Piece Written by Nkosilathi Dube, Trive Financial Market Analyst

In 2023, German equities have exhibited a steady incline, underpinned by a surge in risk appetite amidst shifting market sentiments on interest rates. Notably, the Germany MSCI ETF iShares (EWG – ISIN: US4642868065) stands as a beacon of this resurgence.

This ETF mirrors the MSCI Germany Index, employing a market-capitalization-weighted methodology to gauge the performance of sizable and mid-sized enterprises in Germany. Diversifying across sectors including industrials, consumer discretionary, financials, and healthcare, it offers investors exposure to a broad spectrum of the German economy.

After weathering a challenging 2022, wherein it incurred a substantial 25% market value decline, the EWG has rebounded admirably, boasting a commendable 4.08% year-to-date upswing. The preceding year’s tumultuous descent was chiefly attributed to the European Central Bank’s stringent monetary tightening cycle, its most rigorous in over two decades. This manoeuvre was prompted by robust inflation, resulting in elevated interest rates. Consequently, consumers and businesses faced amplified borrowing costs, curbing spending and escalating expenses for listed companies.

Source: Trive – TradingView, Nkosilathi Dube

Técnicos

The Germany MSCI ETF iShares (EWG) embarked on a noteworthy trajectory in late 2022, carrying its positive momentum into the current year. A breakout from the confining descending channel pattern signalled a shift from a downtrend, fuelled by oversold Relative Strength Index levels. This surge led to a retest of the 100-day moving average, establishing a support level at $19.38.

However, momentum encountered resistance at the $29.56 level, where a brief dip ensued before a retest occurred. This level proved to be a critical juncture, as a double top formation signalled growing downside momentum. Currently, a retracement is underway, with the 38.20% Fibonacci Retracement level entering the fray.

For astute investors, the 50% retracement and the $19.38 level present potential focal points should downside momentum persist. Conversely, a resurgence of optimistic sentiment could propel EWG back towards the $29.56 level.

Fundamentales

Source: Trive – Financial Times, Nkosilathi Dube

The EWG provides concentrated exposure to key sectors, with financial services, industrials, consumer cyclical, and technology forming the backbone, collectively constituting nearly two-thirds of its allocation. Notably, financial services take the lead at 18%, followed closely by industrials at 17%, and consumer cyclical and technology at 16% each.

The ETF’s resilience in the face of surging interest rates can be attributed to its substantial stake in financial services. These stocks thrive in high-interest rate environments, benefiting from amplified net interest income. This fortitude has played a pivotal role in buoying the performance of the EWG ETF.

However, the remaining sectors face a more challenging landscape under the pressure of elevated interest rates. Higher rates result in increased borrowing costs, casting a shadow on earnings and curbing consumer spending. This intricate interplay of sector exposure and interest rate dynamics underscores the nuanced nature of EWG’s portfolio, shedding light on the underlying factors influencing its performance.

Source: Trive – Financial Times, Nkosilathi Dube

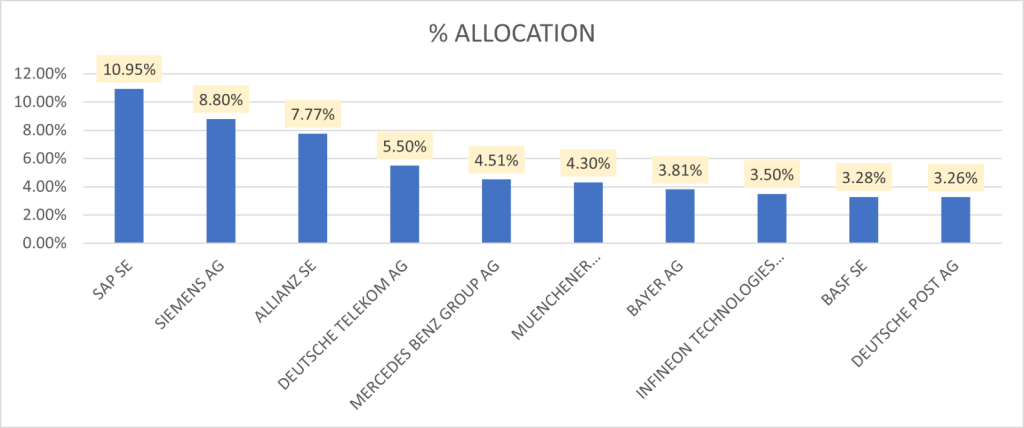

The EWG showcases a strategic allocation strategy, with its top ten holdings commanding a substantial 56% of the total portfolio. This concentrated selection is comprised of venerable blue-chip companies representing a diverse array of sectors.

Within this elite group, investors find a balanced mix of value and growth stocks, embodying a dynamic investment approach. This blend of established, financially robust enterprises not only lends stability to the fund but also offers the potential for both consistent returns and robust capital appreciation. This unique combination of sector diversification and investment styles underscores the thoughtful curation of the EWG ETF, making it an intriguing choice for investors seeking exposure to the German market.

Source: Trive – TradingView, Nkosilathi Dube

The industrial sector, a cornerstone of the German economy, has experienced a marked decline in productivity since 2020. This downturn is vividly reflected in both the German Industrial Production metric and factory orders. These metrics serve as barometers, measuring the output of firms integrated into the industrial sector and the influx of new orders received by manufacturers, respectively. The final Purchasing Managers’ Index (PMI) for manufacturing from HCOB continued its downward trend for the sixth consecutive month in July.

Year-on-year, industrial production has regressed to levels reminiscent of the pre-pandemic era, marking a notable departure from the peak observed in 2021 when pandemic-related disruptions began to recede. This downturn has had a discernible impact on the performance of industrial sector stocks, which constitute the second-largest portion of the EWG ETF. As productivity waned, so did the fortunes of these stocks, illustrating the sector’s pivotal role in shaping the fund’s overall performance.

Source: Trive – TradingView, Nkosilathi Dube

Germany’s economy showed no signs of recovery in the second quarter, remaining stagnant after a winter recession. This cements its position as one of the world’s weakest major economies. The GDP figure, which revealed zero growth, aligns with an earlier estimate. Year-on-year, the adjusted GDP contracted by 0.2% in Q2. This marks two consecutive quarters of contraction, meeting the technical definition of a recession.

Resumen

The EWG has adeptly weathered economic challenges, standing resilient amidst the European Central Bank’s rigorous monetary policy and industrial productivity declines. Offering diversified exposure across pivotal sectors, its balanced approach combining stability and growth potential provides a well-balanced approach to diversification. However, the underlying weaknesses in the German economy may pose short-to-medium-term pressures for the EWG. This calls for prudent consideration of risk factors in investment decisions.

Sources: London Stock Exchange Group, European Central Bank, Federal Statistical Office, HCOB, Reuters, TradingView, Koyfin