Piece Written by Nkosilathi Dube, Trive Financial Market Analyst

Target Corporation’s (ISIN: US87612E1064) second-quarter results left investors both intrigued and contemplative. While the reported $1.80 earnings per share exhibited an astounding 25.79% divergence from Wall Street’s projections, it catapulted the stock nearly 8% higher at Wednesday’s market open—a testament to the market’s thirst for positive surprises. However, as the initial enthusiasm subsided, a more nuanced narrative emerged. Delving into the earnings report further revealed a top-line performance that fell short of expectations.

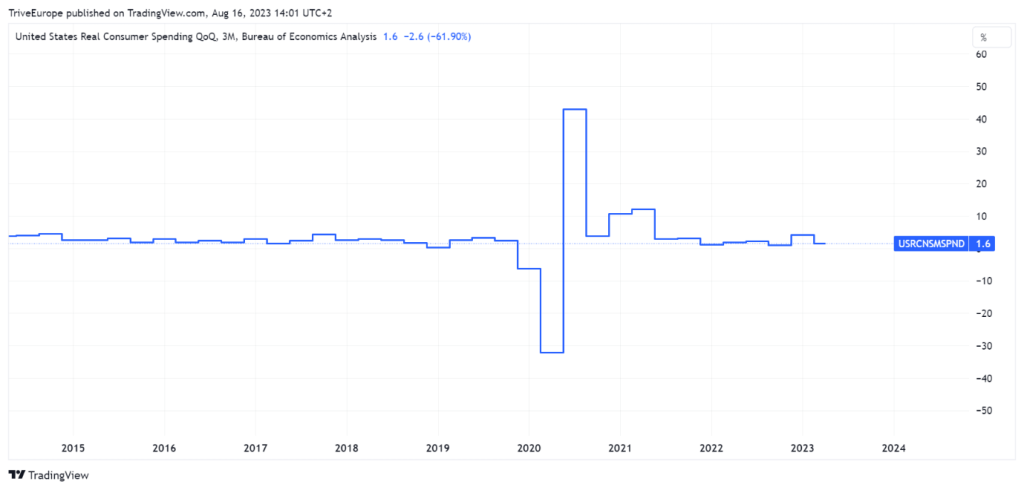

Beneath the surface, Target’s struggle to entice consumers beyond essential purchases has cast a shadow on its full-year outlook. A landscape marked by elevated inflation and the constrictions of U.S. monetary policy has reshaped consumer behaviour, causing restraint toward discretionary spending. This trend has manifested as a discernible deceleration in quarterly consumer spending growth, hinting at a more frugal mindset. This shift underscores the impact of the fading echoes of pandemic-era quantitative easing, painting a picture of evolving consumer dynamics and the intricate interplay between financial indicators and broader economic forces.

Source: Trive – Bureau Of Economic Analysis, Nkosilathi Dube

Technische Analyse

Target Corporation’s stock has faced a challenging journey, buffeted by headwinds of high inflation and weakened earnings, leading to a substantial 13.61% year-to-date decline. The share price has navigated a persistent downtrend, consistently trading below the ominous cloud of the 100-day moving average, exacerbating its downward trajectory.

Notably, the $177.04 per share level, a pivotal resistance formed early in 2023, has played a defining role in the stock’s fortunes, acting as the origination of a subsequent downward spiral. Meanwhile, the breach of the crucial support at the $139.65 per share level, established in mid-2022 and respected in prior quarters, marked a critical turning point. The week of May 22, 2023, ushered in this breach, causing further downside price action.

Yet, amidst this landscape of decline, a glimmer of potential emerges. The $114.23 per share level, a bedrock of support preceding a swift upside surge, could serve as a beacon of stability should the current downside momentum persist. Optimistic investors may find solace in the potential of the $139.65 per share level to serve as a medium-term prospect should the winds of momentum shift in their favour.

Fundamentalanalyse

Target Corporation’s recent quarterly performance has been shaped by the formidable challenges posed by a shifting consumer landscape. In this climate, total revenue marked a notable 5% decline, settling at $24.74 billion compared to the $26.04 billion of the preceding year. The crux of this setback is embodied in the crucial indicator of comparable sales, which plummeted by 5.4%, delineating a complex tale of struggles in both physical stores and online platforms.

The narrative takes a nuanced turn when examining the granularity of comparable sales. Notably, retailers witnessed a 4.3% decrease, with a more pronounced downturn of 10.5% in comparable digital sales. However, this tale of dwindling sales is rooted in a broader economic backdrop. Customers, grappling with the squeeze of high inflation and financial constraints, channelled their spending towards necessities like food and energy, resulting in reduced purchases of non-essential items like clothing and accessories.

Interestingly, despite the harsh sales climate, Target’s net income for the fiscal second quarter underwent a remarkable transformation. It surged from $183 million or 39 cents per share to $835 million or $1.80 per share, surpassing analysts’ expectations. This turnaround starkly contrasts the nearly 90% profit plunge the retailer experienced during the same period last year. This stark improvement can be attributed to a combination of factors, including fewer markdowns, streamlined supply chains, reduced freight charges, and higher retail prices.

Furthermore, Target’s strategic pivot toward high-frequency categories such as food and household essentials bore fruit during the quarter, offsetting losses in discretionary segments. This recalibration, along with a 17% reduction in inventory compared to the previous year, reflects a deliberate shift away from non-essentials.

