Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

In a remarkable display of resilience, Ford Motor Co (ISIN: US3453708600), America’s top-selling automotive brand, has accelerated past expectations in its second-quarter performance. Surpassing projections by a substantial 32.65%, the company recorded a noteworthy $0.72 earnings per share, solidifying its position as a market leader.

In tandem with this impressive feat, Ford’s revenues surged a remarkable 4.14%, reaching $44.95 billion. This upswing owes its success to the company’s innovative lineup of vehicles, effectively stimulating demand and capturing market attention.

Reflecting the company’s steadfast commitment to progress, Ford’s net income nearly tripled in comparison to the same quarter last year, a testament to the fruits of enhanced operational efficiencies.

Amidst the challenging economic landscape marked by high inflation and interest rates, Ford’s success finds support in the resilience of the U.S. labour market. This market buoyancy, defying economic headwinds, has upheld the company’s robust sales figures, especially within the realm of consumer discretionary products.

Técnicos

Ford Motor Company’s share price has embarked on a dynamic journey, reflecting both its potential and challenges. Despite a year-to-date rise of 4.90%, a retreat from a peak of +33% gains underscores its volatile trajectory. Notably, the stock has consistently outperformed Wall Street earnings expectations over the past two quarters, providing a silver lining amid its price fluctuations.

The technical analysis reveals a pattern of interest, with the stock forming a descending triangle. An upturn came into play as the pattern was breached, leading to a vigorous surge. The $11.24 per share level emerged as a reliable support, anchoring the stock’s progress.

Yet, the road to gains encountered a roadblock at the $15.42 per share level, where lingering downside momentum resided. The price journey surpassed the 61.80% Fibonacci Retracement level, acting as a pivot point and affecting the share’s course.

The market sentiment holds a key role, as optimistic investors set their sights on the $15.42 per share level as a pivotal mark for potential upside.

Fundamentales

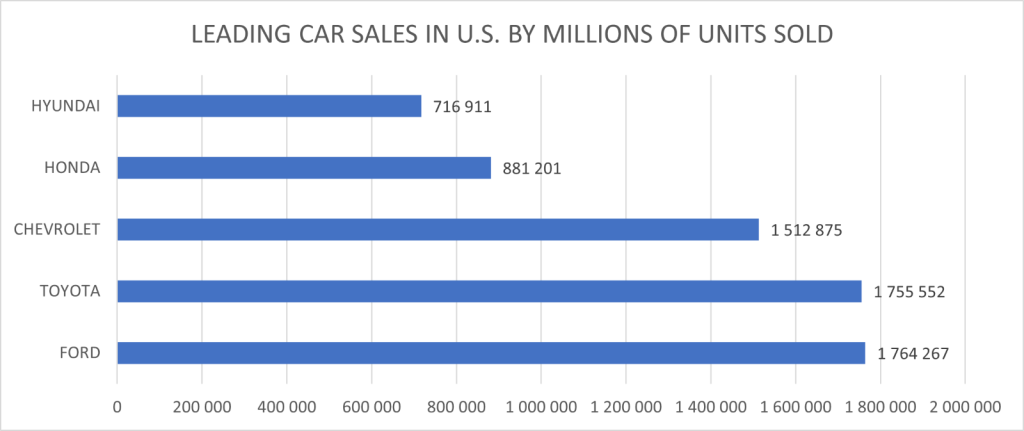

Ford Motor Company’s recent quarterly performance paints a picture of strategic adaptation and robust growth. Despite a slight dip in market share by 20 basis points to 5.1%, the company demonstrated its prowess by driving wholesale units up by an impressive 8% from the same quarter the previous year, totalling 1,119,000 units. As of 2022, with the delivery of nearly 1.8 million vehicles to American customers, Ford surpassed Toyota as the top automaker in the country.

Source: Trive Financial Services Malta – Statista, Nkosilathi Dube

This surge in units translated into remarkable revenue growth, with a 12% increase to $45.00 billion. The driving force behind this expansion was the resounding demand for Ford’s new fleet of trucks, SUVs, and commercial vans. Among these, Ford’s Pro division garnered particular attention, catalysed by the surge in software and repair services sales. The division witnessed an astounding 22% revenue surge, and its EBIT doubled to $2.4 billion, buoyed by an 8% increase in product shipments.

