Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Amidst the effervescent dynamics of the business world, The Coca-Cola Company (ISIN: US1912161007) crafted a sparkling narrative with its triumphant second quarter 2023 earnings report. Defying expectations, the renowned soda giant reported revenue of $11.97 billion, delicately surpassing forecasts by 1.91%. A standout feat, however, was the robust earnings per share of $0.78, revealing an 8.11% overachievement, hinting at the company’s resilience in a competitive landscape.

Coca-Cola’s strategic response to the inflationary challenge speaks volumes to its adaptability and market prowess. Confronting the surge in commodity prices over recent years, the company demonstrated its mettle by raising prices. This calculated manoeuvre bore fruit as the average selling prices escalated by 10% for the second quarter. These increases in no way dampened sales, illustrating consumers’ loyalty and willingness to absorb the upward cost pressure, a testament to the brand’s enduring pricing power.

The stage is now set for intrigue as the fizz of Coca-Cola’s success continues to bubble. With buoyant earnings painting an optimistic picture and the company raising its outlook for the remainder of the year, the coming chapters will unveil whether this momentum remains effervescent, solidifying the brand’s enduring position as a leader in the ever-refreshing world of beverages.

Technische Analyse

Coca-Cola’s share price script unfolds a tale of intriguing movements within the financial stage. The once vigorous uptrend has undergone a change in tempo, with waning volumes ushering in short-lived bursts of upward momentum. Yet, a steadying thread was maintained as the stock upheld its position above the 100-day moving average, affirming the persistence of the overarching uptrend.

The canvas reveals a symmetrical triangle pattern, weaving a narrative of tightening fluctuations between the swing highs and lows. This formation, characterized by converging highs and lows, has marked the terrain of the stock’s journey. Notably, the pinnacle of $64.99 per share emerged as a significant juncture, ushering in resistance that steered the share price into a plummeting descent.

Amid this price action, a support formed at $59.37 per share, compelling a swift reversal from the symmetrical triangle’s lower boundary. However, the weakened upside momentum prompted the share price to revisit its 100-day moving average and the triangle’s lower boundary.

The aura of the company’s upbeat earnings and rosy guidance could cast a spotlight on investor sentiment. Buoyed by this positive outlook, optimistic investors may rally around the $64.99 per share level, positioning it as a potential triumph in the face of upward momentum. Conversely, a breakdown beneath the symmetrical triangle’s confines could usher in fresh chapters of decline, with the $59.37 mark poised to provide an anchoring point, echoing the role of supportive forces in shaping the stock’s journey ahead.

Fundamentalanalyse

The Coca-Cola Company scripted a compelling narrative in its second-quarter performance as it navigates the ebbs and flows of a dynamic market landscape. With net revenues growing by an impressive 6% to reach $12.0 billion, the brand’s trajectory painted a picture of strategic prowess.

A standout highlight was the 10% surge in price/mix, underscoring the brand’s adeptness at enhancing the top line. A star of the show is the iconic Minute Maid brand, a testament to its enduring legacy, evolving from its origins as a traditional orange juice into the world’s largest juice brand.

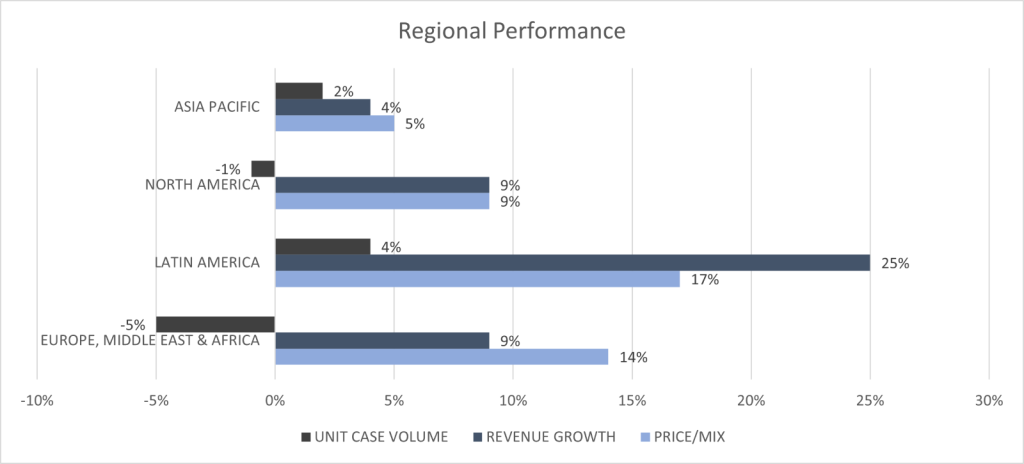

The Latin American stage undoubtedly stole the spotlight, experiencing a remarkable 25% revenue surge. This surge, bolstered by a 17% growth in Price/Mix and a 4% rise in volumes, echoed Coca-Cola’s remarkable pricing power. The harmonious interaction between price and volume reveals consumer acceptance of higher pricing amidst the promise of quality.

