Piece Written by Nkosilathi Dube, Trive Financial Market Analyst

In July of last year, the United Nations and Turkey brokered a historic deal in response to a global food crisis exacerbated by Russia’s invasion of Ukraine in February 2022. This deal, known as the Black Sea Grain Initiative, aimed to provide Ukraine and Russia with unimpeded access to global markets for food and fertilizers through the safe passage of the Black Sea ports of Odesa, previously blocked by Russia’s military aggression.

The agreement’s significance lies in the fact that Ukraine and Russia are major players in the world’s grain export market. The deal acted as a lifeline to ensure the continuous flow of food and fertilizer amidst the restricting effects of the ongoing conflict. With Ukraine and Russia responsible for a significant portion of global grain exports, securing an unhampered export route for these commodities was vital.

Under the terms of the Black Sea Grain Initiative, Moscow committed to facilitating the smooth export of grains, sunflower oil, and fertilizers from Ukrainian-controlled Black Sea Ports. Russia benefitted from the initiative as the conflict, which had resulted in restrictions on payments, logistics, and insurance, created barriers to the shipments of their export products.

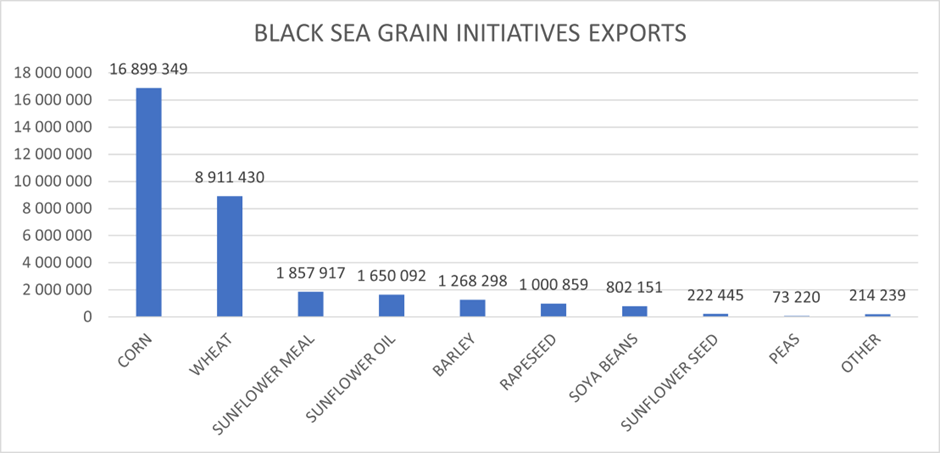

Throughout the duration of the agreement, more than 1,000 ships carrying nearly 33 million metric tons of corn, wheat, and other grains were successfully exported from the Ukrainian Black Sea ports of Odesa. Additionally, the initiative facilitated the transport of 725,167 tons of grain for the World Food Program ships, aiding the most food-insecure countries worldwide, including Afghanistan, Ethiopia, Somalia, Sudan, and Yemen.

Source: Trive Financial Services Malta – United Nations, Nkosilathi Dube

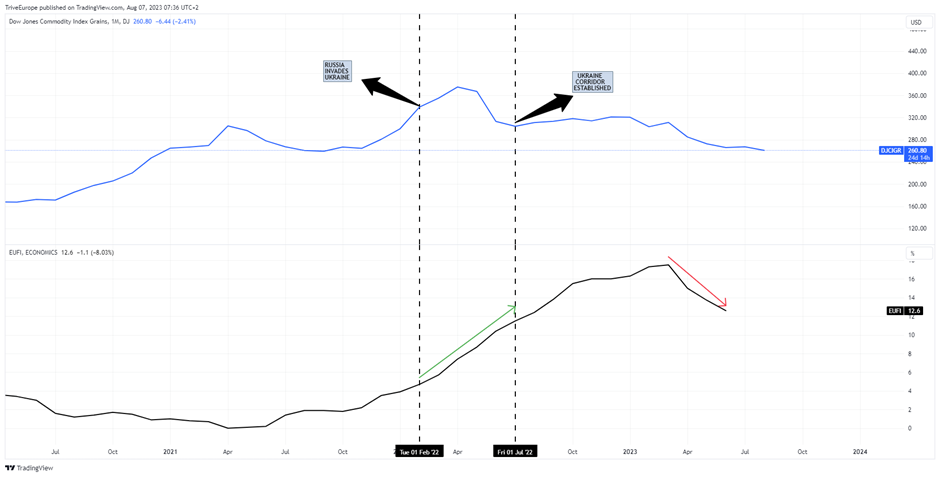

The positive effects of the Black Sea Grain Initiative were evident. According to the UN’s Food and Agriculture Organization, agricultural prices experienced a decline of nearly 20%, benefiting consumers across the globe. The initiative was crucial in stabilizing food prices and ensuring food security in various regions. As shown below, the Dow Jones Commodity Index for Grains saw a steady decline after the implementation of the initiative, following a sharp rise at the onset of the Russia-Ukraine conflict.

Source: Trive Financial Services Malta – TradingView, Nkosilathi Dube

Unfortunately, the deal gradually unravelled as discontent grew from Russia over the restrictions placed on their own grain and fertilizer exports. The fallout from the Black Sea Grain Initiative could be far-reaching and consequential for all parties involved.

With the agreement now undone, Ukraine faces the challenge of exporting most of its grains and oilseeds through its land borders. This poses potential issues for transportation costs and adds pressure on Ukrainian farmers’ profitability, leaving them with less to invest in future seasons. The higher transportation costs may lead to increased prices for end consumers, further impacting global food inflation. Although food inflation in Europe is tapering off, as shown in the depiction above, the export restrictions could lead to a rise in inflation once again.

Furthermore, the termination of the Black Sea Grain Initiative could have severe consequences for Middle Eastern and African countries, which heavily relied on food imports from Ukraine. These regions, already grappling with their own food crises, might face exacerbation of their struggles, leading to a potential rise in food prices in these regions.

The economic ramifications of the deal falling apart could be significant. The disruption in grain supply from Ukraine and Russia could lead to temporary shortages in the global grain market, resulting in higher prices as demand outpaces constrained supply. This scenario could have ripple effects on the broader economy, impacting food inflation and household budgets.

In conclusion, the dissolution of this crucial agreement brings forth serious challenges for both Ukraine and the international community, with food inflation being a highly likely consequence. This could pose a challenge for the European Central Bank (ECB), whose main mandate is to maintain price stability. Given that its steepest interest rate hiking cycle came about as a result of rising inflation (driven by food and energy prices), further rate hikes could be on the horizon if rising inflation unveils itself once again. This could impact the Euro, bonds, indices and equities as markets react to the central bank’s interest rate policy.

Sources: Reuters, CNBC, UN’s Food and Agriculture Organization, European Council, International Food Policy Research Institute, UN Black Sea Grain Initiative Joint Coordination Centre, TradingView

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.