Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Adobe Systems Inc (ISIN: US00724F1012) has demonstrated a robust third-quarter performance, outpacing Wall Street’s projections. The software powerhouse, renowned for its Photoshop suite, posted revenues of $4.89 billion, a 0.50% beat, accompanied by earnings of $4.09 per share, surpassing estimates by 2.81%. This achievement is underpinned by soaring demand for its cutting-edge photo, video editing, and document tools, now enriched with integrated generative AI capabilities.

Strategically, Adobe has been at the forefront of infusing Generative AI features into its creative software, a move hailed by analysts as pivotal for sustaining revenue growth throughout 2024 and beyond. Moreover, the company disclosed plans to adjust product pricing from November onwards, signalling a proactive approach to market dynamics.

Looking ahead to the fourth quarter, Adobe projects a revenue range between $4.98 billion and $5.03 billion. While this slightly deviates from analysts’ anticipated $5 billion mark, the company remains poised for a promising end to the fiscal year. Additionally, an adjusted profit range of $4.10 to $4.15 per share is forecasted, notably eclipsing the average analyst estimate of $4.06 per share. Adobe’s strategic integration of Generative AI and its forward-looking pricing strategy showcases a well-positioned entity in the ever-evolving software landscape.

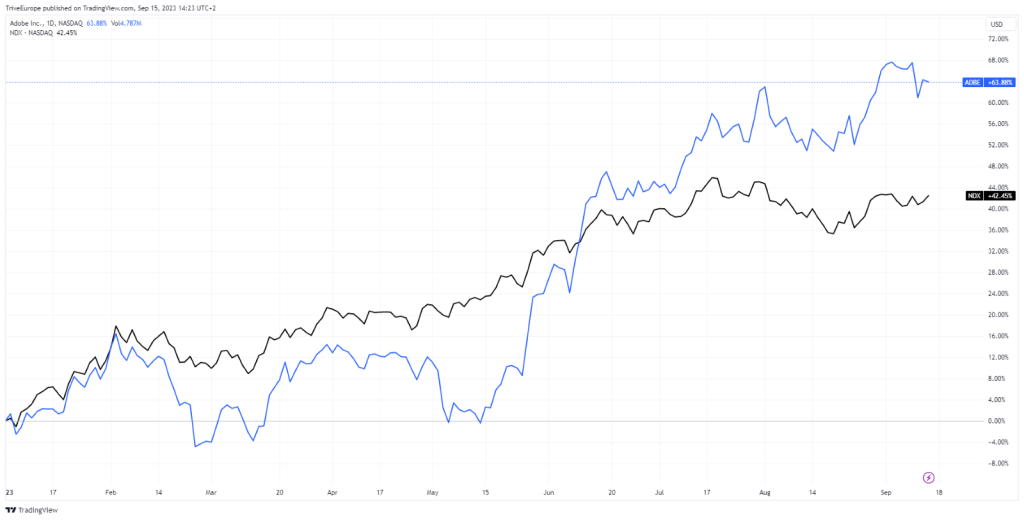

Source: Trive – TradingView, Nkosilathi Dube

Adobe Systems Inc. has showcased remarkable resilience in the market, with its share price soaring an impressive 64% year-to-date, eclipsing the performance of the broader tech sector exemplified by the NASDAQ100 index. This stellar performance is underpinned by a surging demand for AI technology, a trend Adobe has adeptly capitalized upon. This positions the company as a key beneficiary in the evolving tech landscape. The growth in investor confidence is palpable, reflecting a well-founded belief in Adobe’s ability to harness technological advancements for sustained success.

Technical

Adobe’s stock has displayed a remarkable turnaround in 2023, with a year-to-date gain of 64%, nearly erasing the losses suffered in 2022 when the company’s market value plummeted by 40.65%.

In January, Adobe’s stock broke free from a descending channel pattern that had been constraining it throughout 2022. This breakout signalled a shift in market sentiment and a reversal in the prevailing downtrend. Subsequently, the stock’s upward momentum was validated when it crossed above the 100-day moving average, a key technical milestone for many investors.

During this ascent, a crucial support level emerged at $331.89 per share, fuelling a surge in Adobe’s stock price. Currently, the stock is trading near its resistance level at $583.50 per share, which was formed as a swing high at the end of 2021. With the Relative Strength Index (RSI) indicating overbought conditions, investors may anticipate a potential reversal.

If a reversal occurs, the moving average could act as an initial barrier against downside pressure, with the $331.89 per share level potentially attracting bargain hunters. Conversely, if the upside momentum persists, investors could aim for the $699.50 per share level, slightly above the 50% Fibonacci Extension level, as the next upside objective.

Fundamental

Adobe demonstrated impressive growth in its third quarter of fiscal year 2023, showcasing a 10% year-over-year increase in revenue to $4.89 billion. This stellar performance underscores the company’s robust position in the digital software market, emphasizing its capacity to evolve and adapt to changing technological landscapes.

Operating income figures further solidify Adobe’s financial prowess. Operating income in the third quarter reached $1.70 billion, representing a 14.35% growth year-on-year, underscoring the company’s proficiency in optimizing its operations and maximizing profitability.

Net income figures reveal a similarly positive trend. Net income was reported at $1.40 billion, up by a staggering 23.50% and largely driven by higher non-operating income. This showcases Adobe’s ability to manage expenses and generate substantial bottom-line results efficiently. Cash flows from operations were notably robust at $1.87 billion, reflecting the company’s ability to convert its operational activities into liquid assets.

One notable highlight is the Remaining Performance Obligations (RPO) figure of $15.72 billion. This metric indicates the amount of revenue expected to be recognized in the future from existing contracts. It provides insight into the company’s revenue visibility and underscores its strong foundation for future growth.

