Piece written by Nkosilathi Dube, Trive Financial Market Analyst

The second quarter of Bank of America’s (ISIN: US0605051046) 2023 fiscal year was nothing short of fruitful as it delivered one of its best second quarters and half-years on a net income level. The benefits of higher interest rates were supported by ongoing organic client growth and client engagement across its segments, which led to an 11% rise in revenue.

Bank of America moderately beat Wall Street earnings and revenue estimates by 4.78% and 0.88%, respectively; earnings landed at $0.88 per share, while revenues surged to $25.20B. The steep interest rate environment boosted net interest incomes significantly, leaving the top line northbound, while the U.S. economy’s resilience supported investment banking and client activity.

Source: Trive Financial Services Malta – TradingView, Nkosilathi Dube

Since the onset of the banking sector crisis, Bank of America’s share price moved out of a positively correlated relationship with the S&P500 (SPX), leading to a negative correlation between the two financial instruments. The Bank of America has since underperformed, returning -9.94% year-to-date, while the S&P500 has returned a healthy 17.80%. Should investors keep Bank of America on their watchlists with two positive quarters now in the books?

Technische Analyse

The share price of Bank of America is currently trading below the 100-day moving average and is firmly in a downtrend. Volumes decreased after the selloff induced by the banking sector crisis, which led to a sideway consolidation forming a rectangle pattern.

The market is likely ranging before a breakout kickstarts a move at the conclusion of the consolidation. With the share price surging through the midway point of the consolidation range characterised by support and resistance at the $27.09 and $30.37 per share levels, respectively, optimistic investors likely have the upper hand at present.

The resistance level of $30.37 per share, which coincides with the 38.20% Fibonacci Retracement, may serve as a level of interest for optimistic investors if the positive earnings result catalyses upside price action. The market may be exposed to further upside potential if a high volume breakout above the resistance level occurs, which might perpetuate the upside momentum.

However, if the share price declines, optimistic investors may turn their attention to the $27.09 per share level as the next potential level of interest due to demand outpacing supply at that price, historically. However, if this level is broken, there may be room for additional downside scenarios, making the $23.21 per share level the next area of focus for upside positioning.

Fundamentalanalyse

Revenue increased 11% to $25.20B, driven chiefly by a 14% increase in net interest income (NII) to $14.2B as the bank increased its revenue from customer loan repayments on the back of steeper interest rates. The investment banking division also performed better than anticipated. The bank claimed that investment banking fees increased by 7% to $1.2B. Comparatively, peers’ earnings were negatively impacted by a dealmaking slump that lasted for months. The consumer banking division of Bank of America, whose revenue increased 15% to $10.5 billion, was supported by consumers’ financial stability throughout the quarter.

The best-performing business segments were the Global Banking and Consumer banking segments, whose revenues surged by 23% and 15%, respectively, to $2.9B and $10.5B. Helping boost the consumer banking segment was the addition of 157K net new customer checking accounts, an 18. consecutive quarter of growth, while consumer investment assets of $387B grew 23% in the quarter. The global banking segment was helped by a 2% increase in average loan and lease balances to $383B.

As a result of the positive flows to the top line, the bank’s earnings increased by 19% to $7.4B, which accounts for $0.88 per share, according to Bank of America.

Source: Trive Financial Services Malta – Bank of America Corporation, Nkosilathi Dube

However, banks are experiencing stress in their commercial real estate lending operations, especially in their office loan portfolios, which are negatively impacted by increasing financing costs and a persistent shift towards remote employment. Provision for credit losses increased by $602 million to $1.1 billion in the quarter to reflect the dismal environment. A quarter of Bank of America’s commercial real estate loan portfolio is exposed to office loans, leaving it highly vulnerable to the faltering of debt repayments within this segment.

