The S&P500 futures (CME: ES) has been under the duress of bullish traders that have driven the index higher, with 6.90% gained over the past three weeks to date.

Driving bullish sentiment is growing expectation of a probable rate hike pause ahead, given that the U.S. economy is showing signs of slowing, with the Manufacturing Purchasing Manager’s Index (PMI) lower than expected. At the same time, inflation let go of its growth trajectory, following a decline in the Core PCE Index Month on Month, from 0.5% to 0.3%.

Technical

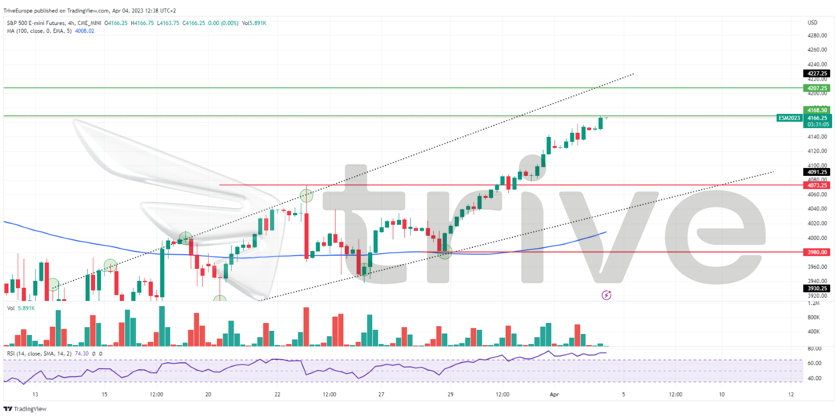

The S&P500 Futures have trended upward, well above the 100-day moving average. A breakout above the prior resistance level fortified the uptrend. Support and resistance were established at the 4073.25 and 4168.50 levels, respectively.

With price trading at the resistance level, a high volume breakout above it could signal bullish momentum preparing to take the index higher. If bulls manage to break through the significance level, they will likely look to the 4207.25 level as the next probable level of interest.

Alternatively, if bearish traders look to use a textbook example of rejected resistance, a reversal is likely. Bears will look to the 4073.25 level with interest if they congregate to undo bullish momentum.

Summary

The week’s highlight will be the Non-farm payrolls due on Friday. Between now and the highlight event, the U.S. JOLTs Job Openings and S&P Global Services PMI will provide short-term volatility. Bulls and bears will likely be bound between the 4073.25 and 4207.25 levels, respectively.

Sources: Reuters, TradingView