Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Exxon Mobil Corporation (ISIN: US30231G1022), the largest oil company in the U.S., reported its second-quarter earnings results, which revealed a significant 56% decline in profit compared to the same period last year.

The profit decline supported a trend seen across the industry as energy prices plummeted and margins shrank. The dip in profits affected global oil majors, with their earnings dropping by about half from the exceptional performance they achieved in 2022 when the invasion of Ukraine by Russia led to a surge in oil and gas prices driven by supply-side constraints.

However, it’s worth noting that when excluding the extraordinary results of the record second quarter in the previous year, Exxon managed to deliver its strongest performance for the April-to-June quarter in over ten years. This achievement was attributed to the company’s efforts in cost-cutting and the strategic sale of less profitable assets. Exxon has been on a path of continuous cost reduction since 2019, having successfully eliminated $8.3B in cumulative expenses.

Source: Trive Financial Services Malta – TradingView, Nkosilathi Dube

Exxon Mobil’s share price is positively correlated with Crude Oil Futures due to their interdependence. When Crude Oil Futures prices rise, Exxon Mobil’s revenue and profits increase, leading to a higher share price. Conversely, a decline in oil prices reduces Exxon Mobil’s top and bottom lines, resulting in a lower share price. The recent second quarter 16.19% drop in Crude Oil Futures from its swing high contributed to a 13.46% decline in Exxon Mobil’s share price from its swing high during the same period, highlighting the direct impact of commodity price movements on the company’s financial performance and stock market valuation.

Técnicos

Exxon Mobil’s share price has struggled to maintain upside traction in light of the subdued commodity prices, which have strained its earnings capability so far this year. The share price is down 13.25% from its year-to-date peak and is consolidating sideways on the weekly timeframe as volumes have somewhat stalled compared to prior months. Support and resistance were established at the $97.87 and $119.97 per share levels, respectively.

The share price breakout below the ascending channel pattern and 61.80% Fibonacci Retracement Golden Ratio reveals that the uptrend could be coming to an end. Given that the share price is consolidating sideways within a rectangle pattern, following the breakdown below the ascending channel pattern, a high volume breakout to either side of the consolidation pattern could lead to an extended move in the breakout direction. The $119.97 per share level will likely attract optimistic investors if the share price breaks out above the sideway pattern convincingly. In contrast, optimistic investors could look to the $97.87 per share level as a level of significance if the share price falters and moves further lower.

Fundamentales

Exxon recorded a net quarterly income of $7.88B, or $1.94 per share, for the second quarter, down from a record-breaking $17.85B for the same period in the prior year. Despite this performance, Wall Street analysts had expected earnings of $2.01 per share.

Given that benchmark Brent crude prices averaged approximately $80 per barrel during the second quarter, a far cry from the $110 level seen a year ago, the decrease in profits for all major oil corporations was anticipated. In addition, the cost of liquefied natural gas (LNG) decreased dramatically, from almost $33 during the same period last year to just $11.75 per million British thermal units (mmBtu).

Energy product earnings at Exxon Mobil fell by $1.9 billion from the first quarter to $2.3 billion. However, a huge increase in earnings from chemical products, which skyrocketed to $828M from $371M in the same quarter, somewhat offset this decline. A decrease in feed costs was cited as the cause of the increase in chemical product sales.

Exxon maintained its performance in terms of oil production at 3.7M barrels of oil equivalent per day (boepd) year-to-date, continuing to be consistent with the company’s annual objective and remaining constant compared to the prior year.

With the purchase of Denbury, Exxon Mobil is advancing its energy transition business, demonstrating its dedication to using cleaner energy sources. Exxon’s emphasis on cost-efficiency, sustainability, and diversity will be key in determining its performance in the sector going forward as the energy market evolves further.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Exxon Mobil stands out among major competitors, boasting the highest latest twelve-month operating profit with $66.07B in earnings before interest and tax. When excluding Saudi Aramco, the world’s largest oil company, Exxon still maintains industry-leading profitability, boasting a net income margin of 14%, comparable to Chevron Corporation (ISIN: US1667641005).

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

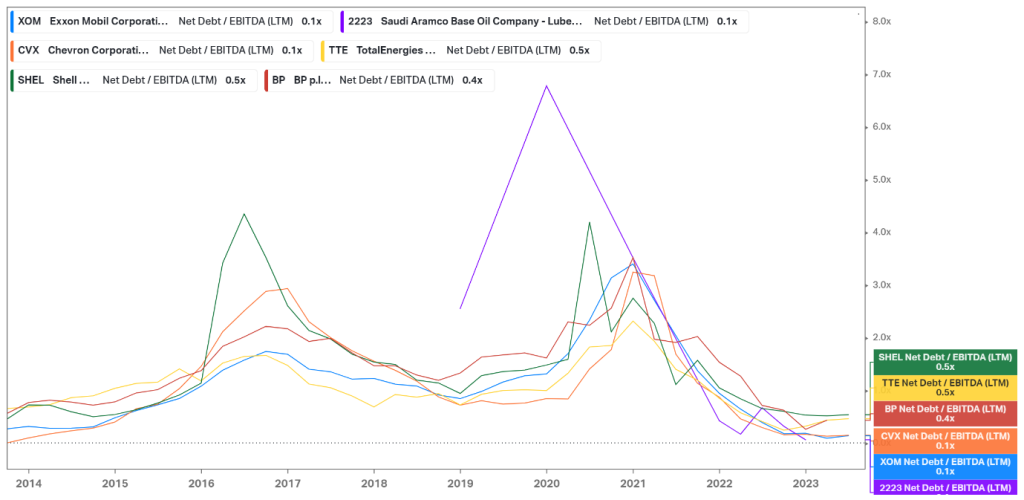

Based on the latest twelve-month data, Exxon Mobil maintains a low net debt to EBITDA multiple of 0.1 times. This demonstrates the company’s strong financial position and ability to comfortably cover its debt obligations with its earnings before interest, taxes, depreciation, and amortization. The conservative multiple signifies a reduced risk of financial distress and reflects the company’s prudent approach to managing its debt levels compared to its competitors.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Exxon Mobil’s Return on Equity (ROE) stands at 27.20%, positioning it in the mid-tier among its primary competitors. Unlike its peers, the company exhibits remarkable stability in ROE, avoiding drastic fluctuations, underscoring its consistent performance in generating profits relative to shareholders’ equity.

After discounting for future cash flow, Exxon Mobil’s fair value was derived at $116.00 per share.

Resumen

As a result of the adverse market conditions with reduced energy prices and fuel margins, Exxon Mobil’s second-quarter earnings results showed a fall in profits, which was anticipated. However, after excluding the exceptional results from the prior year, the corporation had its best performance in more than ten years, mostly due to effective cost-cutting initiatives and strategic asset sales. The latest output cuts by OPEC+ nations has further supported crude oil prices, taking them off the bottom former for the year. If the market continues to drive up commodity prices as a result, Exxon Mobil’s share price could converge with its fair value of $116.00 as earnings potentially improve.

Sources: Exxon Mobil Corporation, CNBC, Reuters, Refinitiv, TradingView, Koyfin