Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Apple Inc.’s (ISIN: US0378331005) third-quarter 2023 performance proved to be a tale of two sides as the tech giant navigated through a landscape of record-breaking achievements and a few challenges along the way. With a modest beat of Wall Street’s earnings expectations, Apple reported an impressive $1.26 earnings per share, surpassing consensus estimates by 5.42% on revenues of $81.80B, in line with market projections.

The star of the show was Apple’s flourishing services division, shining brightly with an 8% growth from the previous year and reaching an all-time high. Over 1 billion paid memberships fuelled this remarkable success. The sustained strength of emerging markets, buoyed by robust iPhone sales, played a significant role in driving this exceptional performance.

Despite these soaring achievements, Apple faced a slight setback with a 1% drop in revenues compared to the previous year, mainly due to declines in sales for the iPhone, Mac, and iPad lines. As investors witnessed the share price surging 47% year-to-date, it seemed Apple was on an unstoppable trajectory. However, August brought a touch of uncertainty as the company’s stock unwound some gains. Investors expressed concerns over the underwhelming iPhone and Mac sales.

The question now remains – what lies ahead for this tech behemoth? As the world watches with anticipation, will innovation and strategic growth propel them to even greater heights, or will challenges persist?

Técnicos

Apple Inc.’s share price embarked on an upward trajectory after surpassing the 100-day moving average, signalling a shift in momentum. Breaking above the descending channel pattern, which formed in late 2021, further solidified this uptrend.

The critical $176.11 per share level was pivotal as the share price pierced through, indicating prevailing upside momentum. Climbing to an all-time high of $198.23 per share, investors saw this level transform into a resistance, providing a clear boundary for further price action.

However, signs of caution emerged as volumes declined, and the share price’s Relative Strength Index (RSI) reached overbought levels. Accompanied by a weekly bearish candle formation, these indicators hint at fading upside momentum and a potential reversal. For optimistic investors, the $176.11 per share level may be of interest, serving as a support level in case of a sustained reversal.

Conversely, a convincing breakout above the all-time high at $198.23 could reignite upside momentum, enticing buyers to step in. The $215.84 per share level, corresponding to the 23.60% level of the Fibonacci Extension, holds significance to the upside if momentum pushes the share price higher.

Fundamentales

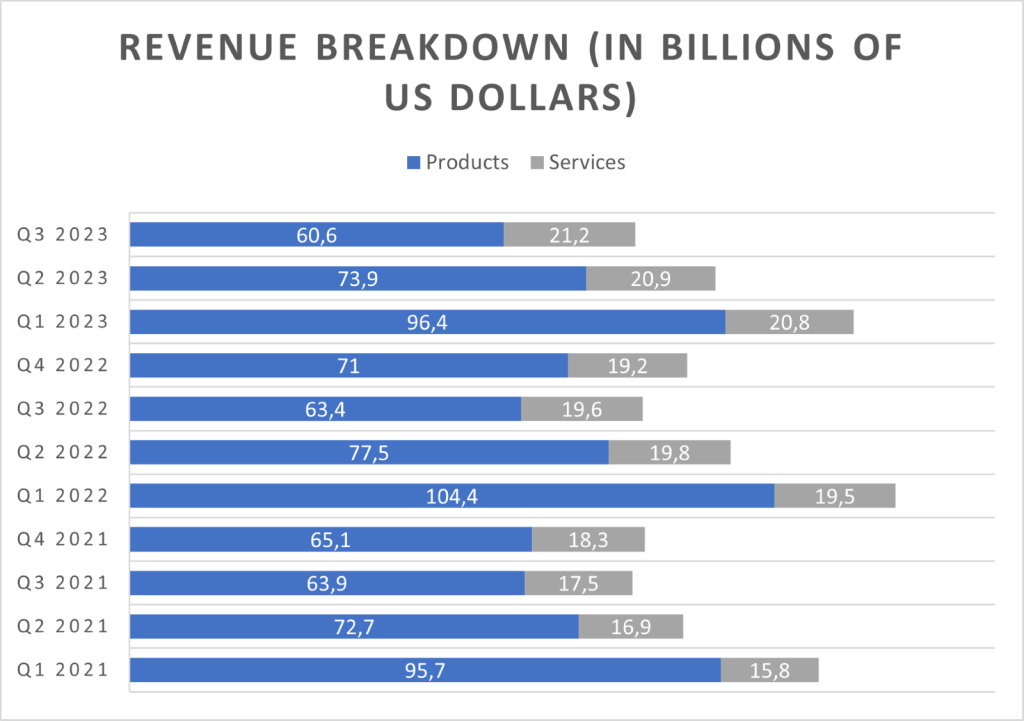

The tech giant reported quarterly revenue of $81.8 billion, reflecting a slight dip of 1% compared to the previous year. The main driver behind this decline was the products division, which experienced a notable slump of 4% year on year, reaching $60.58 billion in revenue.