In terms of share repurchases, Adobe displayed a prudent approach by repurchasing approximately 2.1 million shares during the quarter. This demonstrates the company’s commitment to maximizing shareholder value while maintaining a balanced approach to capital allocation.

Turning to the business segments, the Digital Media segment exhibited robust growth, with revenue reaching $3.59 billion. This represents an impressive 11% year-over-year increase. The breakout of this segment into Creative and Document Cloud highlights the diverse offerings within Adobe’s product portfolio, catering to a wide range of creative and document management needs, with both subsegments growing 11% and 13% year-on-year, respectively.

The Digital Experience segment also showed strong performance, with revenue of $1.23 billion, reflecting a 10% growth year-over-year. The subscription revenue growth of 12% within this segment further underscores Adobe’s success in providing valuable digital experience solutions to its customers.

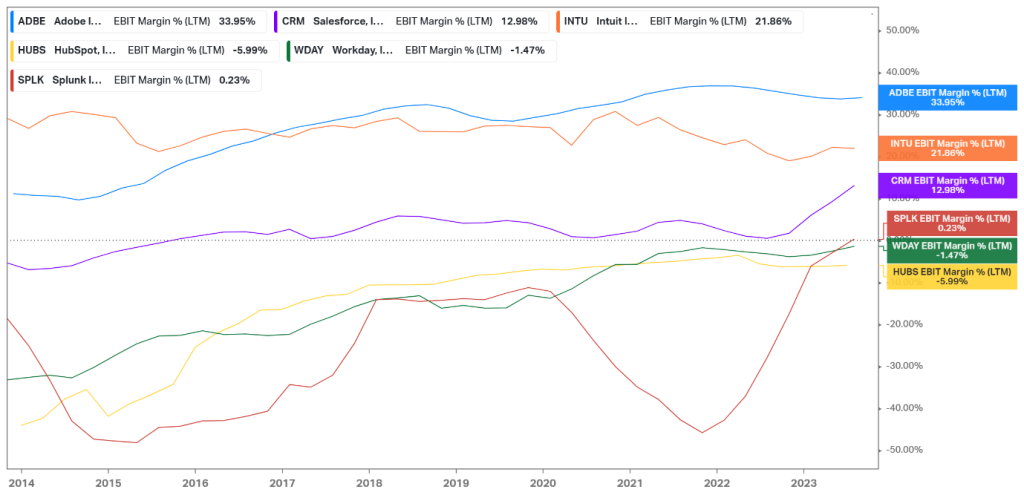

Source: Trive – Koyfin, Nkosilathi Dube

Adobe shines as a profitability leader in its industry, boasting an EBIT margin of an impressive 33.95%. This far surpasses the average of its key competitors, standing at a mere 10.26%. Such a stark contrast underscores Adobe’s exceptional operational efficiency and financial strength. A higher EBIT margin signifies a company’s ability to generate significant earnings from its operations, affirming Adobe’s robust position in the market. This stellar profitability not only signals prudent cost management but also suggests superior value creation for shareholders. Adobe’s profitability prowess sets a formidable standard, reaffirming its status as a standout performer in the competitive landscape.

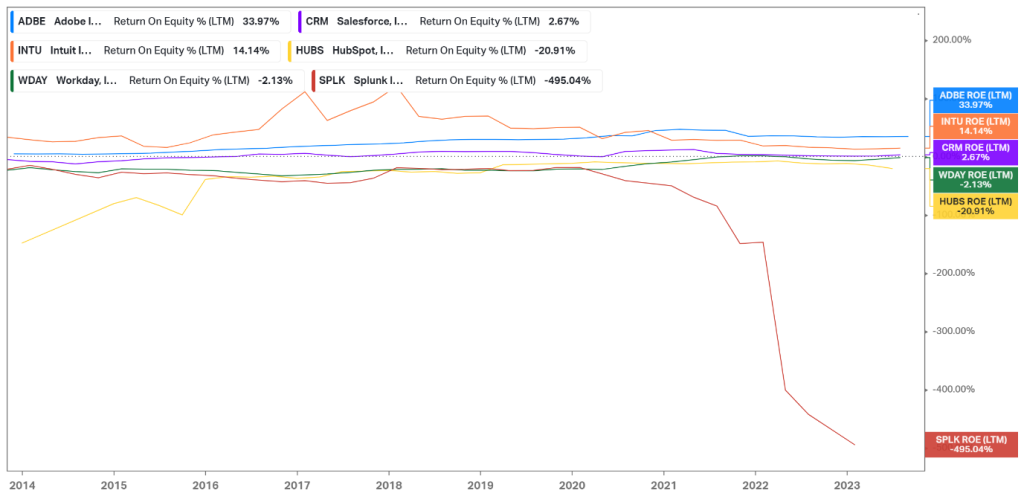

Source: Trive – Koyfin, Nkosilathi Dube

Adobe demonstrates exceptional proficiency in generating returns for its shareholders, boasting an impressive Return on Equity (ROE) of 33.97%. This significantly outpaces the average ROE of its key competitors, which stands at 5.55% after excluding outliers. Adobe’s robust ROE not only signifies efficient capital allocation but also underscores the company’s capacity to create substantial value for its stakeholders. This stark performance differential further cements Adobe’s position as a standout player in the industry, showcasing its adeptness in maximizing shareholder wealth.

After discounting for future cash flows, a fair value of $557.00 per share was derived.

Summary

In conclusion, Adobe’s third-quarter performance showcases a company that is successfully leveraging its technological expertise and comprehensive product offerings to deliver impressive financial results. With strong growth across its business segments and a solid financial foundation, Adobe is well-positioned to continue its upward trajectory in the dynamic digital software landscape.

Sources: Adobe Systems Inc, Reuters, CNBC, TradingView, Koyfin