Meta Platforms Inc (ISIN: US30303M1027) opened up its 2023 Fiscal Year with positive earnings, a step in the right direction, after recording its first sales growth in four quarters. The company released its first quarter results with a cherry on top in the form of upbeat guidance for the current quarter.

Meta beat Wall Street expectations for the first quarter of 2023, with earnings landing on $2.20 per share, 8.86% higher than expected, while revenues exceeded expectations by 3.53% to $28.65B. Driving topline growth was bolstered advertising spending by companies that preferred safe haven advertising channels, such as Meta and Google (ISIN: US02079K3059), amid tougher macroeconomic conditions.

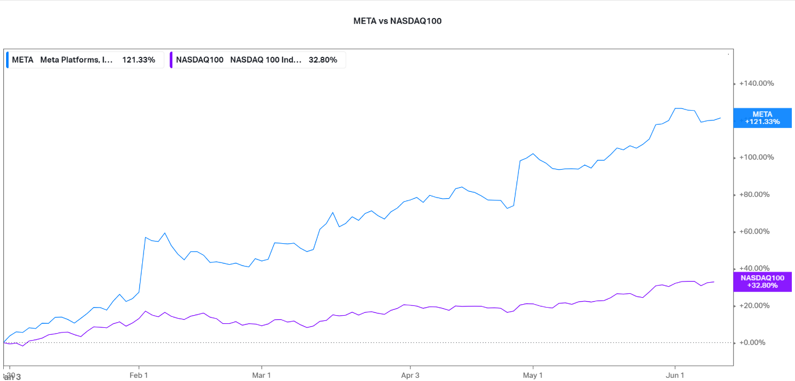

On a year-to-date basis, the stock has gained 120.17% after plummeting by just over two-thirds in 2022. Steep interest rates tripped out equity valuations in 2022, especially in the tech sector, which relies heavily on debt for expansion. High-interest rates weighed down on earnings, as borrowing costs eroded bottom lines, while higher discount rates eroded equity valuations. Will Meta’s share price recovery sustain?

Técnicos

Meta’s share price took a knock in 2022, establishing a resistance at the $382.28 per share level. A downtrend ensued as the price fell below the 100-day moving average before finding support at the $90.49 per share level. The oversold Relative Strength Index conditions accompanied a reversal from the support level, and the upside price action moved with high momentum, taking the share price back above the 100-day moving average to establish an uptrend.

Given that price action has reached a key technical inflection point at the 61.80% Fibonacci Retracement Golden Ratio level, investors will likely wait to see how the share price reacts to the level before committing to the upside. If the level holds as a dynamic resistance, the share price could move back down lower. Investors optimistic about the company’s outlook could look at going long at a discount to the current price. The 50.00% and 38.20% Fibonacci Retracement levels at the $236.83 and $202.46 per share levels could offer long-term investors opportunities to go long if downside volumes dissipate, signalling declining interest in a lower price.

Alternatively, a high volume breakout above the Golden Ratio at the $271.20 per share level could indicate that bullish intent presides over the market. If upward momentum sustains, the $382.28 per share level could come into play in the short to medium term.

Fundamentales

Meta’s first quarter revenues rose by 3% from $27.91B a quarter a year ago to $28.65B, supported by increased advertising spend on more wide reach channels. Advertising revenue grew by 4.1% to $28.1B from the first quarter of 2022. However, weighing on the topline was a decline in the Reality Labs segment revenue, which declined by just over 50%. Total income from operations declined by 15%, partially due to a 10% increase in costs and expenses. Growth in restructuring costs primarily impacted cost and expenses, which reduced earnings per share by $0.44. This resulted in a decline in net income of 24% from the quarter a year ago to $5.71B.

Despite the financials giving mixed signals, Meta performed slightly better year over year, operationally. Facebook’s monthly and daily active users moved north by 2% and 4%, respectively, year-over-year to 2.99B and 2.04B. Family monthly and daily active people moved higher year-over-year by 5% each, to 3.81B and 3.02B, respectively. The growth in users on a daily and monthly basis was a positive sign that the company’s demand for services remains resilient, despite the many macroeconomic challenges that consumers and businesses face. This was validated by the improved Average Revenue per User (ARPU), which landed at $9.62 versus consensus of $9.30 expected, according to StreetAccount.