The debut of the Super Duty work truck had an immediate impact, propelling U.S. Super Duty sales up by a remarkable 28% on a quarterly basis. The global market also responded favourably to commercial vehicles, including the gas and electric engine, leading to an all-round uplift.

Ford’s commitment to green technologies and sustainable solutions manifested in its Blue gas and hybrid business. The division saw an uptick of 7% in wholesales and 5% in revenue, a trend witnessed across all regions, strengthening the brand’s global position. The introduction of the all-new global Ranger further bolstered profitability, contributing to the $2.3 billion in EBIT for Ford Blue.

An even brighter spot on the horizon was the Ford Model E division. With wholesale units surging by an impressive 44% and a subsequent 39% boost in revenue amounting to $1.8 billion, the division outshone expectations.

These accomplishments prompted Ford to raise its full-year 2023 guidance, projecting an adjusted EBIT between $11 billion and $12 billion, and adjusted free cash flow between $6.5 billion and $7 billion. This forecast takes into account various economic forces, including exchange rates, costs related to union contract negotiations, industry-wide customer incentives, and inflationary pressures.

Analysing the factors contributing to this performance reveals a balanced approach. Ford’s strengthened supply chain, benefits from the Super Duty introduction, increased industry volumes, and decreased commodity costs all bolstered its position. Conversely, headwinds such as currency fluctuations, increased warranty costs, and inflation were considered in shaping the guidance.

When assessing Ford’s valuation, a fair value of $15.63 per share was determined after projecting future cash flows.

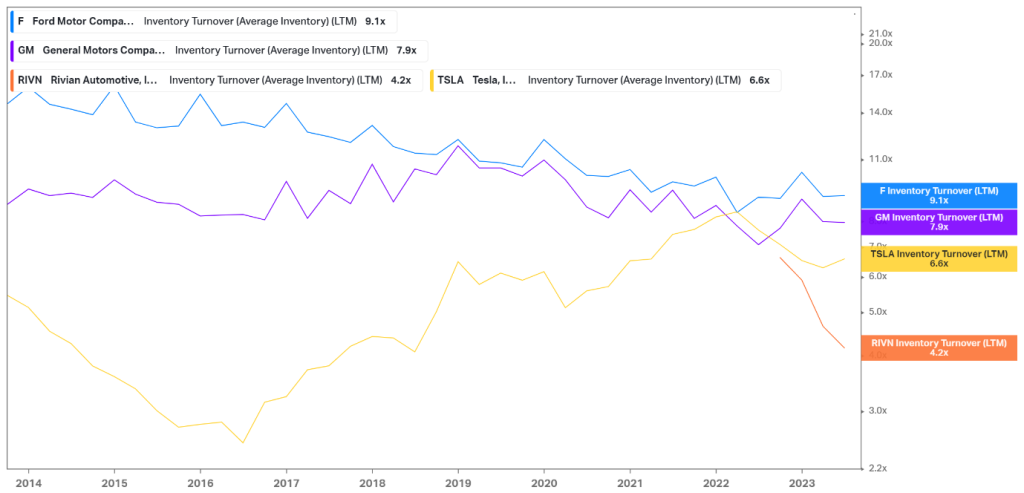

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Ford Motor Company’s inventory turnover prowess shines bright with a remarkable 9.1× ratio, showcasing its unparalleled effectiveness in inventory management. This consistent feat over the past decade solidifies its standing as the top U.S. automaker, harmonising seamlessly with its position as the nation’s highest-selling auto brand.

