Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Levi Strauss & Co. (ISIN: US52736R1023) navigated a challenging third quarter, unveiling a mixed performance that mirrored broader trends in the consumer discretionary sector.

While the denim retailer surpassed Wall Street’s earnings expectations with earnings per share of $0.28, a commendable 3.58% above projections, it fell just shy on the revenue front, recording $1.51 billion, missing the mark by nearly 2%.

This divergence in performance reflects a broader trend in the consumer discretionary sector, which has seen a waning investor confidence, resulting in a 14.88% year-to-date decline in Levi’s share price. The prevailing headwinds can be attributed to weakening shopping trends in department stores and large-scale retailers across the U.S.

These market shifts have positioned the company for a second consecutive year of contraction, reflecting the broader challenges facing the consumer discretionary landscape. Concurrently, Levi’s has grappled with the strengthening Greenback, as growing yields propelled it to 10-month highs, impacting not only its performance but also contributing to a 4.31% drop in the S&P500 and a 7.08% dip in the Consumer Discretionary Select Sector Index.

Técnicos

Levi’s stock performance has charted a distinct course since its peak in May 2021, characterized by a discernible downward trend. This trajectory finds validation in the share price’s consistent trading below the 100-day moving average within a descending channel pattern. Notably, a pivotal moment occurred at the $18.48 per share mark, witnessing a surge in selling activity that precipitated a sharp decline.

Yet, at $13.21 per share, a fortification emerged, establishing a sturdy support level. This juncture has proven pivotal, as attempts to breach it have faltered, with two retests ultimately culminating in a reversal as steadfast buyers defended their ground. The 38.20% Fibonacci Retracement level assumed significance as an intermediate resistance post the support level’s reversal.

Presently, the share price finds itself perched at the support level, potentially emboldening optimistic investors to consider a position consistent with historical trends. Conversely, a substantial volume-driven breach beneath this support level could usher in further downward momentum, potentially targeting the $11.84 per share level, a support base formed back in July 2020. Optimistic investors may keep a watchful eye on the 38.20% level at $15.07 per share, ready to seize opportunities should momentum shift favourably.

Fundamentales

Levi’s recently released its third-quarter financial report, revealing a nuanced performance amid shifting market dynamics. The company’s net revenues held steady at $1.5 billion, aligning with the previous year on a reported basis, but showed a 2% dip in constant-currency terms compared to Q3 2022.

Notably, the Direct-to-Consumer (DTC) segment emerged as a bright spot, with net revenues surging by an impressive 14%. This growth was underpinned by robust expansion across the company-operated mainline and outlet stores, as well as in e-commerce channels. Impressively, e-commerce revenues soared by 19%, showcasing strong traction across all brands. However, the wholesale segment faced headwinds, experiencing an 8% decline in net revenues on a reported basis. While Asia and Latin America showed growth, North America and Europe witnessed declines.

In the Americas, DTC net revenues climbed by 12%, propelled by the company-operated stores and e-commerce channels. Wholesale revenues, however, slumped by 12%, reflecting softness in North America, though Latin America demonstrated some growth.

Europe faced a moderate decline in net revenues, down 2%. Excluding Russia, the decrease was slightly more pronounced at 3%. DTC net revenues painted a more positive picture, increasing by 10%. This rise was primarily attributed to company-operated stores and e-commerce channels. On the other hand, wholesale revenues in Europe dropped by 10%, indicating a cautious approach among wholesale partners.

Asia emerged as a strong performer, with net revenues shooting up by 12%. This growth was widespread, with robust expansion in China. DTC net revenues followed suit, rising by 15%, driven by the company-operated stores and e-commerce. Wholesale net revenues also saw a healthy increase, up 8%.

In terms of profitability, the operating margin saw a significant contraction, dropping from 13.1% in Q3 2022 to 2.3%. This was attributed to higher operating expenses and a notable impairment charge related to the Beyond Yoga acquisition. Adjusted EBIT margin declined by 330 basis points to 9.1%, primarily due to gross margin contraction and selling, general and administrative deleverage resulting from increased DTC expenses.

Looking ahead, Levi Strauss & Co. anticipates reported net revenues to remain relatively stable, with a potential upswing of up to 1% year-over-year. In terms of earnings per share (EPS), the adjusted diluted EPS is foreseen to land on the lower end of the previously provided guidance range of $1.10 to $1.20.

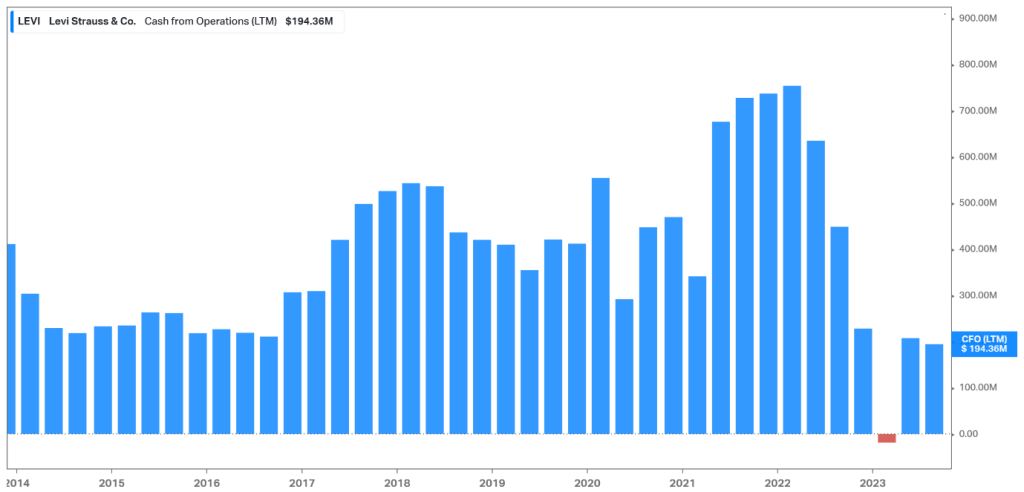

Levi’s cash from operations has experienced a notable dip, contrasting sharply with its peak performance in 2022. Remarkably, the current cash flow falls even below pre-pandemic levels. This shift is primarily attributed to alterations in working capital stemming from increased accounts receivables and accrued expenses.

After discounting for future cash flows, a fair value of $14.11 per share was derived.

Resumen

Overall, while Levi Strauss & Co. showcased strength in its DTC segment and in certain international markets, challenges in the wholesale segment and margin pressures warrant attention. The company’s prudent inventory management strategies are expected to further bolster its position in the coming quarters as it navigates the intricacies of a dynamic global market.

Sources: Levi Strauss & Co, Reuters, CNBC, Nasdaq, Dow Jones Newswire, Chicago Board Options Exchange, TradingView, Koyfin