The Levi Strauss & Co. (NYSE: LEVI) share price shed an eye-watering 16.83% on its earnings release as investors were put off by the cautious outlook provided by the company. The sell-off came against all odds, considering that LEVI resoundingly beat earnings, with Earnings Per Share up 5.63% on consensus to $0.34 per share, while revenues landed on the $1.69B mark, beating consensus by 4%.

Technical

LEVI has traded in a downtrend, following the price crossing below the 100-day moving average. Volumes subsided in the prior weeks, leaving price to form a Bearish Pennant pattern with lower highs and higher lows. With the downtrend unfolding, support and resistance were established at the $13.63 and $19.30 per share levels.

With price trading at the bearish pennant’s lower end or support level, the share price could surge if it rejects the pattern’s support. Bulls will likely look to the $19.30 per share level with interest if they rush to the stock.

Alternatively, with the pattern suggesting a bearish outlook, the share price could continue its downward motion. Bullish investors will keenly watch the $13.63 level, which forms support, for long opportunities. If the price declines towards support on tapering volume, it could signal the wearing out of bearish momentum and a higher likelihood of a reversal.

Fundamental

LEVI’s top line was the highlight of the quarter’s earnings result, after gaining 6% year-on-year to close the quarter at $1.7B. Despite stubbornly high inflation, revenue growth was supported by stable demand for denim and non-denim outfits, including tops, chinos, and accessories.

Revenue growth was attributed to LEVI’s improved Direct-To-Consumer (DTC) business, which increased by 12%, driven by broad-based growth in the company’s operated stores and e-commerce (up 11%) in all segments. Overall, DTC revenues contributed 42% of the top line, indicating LEVI’s brand strength and ability to sell directly to its consumers.

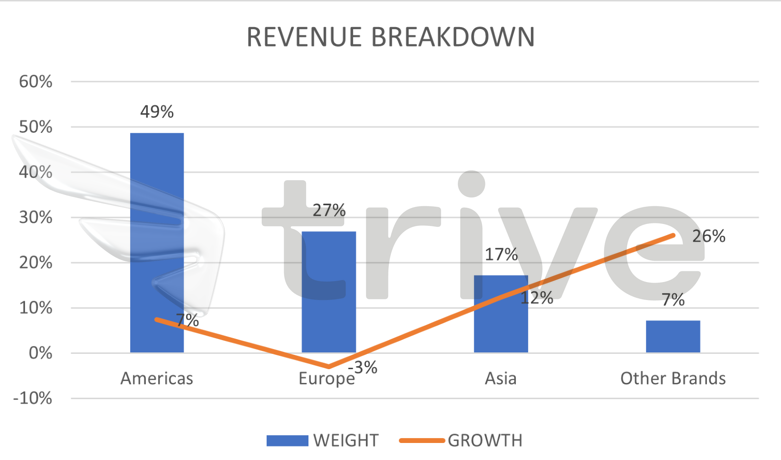

LEVI’s revenues are mainly from the American, European and Asian markets. Despite inflation eating into consumers’ pockets, revenues grew in all regions except Europe. Asia grew the most, with sales up 12% for the quarter a year ago. America’s followed behind Asia with 7% growth. At the same time, Europe, which battled with significant cost pressures due to the energy crisis, suffered the most, with a 3% decline in the quarter compared to a year ago and a 4% negative impact from the pullout of Russian operations.

The outlook is not as rosy, despite positive results for the quarter. Following a 33% rise in inventory on a dollar basis, investors are cautious about the outlook for the year.

Higher inventory levels are likely a sign of the adverse effects of inflation on the company’s ability to sell more of its products. LEVI will likely be forced to continue price-cutting and promoting its products to clear out inventory, watering down revenues and earnings in the medium to long term. First-quarter gross margins slid by 360 basis points to 55.8% due to discounting efforts, and investors worry the trend could be ongoing as the macroeconomic conditions persist.

LEVI warned of a probable margin crunch for 2023 due to promotional selling while it grapples with higher costs induced by supply-side inflation on key inputs, including escalating freight, labour and cotton costs.

After discounting for future cash flows, a fair value of $17.69 per share was derived. The price currently trades at a 15.20% discount to fair value in pre-market hours, leaving significant room for upside gains.

Summary

The macroeconomic environment, including high-interest rates and inflation, is likely to leave LEVI facing headwinds from constrained consumer spending, along with inflationary pressures on the supply side. Investors will likely look to buy the company’s stocks at a discounted price if the conditions reverse, with $15.20 or $13.63 per share, the next best price available, from a technical standpoint.

Sources: Levi Strauss & Co., Reuters, Nasdaq, Refinitiv, TradingView, Koyfin