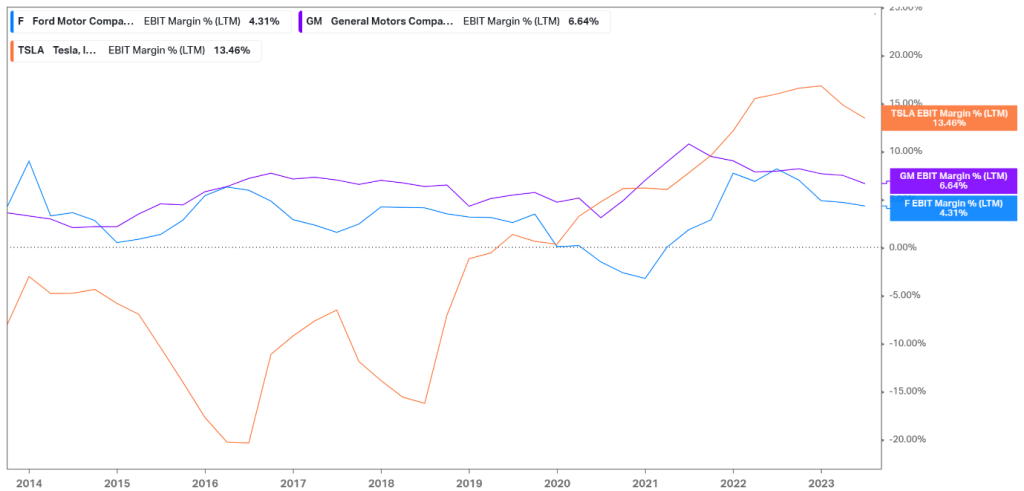

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

While Ford commands the highest U.S. auto sales, its profitability, with a 4.31% Earnings Before Interest and Tax (EBIT) margin, trails Tesla Motors Inc (ISIN: US88160R1014) and General Motors Co (ISIN: US37045V1008). Notably, Ford’s stable yet comparatively modest profitability signifies resilience in the face of market dynamics, reflecting its commitment to steadfast performance as well as its stability.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

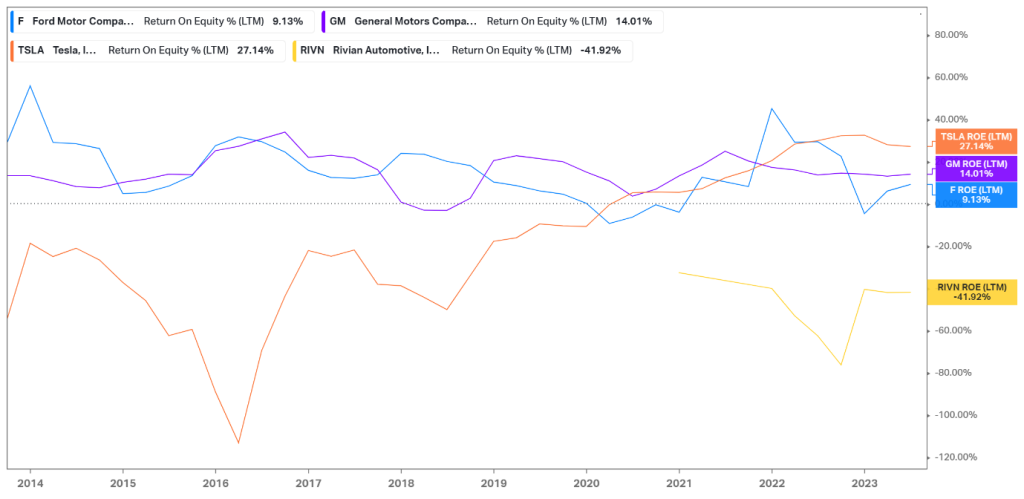

Ford’s Return on Equity reflects its EBIT margin’s challenge, standing as the lowest among rivals. Despite this, its returns rebounded from adversity in 2020, signalling its unwavering resilience and determination to regain positive traction.

Resumen

Ford Motor Company’s journey through the quarters is one of perseverance and adaptability. Amidst challenging market fluctuations, Ford has showcased its prowess in inventory management and vehicle demand. While profitability and equity returns may trail some competitors, Ford’s stable performance and resilience shine through, reinforcing its position as a steadfast industry leader. Its fair value of $15.63 per share could materialise if investors regain confidence in the company’s outlook, driven by positive earnings.

Sources: Ford Motors Company, CNBC, Reuters, Statista, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.