Within the products division, iPhone sales, Apple’s flagship product, declined by 2% to $39.67 billion. iPad sales also faced a significant setback, plunging 20% year over year to $5.80 billion, while Mac’s year-on-year revenue dropped by 7% to $6.84 billion. These numbers indicate a challenging market environment for some of Apple’s core hardware products.

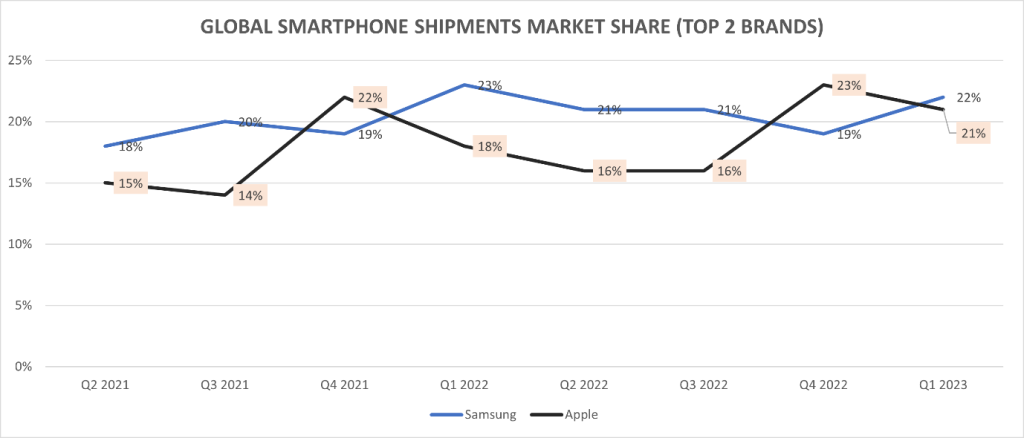

Despite the drop in iPhone sales, the company highlighted a positive development – an increasing number of “switchers” from Android handsets to iPhones, particularly in China. This trend bodes well for Apple’s market share prospects and indicates the strength of its brand appeal.

In contrast to the products division, Apple’s Services division showcased robust growth, offsetting the decline in the top line. The Services division, which houses subscriptions, streaming TV, warranties, advertising, and payment services, demonstrated an impressive 8% year-on-year growth, building on the 5.5% growth from the prior quarter. The company effectively monetized its active base of 2 billion devices, with over 1 billion paid subscriptions contributing significantly to this uptrend. The impressive growth in services revenue reached a record high, reflecting Apple’s ability to diversify its revenue streams and capitalize on its vast user base.

The company’s net income saw a modest uptick, edging 2.26% above the same quarter a year ago and reaching $19.88 billion. This boost in net income was largely attributable to an improved gross margin, up 126 basis points year-over-year to 44.52%. The products division played a significant role in driving this improvement as margins improved, signalling Apple’s efforts to optimize its hardware profitability.

The quarterly earnings per diluted share came in at $1.26, demonstrating a commendable 5% increase year over year. Investors, however, remained mindful of Apple’s cautious outlook for the September quarter, anticipating a 1% year-over-year sales reduction, with gross margins projected between 44% and 45%.

Looking at Apple’s performance through a financial lens, it becomes evident that the company is navigating through a competitive landscape for its hardware products. Nevertheless, its ability to leverage the loyal and vast user base to bolster services revenue signifies its resilience and diversification strategy. The shift towards services aligns with fundamental economic principles, as companies seek to generate stable and recurring revenue streams while balancing the cyclicality of hardware sales.

Source: Trive Financial Services Malta – Factset, Nkosilathi Dube

While the products division enjoys the bigger share of revenues and seasonal spikes during the first quarter, driven by holiday demand, the services division emerges as the steady backbone of the business, showcasing stability and resilience.