In contrast, Europe, the Middle East, and Africa grappled with a 5% volume decline, attributed largely to business suspension in Russia. However, a resolute 14% rise in Price/Mix allowed the region to rally a commendable 9% revenue growth, showcasing the power of strategic pricing manoeuvres.

The North American arm held its ground, resiliently manoeuvring a 1% Unit Case Volume decline. This feat was magnified by a 9% Price/Mix rise, driving a robust 9% revenue growth, a testament to the brand’s adeptness at exercising its pricing power.

Source: Trive – The Coca-Cola Company, Nkosilathi Dube

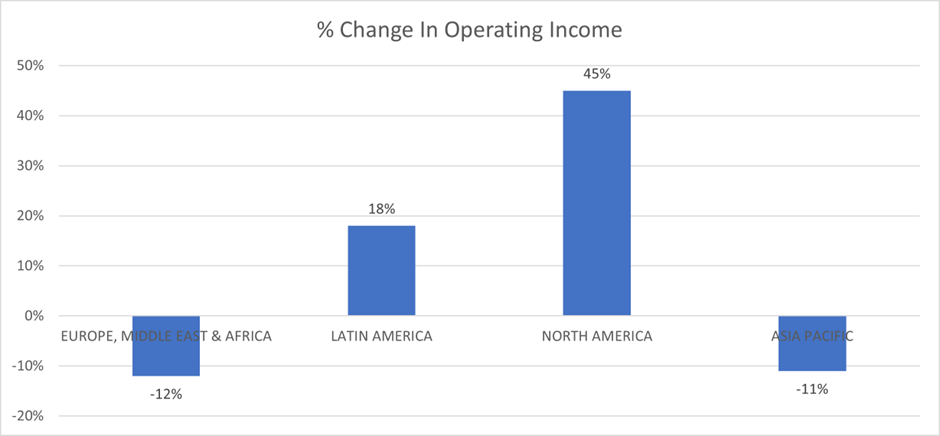

The operating income scene unfolds amid the symphony of pricing and top line growth. A pattern of divergence emerged as regions swung from staggering declines to resounding surges. Europe, the Middle East, and Africa, as well as Asia Pacific, grappled with declines of 12% and 11% in operating income, respectively, contrasting starkly with the soaring 45% and 18% surges in North and Latin America. In addition, a resounding feat arrived in the form of a 34% surge in net income, reaching $2.55 billion. This was powered by the harmonious growth of interest income and equity income.

Source: Trive – The Coca-Cola Company, Nkosilathi Dube

In light of these fluctuating results, Coca-Cola’s guidance found its voice. Buoyed by the positive momentum of the second quarter, the brand’s outlook was brightened. The soda giant now aspires to orchestrate organic revenue growth of 8% to 9%, surpassing previous expectations of 7-8%. Similarly, comparable EPS growth was elevated to 5% to 6%, a stride beyond the earlier guidance of 4% to 5%.

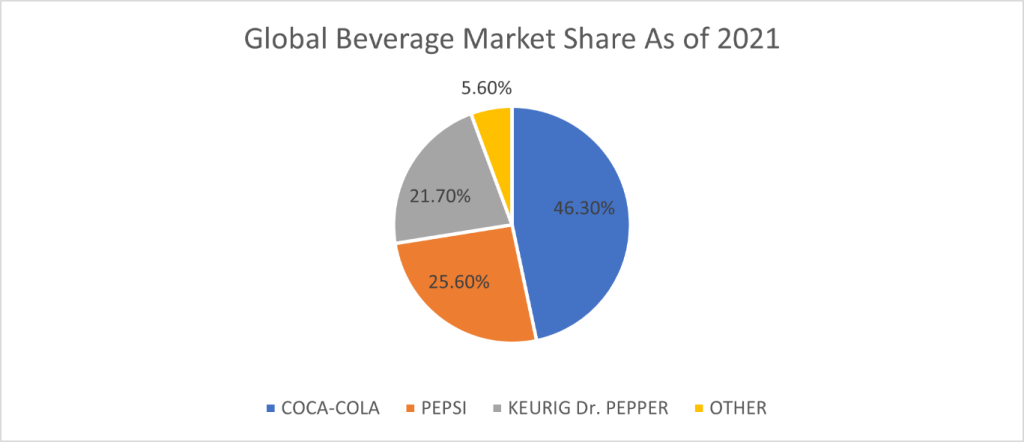

Source: Trive – Statista, Nkosilathi Dube

Coca-Cola’s dominance in the global beverage market is unmistakable, with a market share of 46.30% as of 2021, towering over its closest competitor, Pepsico Inc (ISIN: US7134481081). This staggering lead is a testament to Coca-Cola’s brand prowess, fostered by its strong brand loyalty and extensive global presence spanning over 200 countries. This substantial market share underscores the company’s strategic positioning and role as a commanding force in the beverage industry.