Despite these efforts, Target’s full-year guidance takes a cautious stance. Amidst evolving economic landscapes and shifting inflation dynamics, the company envisions a mid-single-digit decline in comparable sales and projects earnings per share to hover within the $7 to $8 range. This outlook diverges from earlier projections of earnings ranging from $7.75 to $8.75 per share and comparable sales spanning a spectrum from slight decline to marginal growth.

After discounting for future cash flows, a fair value of $138.76 per share.

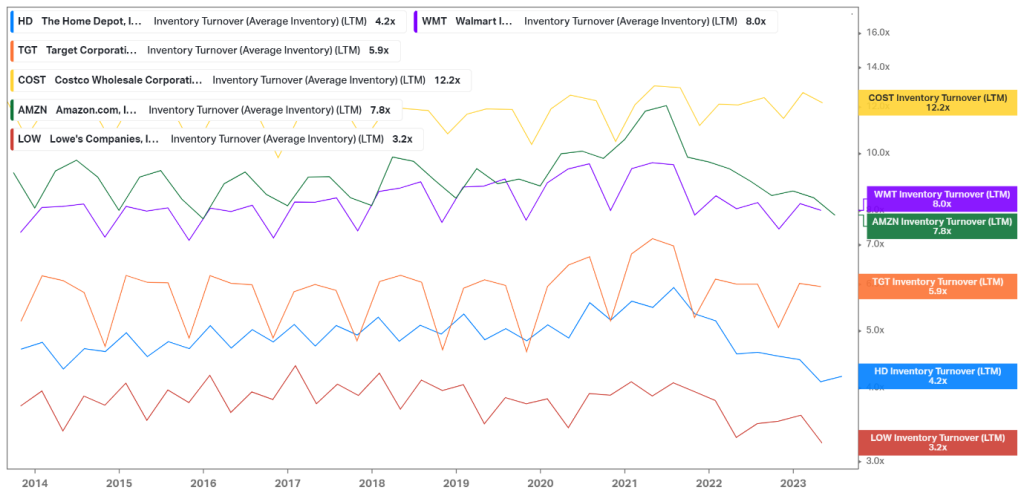

Source: Trive – Koyfin, Nkosilathi Dube

Target Corporation’s inventory turnover of 5.9× positions it as a balanced player within its competitive arena. The strategic blend of fast-moving consumer goods (FMCG) and discretionary products contribute to this moderate turnover rate, distinct from more conventional FMCG-focused retailers. This dynamic approach reflects a conscious effort to optimize inventory management, aligning with the fluid nature of modern consumer preferences.

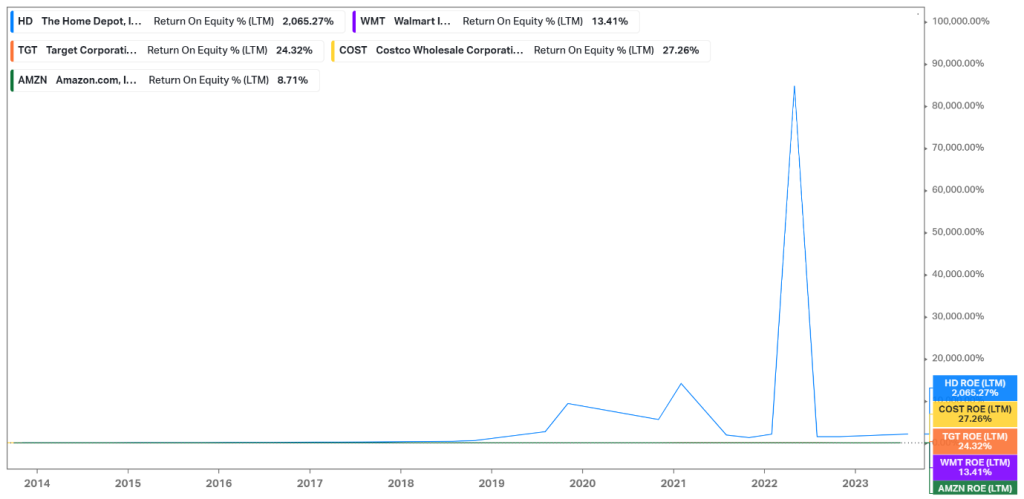

Source: Trive – Koyfin, Nkosilathi Dube

Target Corporation boasts a commendable Return on Equity of 24.32%, situating itself favourably within competitive circles. While trailing Home Depot Inc (ISIN: US4370761029) by a notable margin, Target finds its place among the upper ranks of assertive retail contenders. For investors seeking robust earnings potential, Target emerges as an enticing avenue for investment consideration. This profitability metric underscores Target’s capacity to generate healthy returns and reflects its adeptness in leveraging shareholder equity for sustainable growth.

Zusammenfassung

In the broader context, this complex tale of Target’s quarterly performance highlights the intricate interplay between consumer behaviours, economic headwinds, and strategic adaptations. Given that the U.S. has made steady progress in lowering inflation, combined with a resilient labour market, consumer spending has remained steadfast with the potential for positive prospects. If the big-box retailer’s earnings remain stable to positive, the share price could progressively close down on the $138.76 per share level.

Sources: Target Corp, Reuters, CNBC, Bureau Of Economic Analysis, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.