Source: Trive Financial Services Malta – Apple, Nkosilathi Dube

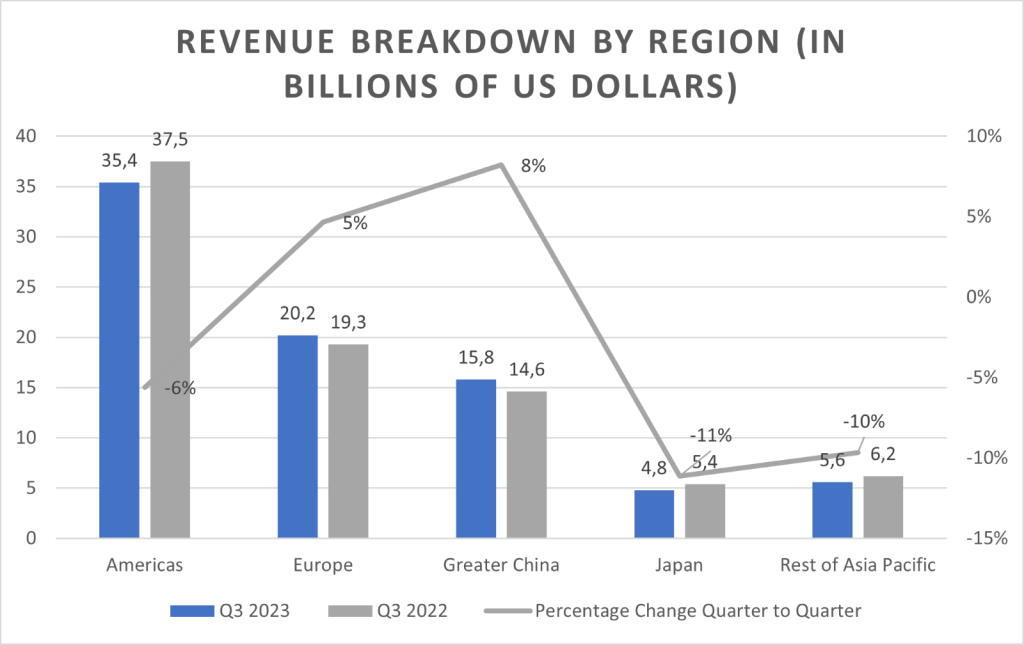

Apple Inc.’s revenue performance across regions has been a mixed bag. China and Europe stood out as beacons of growth, boasting 8% and 5% revenue growth, respectively. Conversely, Japan and the Rest of Asia Pacific faced challenges, witnessing declines of 11% and 10% in revenues.

Source: Trive Financial Services Malta – Counterpoint Research, Nkosilathi Dube

Apple Inc.’s market share in the global smartphone industry reflects a fierce battle with Samsung. As of 2023, Apple commands just over 20% of the market, trailing slightly behind Samsung’s 22%. Apple’s brief moment at the top in Q4 2022 showcases the competitive nature of the smartphone market, where market leaders continuously vie for dominance through innovation and strategic manoeuvres.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

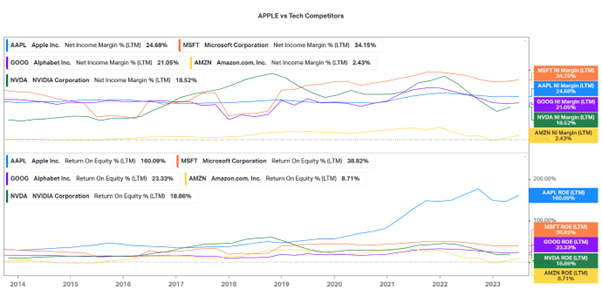

Apple Inc. truly shines when it comes to profitability within the tech stock universe. With a Net Income margin rivalling only Microsoft Corporation, Apple efficiently converts each sale into profit while maintaining stability. But the company’s astounding return on equity, which soared to an impressive 160.09%, crowns Apple as the undisputed king among its tech peers and exemplifies its ability to generate exceptional returns for its shareholders. This robust financial performance speaks to Apple’s sound business strategies and fundamental strength in the competitive tech landscape.

After discounting for future cash flows, a fair value of $202.55 per share was derived.

Resumen

Apple Inc.’s third-quarter 2023 performance showcased record-breaking achievements and challenges. The services division stood out with impressive growth, offsetting declines in the products division. The tech giant navigated through a competitive landscape, leveraging its user base for profitability and generating exceptional returns, solidifying its position among tech giants. Given the advent of Artificial Intelligence, Apple’s revenues and earnings will likely be shored up as the astounding technology becomes more popular among daily users. The fair value of $202.55 per share is, therefore, likely.

Sources: Apple Inc, United States Securities And Exchange Commission, Refinitiv, CNBC, Reuters, Factset, Counterpoint Research, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.