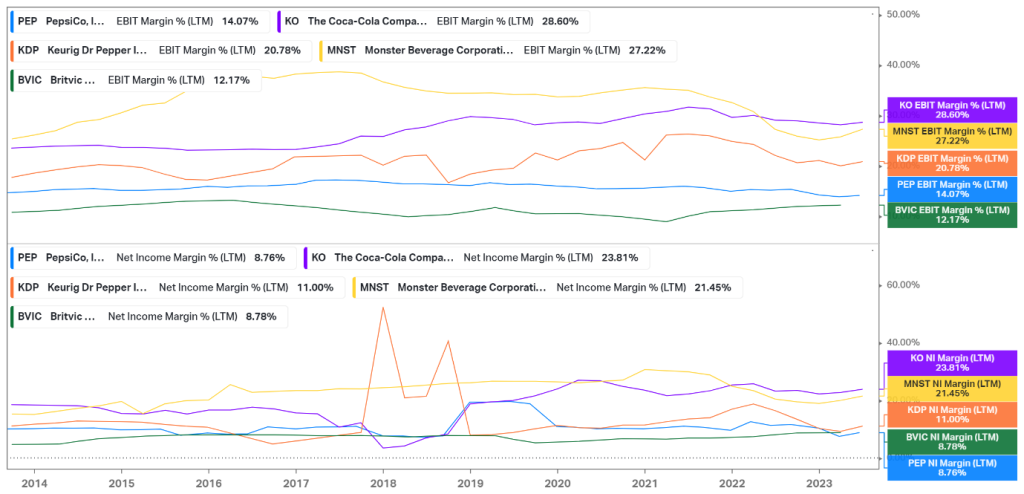

Source: Trive – Koyfin, Nkosilathi Dube

Coca-Cola emerges as the titan of profitability among its competitors, flaunting an EBIT margin of 28.60% and a Net Income Margin of 23.81%. This fiscal prowess enables it to expertly transform sales into substantial profits, reaffirming its strategic prowess. What sets Coca-Cola apart is not only its impressive profitability but also its unwavering stability over time, illustrating its resilience amidst market dynamics and underscoring its firm grip on the pinnacle of the beverage industry.

Source: Trive – Koyfin, Nkosilathi Dube

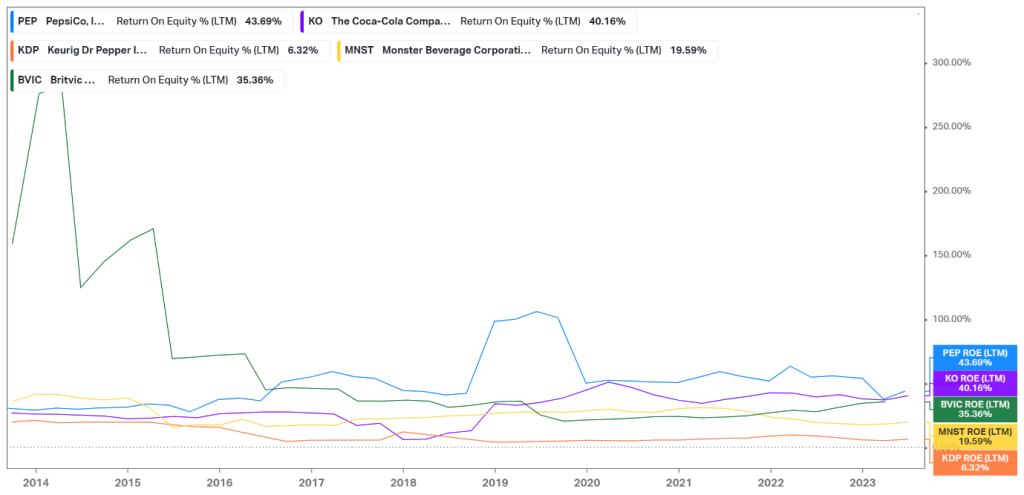

Coca-Cola, second only to Pepsico Inc, shines in delivering rewards to its shareholders. With an impressive 40.16% return on equity, it solidifies its position as a reliable cornerstone in the dynamic beverage industry. This stable performance showcases the brand’s commitment to nurturing shareholder value, making it an alluring investment prospect in a competitive market landscape.

After discounting for future cash flows, a fair value of $65.00 per share was derived.

Zusammenfassung

Coca-Cola’s story is one of resilience, strategic finesse, and undeniable dominance in the global beverage market. With soaring revenues, impressive profitability, and steadfast returns for shareholders, it stands as a testament to the power of brand loyalty and strategic vision. As the fizz of success continues to bubble, the story of Coca-Cola invites us to witness the evolution of an enduring leader, beckoning investors and enthusiasts to quench their curiosity and be part of this refreshing journey. At $65.00 per share, the fair value could materialise, given the subsequent quarters remain upbeat.

Sources: The Coca-Cola Company, CNBC, Reuters, Refinitiv, Statista, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.