Piece written by Mfanafuthi Mhlongo, Trive Financial Market Analyst

After a notable multi-day winning streak, WTI crude oil futures (NYMEX: CL) are experiencing a momentary dip, with the price action declining over 0.6% to $87.03/BLL during the Thursday session. This pause comes as traders eagerly await U.S. inventory data from the Department of Energy later today, which will provide insights into crude oil demand.

A private sector reading revealed a 5.5 million barrel drawdown in U.S. stocks for the week, though this was less substantial than the prior week. In addition to this data, traders are closely monitoring Chinese trade figures. While these figures showed both imports and exports declining in August, the drops were less severe than expected.

This mixed picture reflects ongoing uncertainty in the market. Concerns over energy demand are surfacing due to slowing global economic growth, while the effects of extended supply cuts by OPEC+ leaders Saudi Arabia and Russia are still being felt.

Técnicos

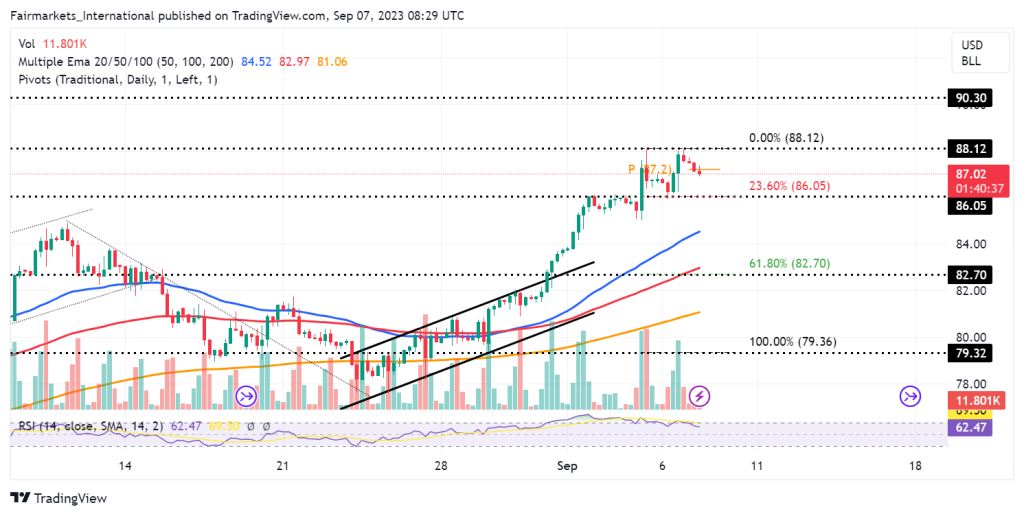

In the 4-hour chart, oil futures trade at $87.02/BBL, bearishly positioned below the daily pivot point but well-supported above the 50-EMA, 100-EMA, and 200-EMA. The 50-EMA maintains its bullish advantage over the 100-EMA and 200-EMA, although a declining RSI (62.47) and RSI-based MA (69.30) hint at weakening bullish momentum.

Short-term trading opportunities could materialize if the price breaks below the daily pivot point, targeting the 23.60% Fibonacci retracement level at $86.05/BBL. A decisive breach with significant volume might extend the downward move to $82.70/BBL and $79.32/BBL.

Alternatively, sustaining an upward push above the daily pivot point could offer short-term trades towards the $88.12/BBL resistance level, potentially paving the way for a challenge of the $90.30/BBL resistance.

Resumen

The outlook for WTI crude oil prices is mixed in the short term. Prices could fall further if demand concerns continue to outweigh supply concerns, with the $86.05/BLL and $82.70/BLL support levels likely acting as levels of interest.

However, prices could also rise if U.S. crude oil inventories fall more than expected, with the $88.12/BLL likely the first target to fall as the price pushes for the $90.30/BLL resistance level.

Fuentes: TradingView, Trading Economics, Dow Jones Newswire, Reuters.

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with Trive Financial Services Malta Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.