Zoom Video Communications Inc’s (ISIN: US98980L1017) investors were in high spirits, sending the stock north by 2.94% after earnings for Q1 2024 zoomed past Wall Street Expectations by nearly a fifth. Earnings per share landed at $1.16, beating consensus by 17.05%, while revenue beat by 1.96% with $1.105B realised in the quarter.

Zoom’s share price story is a classic case of hero to zero. After soaring during the Covid-19 pandemic to its peak of nearly $590 per share, the stock price followed the shadow of death and is now down a staggering 88%.

The steep selloff sent Zoom’s share price right where it started when it listed on the NASDAQ exchange, at $60.36 per share, but it has since recovered slightly. Will Zoom recover its significant losses, or was its peak a once-off event?

Technische Analyse

Zoom’s share price has trended lower since the final quarter of 2021. After the share price broke below its 100-day moving average, it has been in freefall, trading near where it began. Support and resistance were established at the $60.84 and $84.65 levels, respectively. The stock has formed a descending channel pattern in recent months, indicating that the downtrend is fully at play.

After bouncing off its support level, the share price has begun to make its way north, with bulls piling in on the stock. With the share price approaching the resistance of the descending channel pattern, the up move is likely to stall as the potential for supply outweighing demand looms.

If a reversal occurs, bullish traders could wait on the share price to return to support, where demand is healthy. If volumes decline to the downside, following a reversal, it could indicate weakening bearish pressure with a potential retracement imminent. Bullish traders will likely earmark the $84.65 per share level as a point of interest.

Fundamentalanalyse

Triple-digit growth for Zoom’s top line is a thing of the past as the company is far off its pandemic peak. The company’s revenue beat expectations for the first quarter of 2024 and was up 3% year over year, supported by a 13% boost in revenue in the enterprise business to $632M. However, offsetting the gain in the top line was an 8% decline in the online revenue segment to $473M year over year.

