Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

International Business Machines Corp – IBM (ISIN: US4592001014) narrowly edged past Wall Streets earnings estimates after reporting its second-quarter earnings. IBM’s earnings surprised to the upside of estimates by 8.27% to $2.18 per share on revenues of $15.48B, which missed consensus by a meagre 0.65%.

The software and consulting segments led the way in terms of positive revenue performance in the second quarter, but the business’s infrastructure division struggled. With the help of its improved portfolio mix and productivity measures, IBM continued to increase its gross profit margin. While continuing to increase shareholder value through dividend payments, IBM has used its strong cash position to invest in growth this year, announcing seven acquisitions to support its hybrid cloud and Artificial Intelligence (AI) strategy.

Trive Financial Services Malta – TradingView, Nkosilathi Dube

IBM’s share price lost out this year as the effects of the slump in demand for consumer electronics took a toll on the business. According to Gartner, worldwide PC shipments decreased by 30% in the first quarter of 2023 due to weak demand and high inventories. PC demand was significantly impacted by the likelihood of a worldwide recession, rising inflation, and increasing interest rates. IBM’s share price took a knock but has since recovered to produce a 1.42% decline year-to-date, while the SPX has shined with its 19% gain.

Technische Analyse

IBM’s share prices has been reverting around its mean, represented by the 100-day moving average, with the most recent price action leading up to a crossover above the mean to establish an uptrend. The share price has traded in a gently upward-sloping channel after establishing a low of the decade starting in 2020. Support was established at the year-to-date low of $120.55 per share, while the rejection of the $153.21 per share level formed resistance.

Given the mean reversion nature of the price action, the crossover above the 100-day moving average from the downside could indicate the market’s intention to search for a higher share value. In this case, resistance at the $153.21 per share level is probable if demand continues to outweigh supply. A breakout above the 61.80% Fibonacci Retracement Golden Ratio could validate excess demand over supply.

In contrast, if the share price falters, accompanied by a breakdown below the 100-day moving average, support at the $120.55 per share level could be the most significant level for optimistic investors to watch, given the level’s history of demand outstripping supply.

Fundamentalanalyse

Year-on-year, IBM’s revenue faltered slightly after shedding 0.4% to land on the $15.5B mark. Weighing down on the revenue was the decline in the infrastructure segment’s revenue, which was down 15% year-on-year to $3.6B. The subsegments that experienced the most severe downturn were Hybrid Infrastructure and Infrastructure Support, which declined by 18% and 8%, respectively.

However, the remaining two segments supported the top line from extreme deterioration as revenues surged. Software revenue was up 7% to $6.6B, supported by strong developments in the Data and AI division, which saw revenues surge 10%, while IBM’s platform, RedHat, achieved 11% growth, and Transaction processing improved 9%. Consulting revenue was up 4% to $5.0B, boosted by all its major subsegments, with the most notable growth coming out of Application operations, which surged 6%.

Despite the slight decline in the top line, IBM’s profitability was slightly improved, primarily due to a modest decline of 1% in total and other expenses year-on-year to $6.5B. In January, IBM announced 3,900 job cuts as part of broader cost-cutting measures taken within the tech sector.

As a result, gross profit of $8.5B and net profit of $1.6B were reported in the second quarter, up 3% and 13% year-on-year, respectively. This translated into a gross margin of 54.9%, which improved 160 basis points from the same quarter a year ago, while the Pre-Tax Income margin gained 180 basis points to 12.9% over the same period. The company earned $6.4 billion in net cash from operational activities for the first half of the year, an increase of $1.8 billion over the same period last year, indicating that its operational efficiency has improved year-over-year.

IBM is still expecting sales to increase by 3% to 5% in constant currency, while free cash flow of over $10.5 billion is anticipated, up more than $1 billion from the prior year.

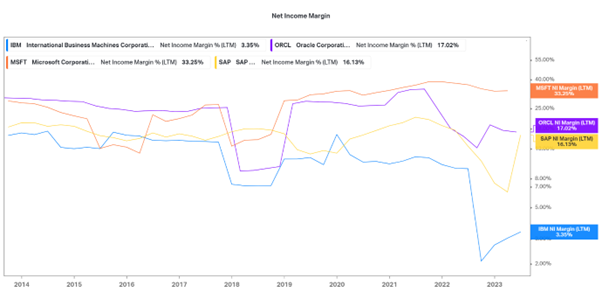

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Among its main competitors, IBM has the lowest levels of profitability, given its 3.35% Net Income Margin, which pales in comparison to the nearest competitor, SAP. Investors searching for strong returns through profitability will likely find IBM less attractive as a result.

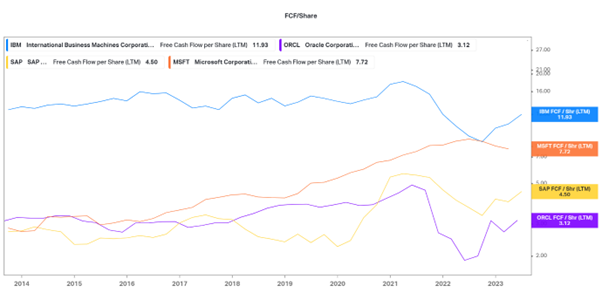

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

However, IBM stands out on a Free Cash Flow Basis as it currently has $11.93 in free cash flows per share, the highest among its competitors for the past ten years. Ultimately, IBM is the most financially flexible company, as it is in the best position among its competitors to pay debt or dividends and facilitate the growth of the business.

After discounting for future cash flows, IBM’s fair value was derived at $150.00 per share.

Zusammenfassung

With the advent of AI, IBM is positioning itself to take advantage of its resourcefulness and introduce it on its platforms and services. It could be a beneficiary of the AI hype in the near term. Given that IBM’s sales and earnings stick on a positive note in the upcoming quarters, its share price could realise the $150.00 per share fair value.

Sources: IBM, Reuters, CNBC, Gartner, TradingView, Koyfin