Tesla Inc’s (ISIN: US88160R1014) price wars have eaten into its gross margin after slashing prices of key models for the sixth time in the U.S. market and globally.

Tesla’s rockstar CEO, Elon Musk, has taken on a strategy of high volumes and low margins to maintain its lead position in the Electric Vehicle (EV) industry amid intensifying global competition, especially where it lost its footing to BYD in China.

The EV giant’s earnings somewhat aligned with Wall Street’s expectations after reporting earnings and revenues of $0.85 per share and $23.33B. However, the share price is down 18.34% as investors are fretting over price cuts and lower gross margins and what that could mean for the company at the end of the fiscal period.

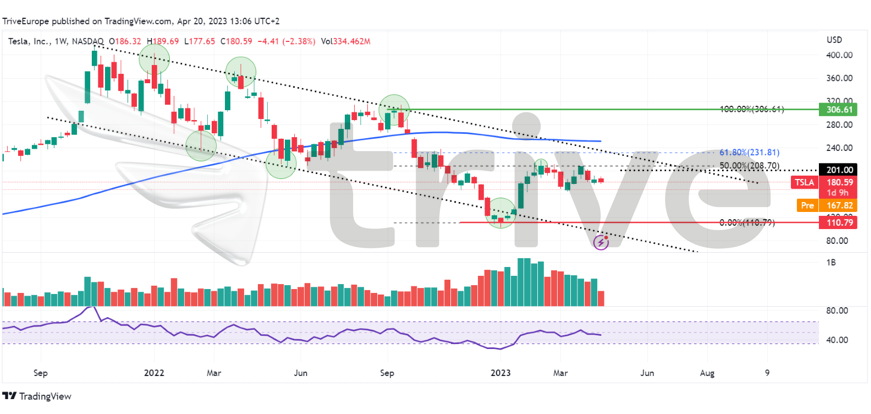

Technical

Tesla’s share price trended lower since the last quarter of 2023 after forming a descending channel pattern while the price crossed below the 100-day moving average to validate the downtrend. Support and resistance were established at the $110.79 and $306.61 per share levels, respectively.

Following a rejection of the descending channel’s support, bulls swept in to take the share price up 87% towards the 50% Fibonacci Retracement level before moving lower again. The $110.79 per share level represents a price where strong demand outweighs supply.

Since the market is moving on a bearish tone, investors could look to the old Financial Adage of “Buying Low”, leaving the $110.79 level as the most attractive price. If the price approaches the downside on declining volumes, it could validate long opportunities as it indicates the wearing out of bearish pressure.

Alternatively, if the recent bullish momentum peaks, the share price could break above the 50% Fibonacci Retracement level as investors aim for the descending channel’s resistance. A breakout above the descending channel on high volumes could signal the market devising a higher value for the stock. Bullish traders could look to enter the market on a retracement toward the pattern, validated by declining volumes to the downside on the retracement.

Fundamental

Tesla’s top line was boosted by price cuts, which increased deliveries by 4% quarter on quarter. Total revenues were up 24% to $23.33B for the quarter compared to a year ago. Driving the 24% surge was an 18% growth in automotive revenues, which concluded the quarter at the $19.96B mark. Other parts of the business saw extensive growth, with a 148% and 44% surge in revenues in the energy generation plus storage revenue and services revenue segments, respectively.

Tesla cut prices of its U.S. models for the sixth time this year, leaving it with an average selling price across its vehicle models of $46000, down 11% compared to $51400 in the final quarter of 2022.

However, positive sales growth did not translate into a healthier bottom line as price cuts squeezed margins. At the same time, higher costs of raw materials, commodities, logistics and warranty costs tag teamed to weigh down on the earnings. Gross margins shed 977 basis points to land at 19.3%, while operating margins shed 770 basis points to close the quarter at 11.4%, a two-year low. The quarter concluded with an eye-watering decline in net income of 24% to $2.51B, to the peril of Tesla Investors.

In addition, Tesla was in its most vulnerable position in two years as free cash flows dropped to $441M, leaving it with less to service its obligations and growth prospects than it did in 2021.