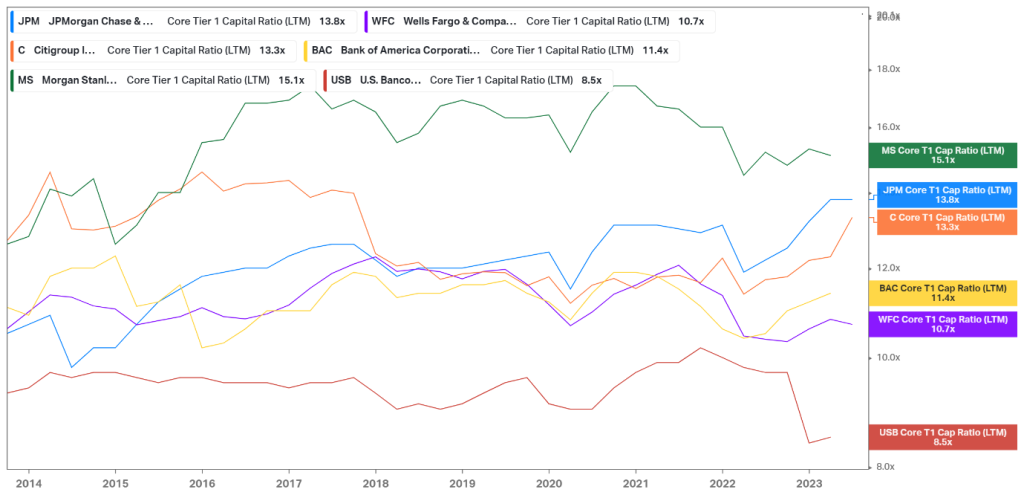

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Compared to the biggest U.S. banks, Bank of America has one of the lowest Core Tier 1 Capital Ratios. In the case of a substantial economic downturn, it is likely a higher-risk stock because it has a lower ratio (11.4) than its greatest rival. It is less likely to withstand economic risk events than the other major U.S. banks, leaving it a less attractive option from a risk management perspective.

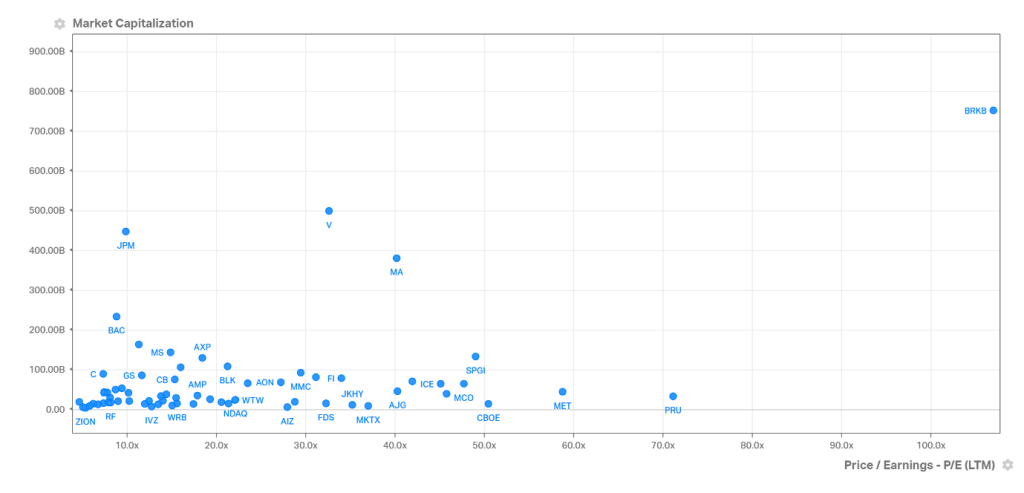

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Bank of America’s Price to Earnings ratio falls in the lower end of the S&P500 financial services stocks spectrum. However, it lies within a similar range to the major U.S. banks, potentially indicating that it aligns with market expectations of its valuation.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

With a price-to-book ratio of 0.9×, Bank of America is undervalued compared to its peers. Relative to the value of the company’s assets, the share price trades at a lower price, as the market prices in its equity at a lower value than its assets. Given the generally higher price-to-book value of Bank of America’s peers, it could indicate that the market is more willing to pay for the ownership of other banking sector stocks, over that of Bank of America, despite its assets weighing more at the present price level.

After discounting for future cash flows, a fair value of $32.00 per share was derived.

Zusammenfassung

Given that high U.S. interest rates are maintained through the remainder of the year, Bank of America’s top and bottom lines could be kept elevated and potentially lure investors to the earnings prospects. The fair value of $32.00 per share will likely play out in the medium to long term.

Sources: Bank Of America Corporation, Reuters, CNBC, TradingView, Koyfin