Piece Written by Mfanafuthi Mhlongo, Trive Financial Market Analyst

The Nasdaq 100, often hailed as the tech-heavy index reflecting the heartbeat of innovation and technology, is home to some of the world’s most influential and game-changing companies. Yet, when we take a closer look at this index, we find that it’s not a perfectly equal playing field.

In fact, just seven companies hold the lion’s share, making up over 50% of the index’s total weight.

Let’s delve into this fascinating aspect of the Nasdaq 100 and discover why these “Magnificent Seven” wield such immense influence.

- Microsoft (MSFT): The Tech Giant

Microsoft, the juggernaut of software and cloud computing, takes a significant slice of the Nasdaq 100 pie. With its Windows operating system, cloud services like Azure, and a plethora of productivity software, Microsoft’s reach extends to nearly every corner of the tech universe.

- Apple (AAPL): The iPhone Empire

Apple’s iPhones have become iconic, and the company’s relentless pursuit of innovation keeps it at the forefront of consumer electronics. From MacBooks to AirPods, Apple’s ecosystem is a testament to its unparalleled design and user experience.

- Amazon (AMZN): The E-Commerce Titan

Amazon’s transformation of e-commerce is nothing short of revolutionary. With its vast online marketplace, cloud computing arm (Amazon Web Services), and ventures into everything from streaming (Amazon Prime) to groceries (Whole Foods), Amazon touches multiple aspects of modern life.

- NVIDIA (NVDA): Powering the Future

NVIDIA, once known for graphics cards, is now a trailblazer in artificial intelligence (AI) and high-performance computing. Its GPUs are the brains behind AI systems, autonomous vehicles, and even cryptocurrency mining.

- Alphabet (GOOGL): The Search Engine Dominator

Under the Alphabet umbrella, Google’s search engine reigns supreme. Beyond search, Alphabet is involved in everything from self-driving cars (Waymo) to life sciences (Verily). With both Class A and Class C shares represented, it’s doubly influential.

- Meta Platforms (META): The Social Media Giant

Meta Platforms, previously Facebook, runs the world’s most extensive social media network, including Facebook, Instagram, and WhatsApp. Its presence in the global social landscape is hard to overstate.

- Tesla (TSLA): The Electric Revolution

Tesla, led by Elon Musk, is driving the electric vehicle revolution. Its innovative approach to sustainable energy extends to solar panels and energy storage solutions, making it a frontrunner in the race to combat climate change.

Year-To-Date: Nasdaq 100’s Soaring Journey Led by the ‘Magnificent Seven’

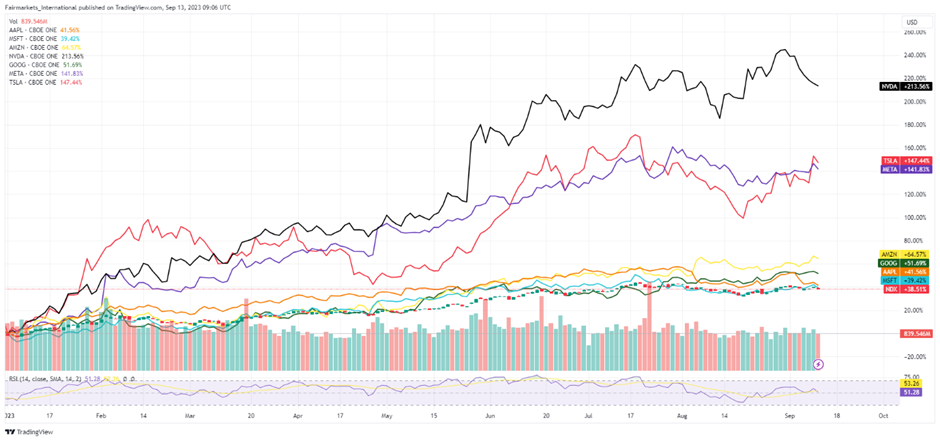

The year 2023 has been nothing short of spectacular for investors in the Nasdaq 100 index. Year-to-date, the index has posted an impressive total return of +38.51%, significantly outpacing broader market benchmarks. This outstanding performance can largely be attributed to the influence of the ‘Magnificent Seven’, whose strong performance has had a significant impact on the overall performance of the index.

For example, Apple has returned 41.56% year-to-date(orange line), Microsoft has returned 39.42% (blue line), and Alphabet has returned 51.96% (green line). These three companies alone have contributed more than half of the total return of the Nasdaq 100.

The other four “Magnificent Seven” companies have also had strong performances. Amazon has returned 64.57% (yellow line), Tesla has returned 147.44% (red line), Meta has returned 141.83% (purple line), and Nvidia has returned a whopping 213.56% (black line).

Source: Trive Financial Services Malta – Koyfin, Mfanafuthi Mhlongo

The “Magnificent Seven” Impact: Beyond Numbers

These seven companies aren’t just weighty figures on a stock index; they’re trailblazers reshaping industries and societies. Let’s explore why they matter:

- Innovation Engines: These companies are synonymous with innovation. They’re pioneering breakthroughs in AI, electric vehicles, social connectivity, and more, driving progress and transforming economies.

- Global Influence: With a global footprint, these giants influence international markets and politics. Their policies on issues like data privacy and climate change resonate far beyond their headquarters.

- Employment Powerhouses: Beyond creating wealth for shareholders, they employ millions worldwide, making them key drivers of local and global employment.

- Economic Barometers: Their performance is often seen as a barometer for broader economic health. Positive earnings reports from these companies can boost market sentiment.

The Ever-Changing Landscape

The dominance of these seven companies is a snapshot in time. Remember, the Nasdaq 100 is not static. Companies rise, fall, and evolve. In the past, companies like Intel and Cisco held significant sway but have seen their influence wane. Others, like Yahoo!, are no longer part of the public markets. The tech sector is dynamic, characterized by disruption and renewal.

The Nasdaq 100: Evolution in Action

The Nasdaq 100’s special rebalancing, which occurred just a few times in history, reflects its commitment to maintaining fairness and balance. As the “Magnificent Seven” grew in influence, it became necessary to redistribute the weights, preventing undue concentration.

In Conclusion: The Tech Titans and Their Impact

The Nasdaq 100, with its “Magnificent Seven,” mirrors the ever-evolving tech landscape. These companies aren’t just about stock prices; they’re about changing the way we live and work. As they continue to innovate and disrupt, their influence leaves them poised to shape our world for years to come.

Fuentes: TradingView, Reuters, Invesco, Investors Business Daily, Visual Capitalist, CNBC, NASDAQ, Business Insider.

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information. The value of your investment may go down as well as up.