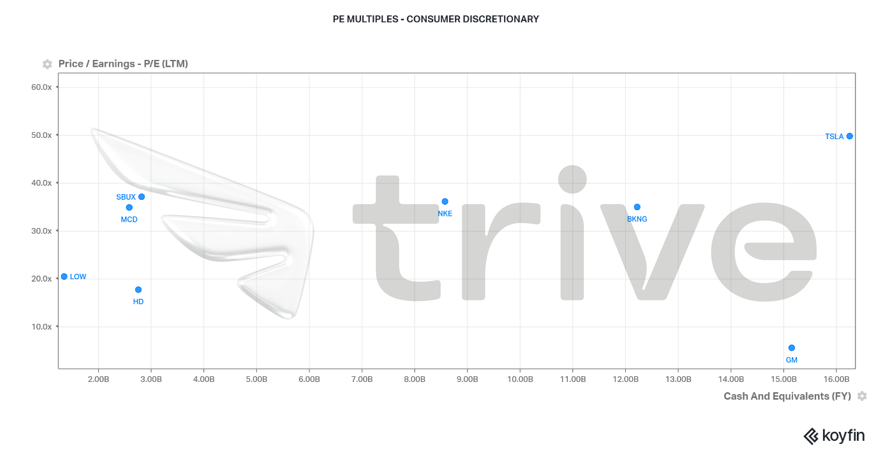

Tesla’s Price to Earnings Multiple (PE) sets it apart as a consumer discretionary mega-cap S&P500 stocks leader indicating its growth prospects. According to S&P Global Commodity Insights, EV sales are forecast to grow well over 50% by 2030. With Tesla’s primary focus on the production and sale of EVs, its PE reflects the industry’s growth potential, which will flow to Tesla as the leader in the industry. Within the sector, refined to an industry basis, Ford and General Motors are far behind Tesla, as their primary focus is presently on the production and sale of combustion engines. Tesla’s share price will likely continue its upward trajectory in the long term, despite taking a knock in 2022.

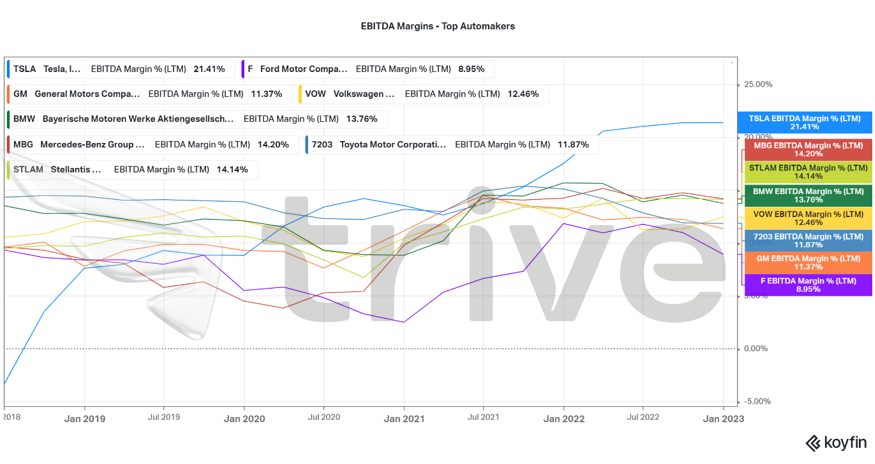

The illustration below compares Tesla’s EBITDA Margin to some of the world’s top automakers. Tesla produces the most operating income per unit sold, making it a leader in the industry, with 21.41%. The next closest competitor is Mercedes Benz Group AG, followed by Stellantis N.V., while the other automaker’s EBITDA Margins land within a narrow range. Tesla’s latest approach of high volumes and low margins is achievable with profitability due to its high margins, over and beyond the industry standard.

Despite reporting a gloomy bottom line, Tesla forecasts that it will deliver 1.8 million vehicles in 2023, which accounts for a respectable 38% growth in deliveries. The outlook is positive for both the industry and Tesla. According to a financial filing from late January, the business looks to capitalise on the growth opportunity by bumping up capital expenditure to between $7B and $9B in 2024 and 2025. This represents an increase in capital expenditure of $1B over the next two years.

After discounting for future cashflows, Tesla’s fair value came in at $201.00 per share, leaving room for just over a 20% gain if the share price moves higher.

Summary

With high-interest rates and a looming mild recession, price cuts will likely maintain or drive up sales going deeper into the year. Along with the anticipated production and delivery of its latest model, the Cybertruck, Tesla could face mild headwinds in the process. Therefore, the share price outlook is stable to positive, given that no force majeure event occurs, leaving the $201.00 per share level probable.

Sources: Tesla Inc, CNBC, Reuters, S&P Global TradingView, Koyfin