The Coca-Cola Company’s (ISIN: US1912161007) share price is shooting for the sky as all-time high after all-time highs are made, to the delight of passive investors. Supporting the narrative was this week’s upbeat first-quarter earnings.

Earnings landed above Wall Street expectations by a healthy 5.22%, at $0.68 per share. At the same time, revenues followed suit with $162M of surplus on a $10.797B forecast. Coca-Cola’s price hiking cycle of last year helped maintain a healthy income statement even through the pressures of high commodity prices. Given the high inflation levels, high-interest rates, and a likely moderating consumer base, the macroeconomic environment remains tough to navigate. But the blue-chip company’s share price will likely stay resilient and provide investors with value-driven exposure.

Compared to the Consumer Discretionary Sector SPDR ETF (ISIN: US81369Y4070), Coca-Cola has performed in line with the sector’s broader participants, reflecting a positive correlation. Over a five-year period, Coca-Cola slightly outperformed the ETF, despite being surpassed in 2021.

Technical

Coca-Cola’s share price gained a decent 7.29% as an uptrend unfolded, with the share price trading above its 100-day moving average with strong upside volumes to support up moves. Support was established at the $52.34 per share level, while a rejection of the $67.37 level formed resistance.

Volumes have, however, been on a downward path, and the share price has formed a symmetric triangle over the course of a year. With price action near the resistance of the symmetric triangle, a reversal is likely. Confluence for a probable reversal can be found in the declining upside volume since the rejection of the 100-day moving average, along with the formation of a weekly red candle, spot on the pattern’s resistance.

Bulls will likely be safer sitting out at present to let the pattern unfold. If price action indeed reverses within the symmetric triangle, bulls could look to buy at the lower end of the pattern, within the $50 to $60 per share range, and aiming for resistance at the $67.37 level.

Alternatively, a breakout above the pattern on high volumes could signal the increased presence of bullish participants. Bulls could look to enter the market if volumes support a move higher, with resistance a probable destination for the share price.

Fundamental

Considering the macroeconomic environment, Coca-Cola’s earnings proved that the blue-chip business has a grip over its consumers. This factor is good for its earnings, giving the share price a competitive edge. Commodity prices soared in the prior year at the onset of the Russia-Ukraine conflict to the detriment of large global businesses, including Coca-Cola. The company had no choice but to pass the cost onto the consumer, and so it did, successfully.

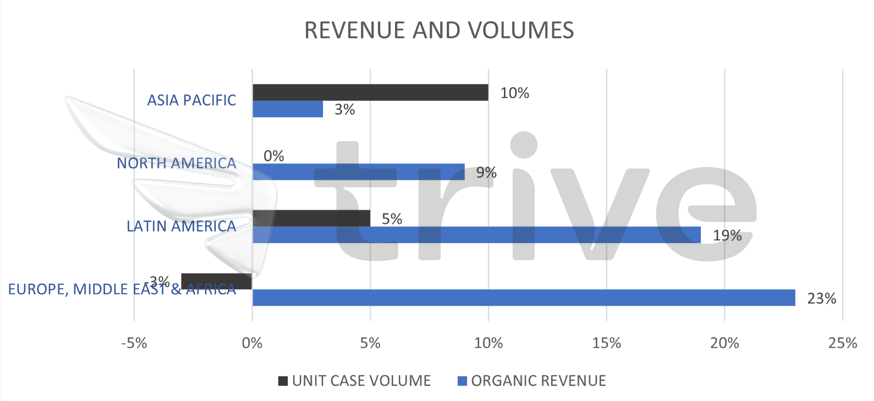

Net sales moved north 5% to $10.98B, while organic revenue was sweeter after growing 12% in the quarter, despite an 11% increase in the price/mix. A key metric measuring the volume without impacts of pricing and currency changes, the unit case volume grew 3% in the quarter. The sales growth translated into a $3.11B bottom line, up from $2.78B a year earlier, despite operating margins falling 180 basis points to 30.7% on higher operating costs.

All regions performed relatively well, with sales and volumes picking up steam. From a volume perspective, the best performer was Asia Pacific, primarily fuelled by the reopening of the Chinese economy and growth in India and Australia’s consumption. Against all odds, the Europe, Middle East and Africa region saw a staggering 23% growth in revenues, despite a 3% decline in volumes. The surge in revenues was largely driven by the 22% growth in price/mix, the highest price hikes across Coca-Cola’s global footprint.

After discounting for future cash flows, Coca-Cola’s fair value was derived at $68.57, leaving room for slightly over 7% of upside gains.

Summary

Coca-Cola provided an upbeat outlook, with organic revenue projected to grow between 7% to 8% while earnings grow up to 5% in 2023. The biggest headache for the company will be commodity inflation, with the cost of goods sold forecast to surge by a mid-single-digit. However, given Coca-Cola’s strong bargaining power, higher costs are likely to be passed onto and absorbed by consumers. Therefore, Coca-Cola’s share price is more than capable of attaining its $68.57 per share fair value.

Sources: Coca-Cola Company (The), CNBC, Reuters, Nasdaq, TradingView, Koyfin