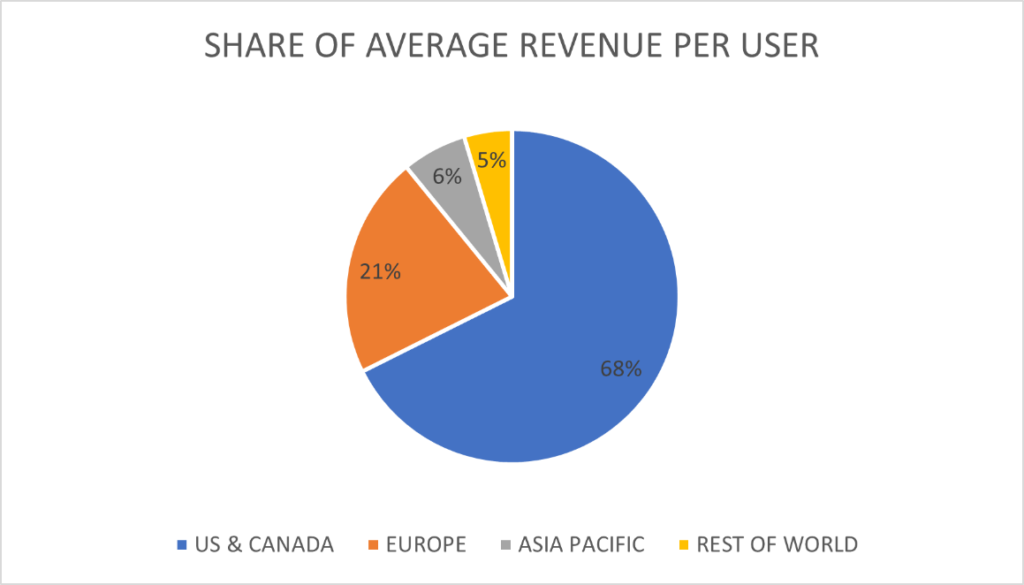

The U.S. and Canada remain Meta’s most important markets, as it contributes the most revenues to the company by a wide margin. With 45.6% of revenues coming from the two countries, followed by 22.2% from Europe, Meta will likely be highly exposed to macroeconomic conditions from the U.S. and Canada.

The U.S. and Canada, as the most significant contributors to revenue, also contribute the largest average revenue per user, with 68%, followed by Europe and Asia Pacific. Given that the U.S. is seemingly at an interest rate peak, with a pause in rate hikes priced in for June, Meta could see its top line grow as the world’s biggest economy begins to taper off interest rates to promote further growth in the medium term.

Investors have rallied around the company’s plans to cut out excess expenses, with layoffs expected to reach about 21000 jobs. Meta expects revenue of between $29.5B and $32B for the second quarter, while analysts expect sales of $29.5 billion, according to Refinitiv. With job cuts likely to reduce costs and expenses, the bottom line could be bolstered, promoting the company’s earnings potential.

After discounting for future cash flows, a fair value of $297.50 per share was derived. 11.50% of upside gains are possible if the share price moves north from the current level.

Meta stocks have been favoured by investors who have rallied on the CEO’s “year of efficiency” narrative. The stock has outshined the NASDAQ100’s year-to-date performance with a 121.33% gain compared to the 32.80% of NASDAQ100.

Resumen

According to Meta, Artificial Intelligence (AI) will “impact every single one” of its apps and services as the new technology’s innovation filters through to the end user. AI-powered reels have already boosted Instagram’s usage time by 24%, signalling the growth potential of AI. If costs are significantly cut down while the top line grows, boosted by AI, Meta’s share price could be less hesitant to an upside move.

This material (whether or not including any opinion) is provided for information purposes only and does not take into account any individual’s personal circumstances or investment objectives. Nothing contained in this material is or should be considered to be financial, investment or other advice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.