Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

The latest act in the Walt Disney Company’s (ISIN: US2546871060) financial drama has unfolded, revealing a performance that blends both triumph and challenge. With a captivating earnings announcement, Disney managed to outshine Wall Street’s earnings expectations, boasting an impressive $1.03 per share, a triumphant 7.76% above projections. However, the plot thickened as revenue figures fell slightly short, clocking in at $22.33 billion, a mere 0.74% shy of forecasts.

This performance unveiled a nuanced tale – on the one hand, a surge in top-line revenue compared to the previous year’s quarter, yet on the other, a plunge into negative territory with a $460 million loss. This financial twist was primarily attributed to Restructuring and impairment charges. Amidst this intricate narrative, Disney’s streaming ambitions faced their own subplot, with Disney+ subscriptions reaching 146.1 million, slightly below the 151.1 million anticipated.

As the curtain drew back further, there were rays of optimism. The company confidently revealed its strides in cost-cutting, promising progress towards nearly $5.5 billion in reductions as pledged earlier this year. Additionally, in a mere three quarters, Disney managed to elevate its direct-to-consumer operating income by approximately $1 billion. In this ever-evolving landscape, the challenge to achieve direct-to-consumer profitability by the end of FY 2024 remains – a testament to the resilience and adaptability of a company navigating the winds of change.

Technical

The plunge below the 100-day moving average illustrates the share price’s downward journey, mirroring a downtrend that has taken refuge beneath it. A descending triangle emerged, with a base anchored at $84.23 per share, signifying a level of substantial support.

This market structure hints at the market’s hesitance to undermine the share price, as evidenced by the absence of a decisive breakdown below the support level. The formation of lower highs, with the most recent resistance at $104.15 per share, amplifies this sentiment. Presently, an oversold Relative Strength Index lends weight to the potential for a reversal, with momentum potentially pivoting upwards.

Should momentum indeed shift, the $104.15 per share level could become a point of interest to the upside, likely to garner significant attention if a breakout breaches the descending channel’s upper trendline accompanied by robust trading volumes. Conversely, a breach below the $84.23 level could unlock the path to the next level of significance – the swing low of $72.66 per share from Q1 2014.

Fundamental

The quarterly revenue, standing at $22.33 billion, showcases a commendable 3.8% year-over-year increase. This success was underscored by the Parks, Experiences, and Products division, where revenue surged 13% to $8.33 billion. The domestic sector saw a 4% uptick, while international markets soared by an astounding 94%, propelling the division’s operating income to $2.4 billion, an 11% boost.

However, the Media and Entertainment Distribution division bore contrasting fortunes, as revenue dwindled by 1% to $14.00 billion, with both domestic and international channels encountering declines of 4% and 20%, respectively. An 18% drop in operating income, amounting to $1.1 billion, reflected these struggles. The media segment’s woes were amplified by lacklustre box office performance, as well as declining linear advertising and television subscriptions.

Source: Trive – Walt Disney Company, Nkosilathi Dube

Amidst these narratives, the streaming realm carried its own twists. The core Disney+ subscribers edged up by 1% sequentially, reaching 105.7 million. However, the broader Disney+ subscriber base reported a 7.4% decline to 146.1 million, a more substantial reduction than anticipated. This dip was largely attributed to Disney+ Hotstar, which suffered a 24% drop due to the loss of cricket broadcasting rights from the Indian Premier League.

Addressing these challenges, Disney announced intentions to bolster its ad-free streaming tier cost and tackle password sharing, echoing Netflix’s (ISIN: US64110L1061) strategy earlier this year. These measures were devised in response to declining user numbers and revenue in the media and entertainment distribution sector.

The Q3 report also unveiled an unusual quarterly net loss of $460 million, a shift from a net income of $1.41 billion the previous year. This was primarily attributed to $2.65 billion in impairments and one-time expenses. Most of these charges stemmed from content impairments, resulting from content removal from Disney’s streaming services and the termination of third-party licensing agreements.

In navigating these twists, Disney’s performance underscores the challenges of the evolving media landscape, where streaming dynamics, content decisions, and market shifts intertwine to shape financial outcomes.

Source: Trive – Koyfin, Nkosilathi Dube

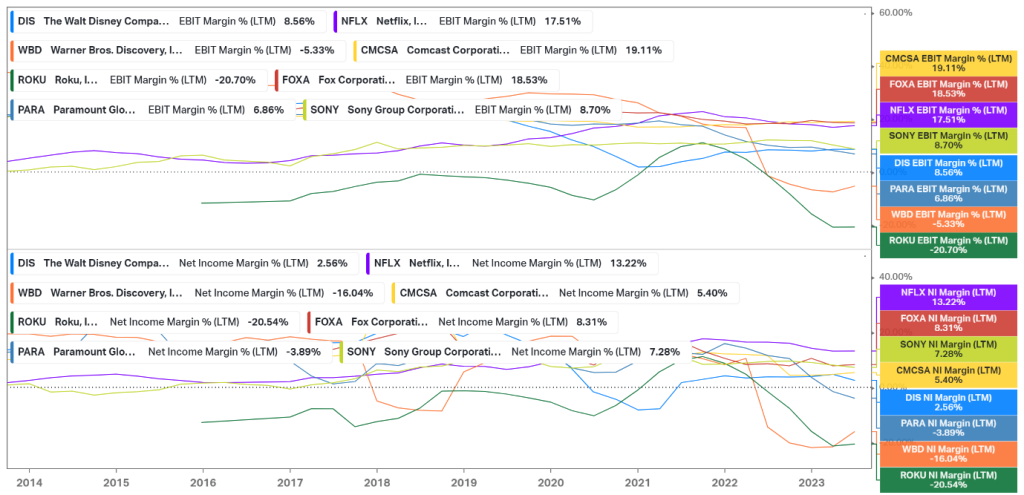

Walt Disney Company’s profitability ranks moderately within its industry peers. With an EBIT Margin of 8.56% and net income margin of 2.56%, it lags behind Netflix Inc but outperforms competitors with negative margins.

Source: Trive – Koyfin, Nkosilathi Dube

Disney’s Return on Equity (ROE) at 2.72% trails behind industry peers, including Netflix at 20.26%. Though Disney’s ROE remained steady post-pandemic, investors seeking robust earnings might find stronger options among competitors. ROE, a key indicator of a company’s profitability relative to shareholders’ equity, highlights opportunities for growth and efficiency.

A fair value of $90.00 per share was derived after discounting for future cash flows.

Summary

Disney’s Q3 earnings showcased mixed results as earnings exceeded expectations but with a slight revenue miss. The narrative revealed a surge in revenue driven by Parks, Experiences, and Products division, yet a loss was incurred due to one-time costs on impairments. Given that the company succeeds in its aggressive cost-cutting programme, earnings could be enhanced in the medium to long term.

Sources: Walt Disney Company, Reuters, CNBC, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.