performance fee incentives and seasonally lower marketing and promotional expenses, BlackRock’s operating income and bottom line shaved 18% and 14% against the first quarter of 2022, respectively, as the decline in costs could not offset the decline in the top line.

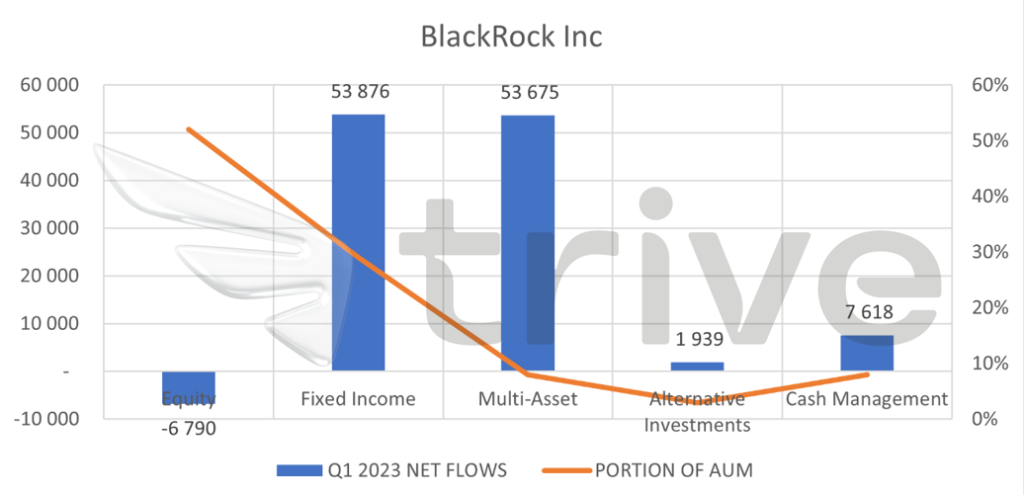

First quarter net flows were representative of the macroeconomic environment that BlackRock operates in at present. The high inflation and interest rate environment led to equity devaluations as future cash flows were discounted by higher rates while borrowing costs were elevated and growth prospects limited. The result was a net outflow in BlackRock’s equity portfolio of $6.8B in the first quarter of 2023.

However, it was not all doom and gloom, as BlackRock’s overall portfolio gained from net inflows. Among the best-performing was the Fixed Income and Multi-Asset flows. Fixed Income portfolios gained from the high-interest rate environment, which investors sought for its higher-yielding capacity. BlackRock’s net inflows of $34B to its bond ETFs were an industry leader, accounting for a staggering 60% of the total fixed-income ETF trading volume in Q1 2023.

After discounting for future cash flows, BlackRock’s fair value was $781.00 per share. The share price currently trades at a 10.36% discount to fair value, leaving significant room for the upside. The fair value also lines up with a key inflexion point forming a technical resistance slightly above it.

Summary

BlackRock’s outlook is moderate to positive, given the rebound that equities have made in the past months, while the elevated global interest rates drive the fixed-income portfolio’s gains. BlackRock’s executives believe a recession is out of the picture in 2023. If accurate, the share price could see upside momentum pick up as the globe shies away from negative economic growth, making $781.00 per share probable.

Sources: BlackRock Inc, Bloomberg, Reuters, CNBC, TradingView, Koyfin