HP Inc.’s (ISIN: US40434L1052) cost-cutting measures came in to cushion the quarter after the second-largest PC Vendor reported positive earnings, despite revenues falling behind expectations slightly. Earnings per share beat Wall Street expectations by 5.27% to $0.80, while revenues fell short of expectations by 1.23% after landing on the $12.91B mark.

PC and electronics sales have slumped since the peak pandemic period as the world has switched to watching its pockets amid steep global interest rates and uncertain economic conditions. Unfortunately, HP’s top line felt the pinch, but the bottom line was kept at bay against consensus by the cost-cutting measures the company deployed in recent months.

The global economy is threatened by a possible recession, which, if materialised, could have negative consequences for PC sales and investment risk appetite. HP will likely face more headwinds than tailwinds from the global macroeconomic environment, potentially threatening its market share price in the medium to long term.

Técnicos

HP’s share price went into a steep selloff in the past year as interest rates ate away at company valuations and earnings. Price action crossed below the 100-day moving average to validate a downtrend. However, the bearish momentum has since subsided, given the weakening volume and the failure of sellers to establish lower lows. With the price recovering losses from 2022, a stable resistance at the $30.99 per share level formed, while the market has printed lower lows to form an ascending triangle pattern.

A high volume breakout above the ascending triangle pattern occurred post-earnings release, indicating that bullish momentum is swinging the pendulum. If bullish investors intend to buy into HP stock beyond what they have in recent months, a retracement back into the ascending triangle on weak volumes could substantiate an imminent reversal, with a move higher probable. Bullish investors will likely aim for the $34.63 per share level, which formed the last swing high of 2022 for possible targets.

Alternatively, if bearish momentum persists further into 2023, the share price could be lured toward support formed at the $26.55 per share level. Bullish investors intending to buy HP stocks at a steep discount could be enticed into buying at the support level, with the $30.99 level potentially earmarked as a point of interest.

Fundamentales

According to Gartner, worldwide PC shipments declined by 30% in the first quarter of 2023 due to low demand and excessive inventories. This has resulted in a second quarter of year-over-year declines in PC shipments wholistically, while it was the seventh consecutive quarter of double-digit declines in shipments for HP.

Weakness in the industry has translated into a weaker HP top line as net revenues declined by 21.7% year-on-year to $12.9B. A decline in consumer and commercial revenues drove the weakness in the top line. Personal Systems revenue was down 29% to $8.2B year-on-year, while weaker Printing segment revenues abound with a 5% decline to $4.7B.

Further stressing the company’s income statement was a slightly weaker operating margin, induced by stiffer pricing competition among PC vendors. As a result, HP’s operating margin shed 1.9% to 5.9% from the quarter a year ago. Net earnings declined 26% year-on-year to $0.8B on a Non-GAAP basis, as weaker revenues and operating margins filtered through to the bottom line.

After discounting for future cash flows, HP’s fair value came in at $30.75 per share. The fair value is relatively in line with the company’s current share price, suggesting that it could be a hold rating.

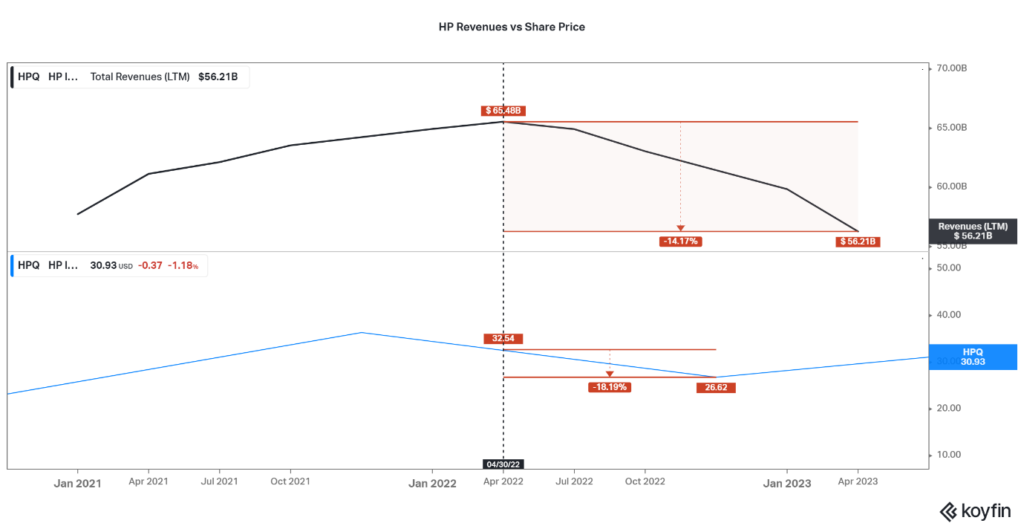

With HP’s revenues falling off their peak in 2022, the steep plunge has been matched by a similar move in the company’s share price as the market has priced in the potential for weaker earnings. The total revenues for the latest twelve months fell 14.17% from the peak in 2022, leading to the share price declining 18.19% as investors feared losing out on earnings potential.

