The elevated interest rate environment has heavily subdued the SPDR DJ Wilshere International Real Estate ETF (NYSE Arca: RWX). The higher rates have made it difficult for real estate sales to pick up as borrowing costs deter potential real estate owners from acquiring debt.

The depressed housing market has been reflected in The SPDR DJ Wilshere Intl Real Estate ETF, which tracks the non-U.S. publicly traded real estate securities in developed and emerging markets. The ETF has lost nearly a quarter of its value since the beginning of 2022 to date, and investors will be keen to track events in the global economy to determine when the right time to buy will be.

Technical

The RWX has been in a downtrend following price crossing below the 100-day moving average in the second quarter of 2022 and forming a descending channel pattern. The downtrend was seemingly threatened by bullish investors buying into the ETF at the $23.09 level, with strong momentum forming support. Price action was led into a breakout above the descending channel pattern resistance as a result.

Following a surge in price, a reversal at the $29.53 level led up to price action declining and rejecting the 61.80% Fibonacci Retracement Golden Ratio at the $25.55 level. If bullish investors are committed to maintaining their upside pressure, the rejection of the Golden Ratio could indicate the beginning of the price moving higher after failing to establish a lower low, with the RSI conditions reversing from oversold territory. Bullish investors will likely aim for the $30.18 level, which forms resistance at a prior lower high.

Alternatively, if bearish momentum fails to subside, a high volume breakout below the Golden Ratio could signal bulls to stay out of the market temporarily. Bullish investors will likely look to the $23.09 level to buy into the market.

Fundamental

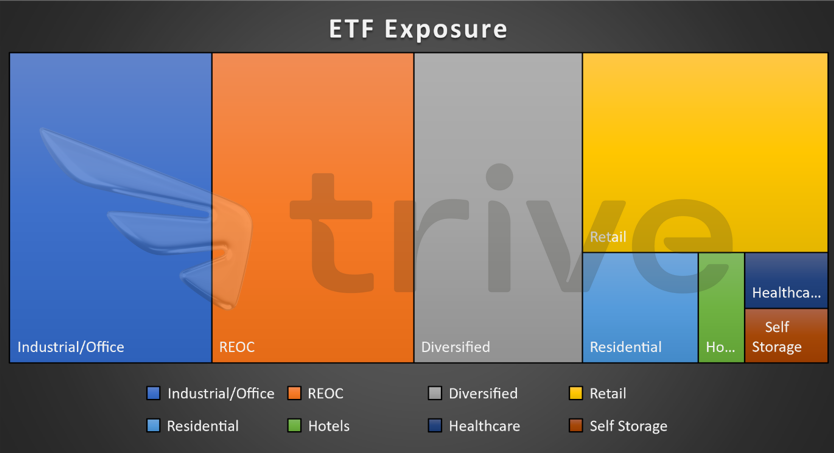

The RWX is mainly exposed to Industrial or Office and Real Estate Operating Companies, which comprise nearly half of the ETF’s exposure. The Diversified and Retail Real estate segments also contribute a significant make-up of the underlying asset. The majority of the exposure represents the cyclical nature of the ETF.

Cyclical stocks tend to be aligned with the performance of an economy, with a positive correlation. If the economy grows, demand for cyclical stocks grows with it, while cyclical stocks lose out when the economy declines. Households and businesses tend to cut back non-essential spending during economic downturns and leave real estate stocks reeling.

This has been evident in most of 2022, which presented headwinds for RWX investors in the form of high-interest rates meant to slow down the global economy.

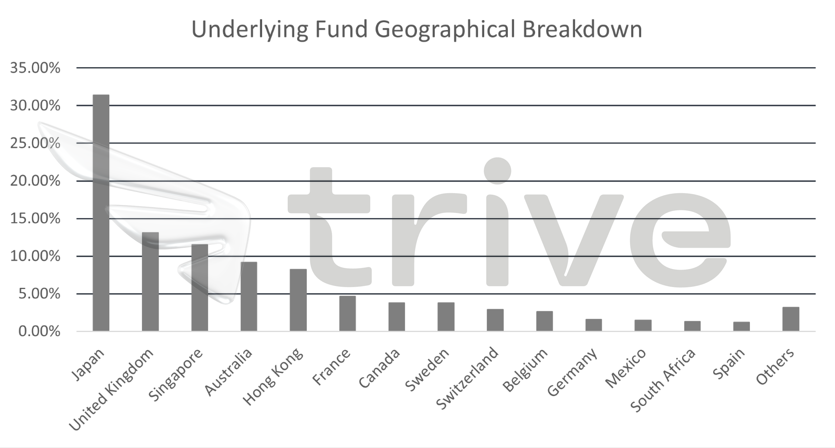

Geographically, Japan has the highest exposure of a single country, while Europe represents the second highest regional exposure after Asia, with a 29.86% weighting.

The RWX has seen a decline, most likely driven by the steep rate hikes in the Euro Area, up 3% from the beginning of 2022. The steep hikes led to a surge in borrowing costs and deterred real estate acquisitions. However, the hiking of interest rates by Central Bankers was a global trend and weighed down the RWX in the majority of regions it is exposed to.

As illustrated below, the U.S. (USINTR) and Euro Area (EUINTR) Interest Rates are tracked against the RWX. Interest rates in both the U.S. and Euro Area were lifted to fight off inflation following a period of cheap money and economic stimulation.

The RWX responded adversely, declining 24.50% between January 2021 and 2022. However, prior to the steep interest rate hikes, U.S. interest rates declined from 2018 to 2020, while the Euro Area Rates remained flat. The result was an Ex-U.S. real estate market which found support and pockets of strength with the RWX surging on two occasions.

Summary

According to FitchRatings, home price growth is expected to slow substantially or decline in 2023 due to cooling demand on the back of high mortgage rates. The broader real estate market will likely see a similar trend weighing it down, leaving the RWX in a precarious position, with downside pressure probably persisting until interest rates begin declining.

Sources: Federal Reserve, Reuters, IMF, FitchRatings, Goldman Sachs Research, TradingView