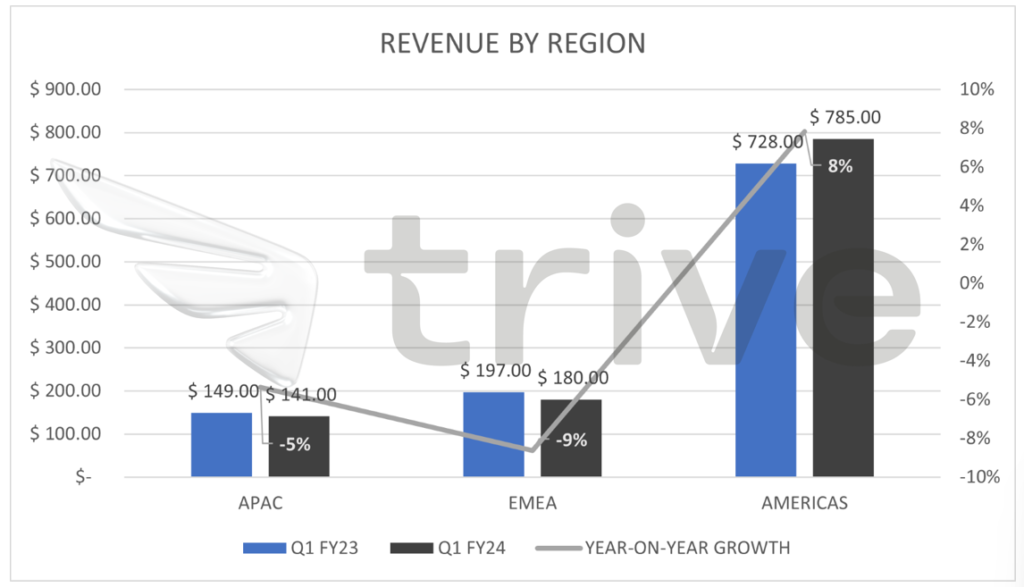

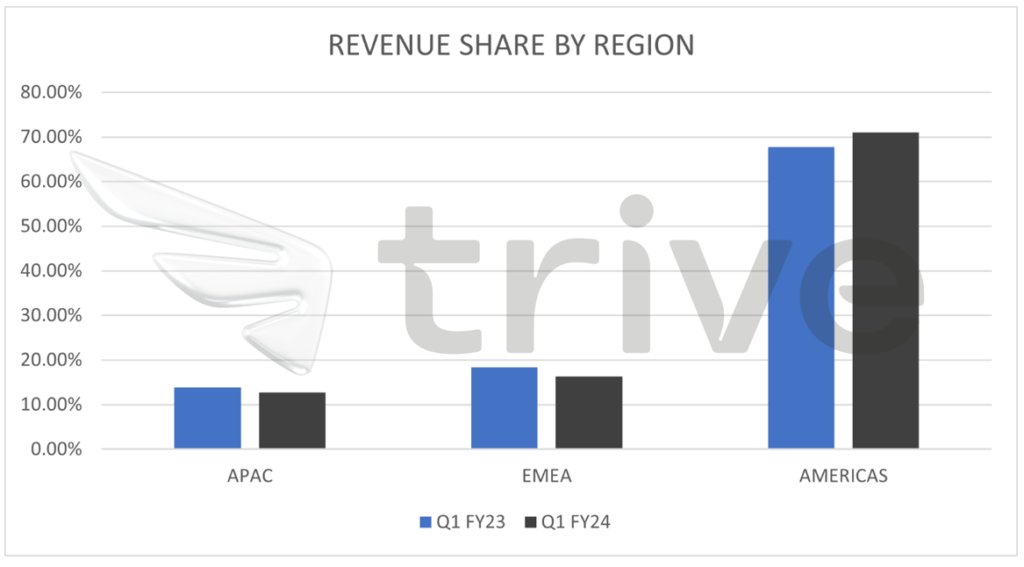

The only region with positive sales growth was the U.S., while the rest of the regions’ sales declined. The U.S. is Zoom’s biggest and most important market; therefore, growth in this market could be considered a plus for the company’s top line. The Asia-Pacific (APAC) and Europe, Middle East, and Africa (EMEA) regions saw sales decline by 5% and 9%, respectively.

America’s revenue share grew by 3%, offsetting the decline in the percentage share of the APAC and EMEA regions, whose revenue share declined by 1% and 2%, respectively. Zoom has been left reeling over its market share as similar services from the likes of Microsoft (ISIN: US5949181045) have overtaken the company to lead the market.

The bottom line was slightly improved due to the slight uptick in the top line. On a GAAP basis, operating profit was up 0.9% year on year, while Free Cash Flows surged 116% to $397M from the prior quarter. Given the bolstered cash flows from quarter to quarter, Zoom is better positioned to meet its short-term obligations, but more is needed to promise an enhanced valuation.

From customers’ perspective, Zoom performed a cut above the quarter a year ago. New and existing enterprise customers grew 9% to 216K, while customers contributing over $100K to the trailing twelve-month revenue surged 23% to 3580.

Zoom raised its full-year outlook for revenue and profit despite growth being a mile off the pandemic boom and business spending taking a downturn on gloomy economic conditions. Revenue is now forecast to be between $4.47 billion and $4.49 billion, representing a 2% growth compared to last year. Earnings are expected to reach between $4.25 and $4.31 per share, compared with an earlier estimate of $4.11 to $4.18 per share.

After discounting for future cash flows, Zoom’s share price was derived at $75.00 per share. This fair value potentially leaves room for a 12% gain to the upside should the share price continue moving higher from its current price.

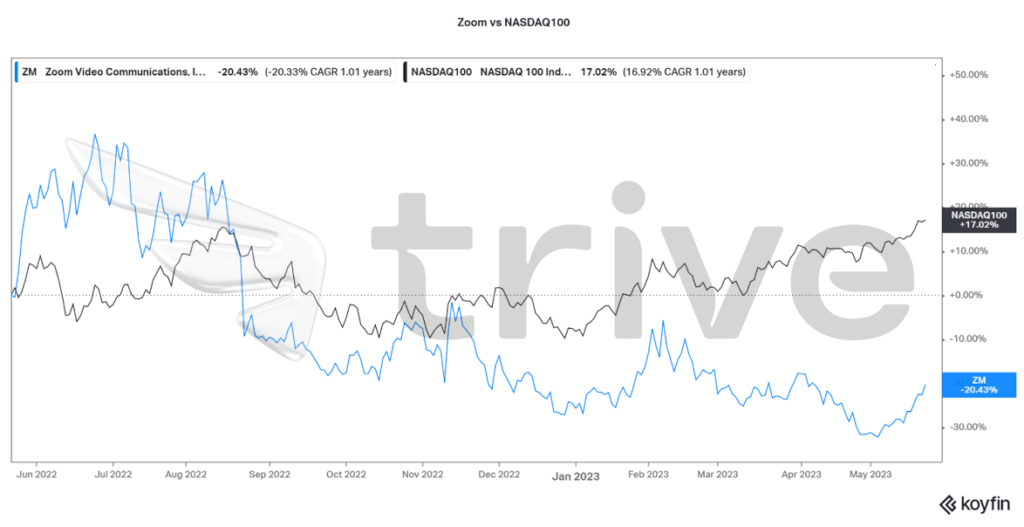

Despite positively correlating with the NASDAQ100 index, Zoom’s share price has underperformed the broader index. The company has fallen out of favour with tech stock investors and is down 20.43% since last year, while the NASDAQ100 is up 17%.

Zusammenfassung

Since going public, Zoom’s share price performance reflects the industry’s intensified competitiveness. The pandemic hype and boom have faded, and Zoom’s share price is unlikely ever to reach those heights unless it finds an edge it can use to beat competitors on market share. The $75.00 per share level is probable if the company sustains its positive first-quarter performance throughout the year.

Sources: Zoom Video Communications Inc, TradingView, Koyfin