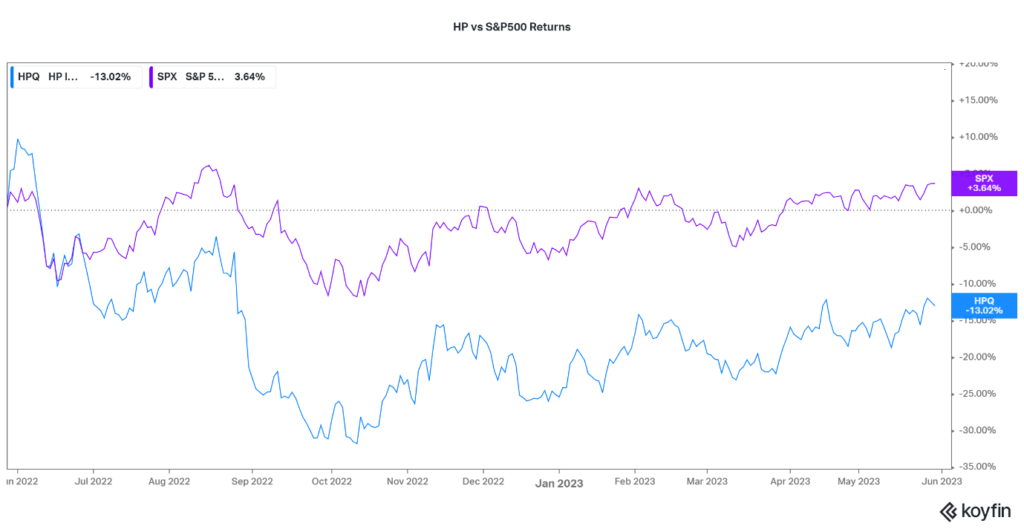

Compared to the S&P500, HP has underperformed the broader index on a one-year basis. The market has favoured mostly tech, energy and banking sectors in recent months, but PC vendors have struggled to keep up as the macroeconomic conditions have not favoured their sales. Over one year, the S&P500 gained 3.64%, while HP has shed 13%, reflecting the market’s lack of confidence in the company.

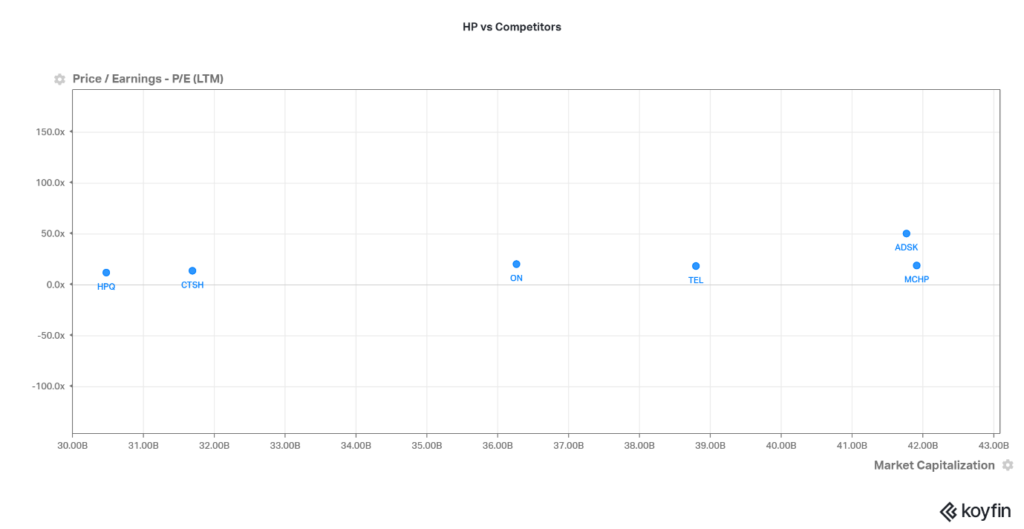

Among S&P500 companies with a market capitalisation of $30B and above, HP has one of the lowest Price/Earnings ratios (PE). With a PE of 13.5×, it falls short of the tech sector’s high PE valuations, which tend to reflect high growth potential. Investors are less willing to pay for HP earnings compared to the rest of the sector, reflecting the weak business environment the company currently operates in.

Resumen

Given that the U.S. has shown signs of economic moderation, a recession is likely looming. HP’s share price could struggle to gain enough upside traction as PC sales remain subdued, with the potential to worsen if a recession plays out. The stock is a hold in the medium to long term but could provide some upside potential once PC shipments pick up steam and the global economy moves out of the current tightening cycle.