Investing can be daunting, as exposure to the stock market can result in various emotions, from joy to heartbreak. While all investors have the common goal of growing their investments, it is often easier said than done, but it does not necessarily have to be.

Setting up any investment portfolio starts by defining your goals and objectives. Determining what you seek to achieve with your investment is crucial to selecting suitable investment options to reach your financial goals. Once your investment goals are stated, the process of growth can begin.

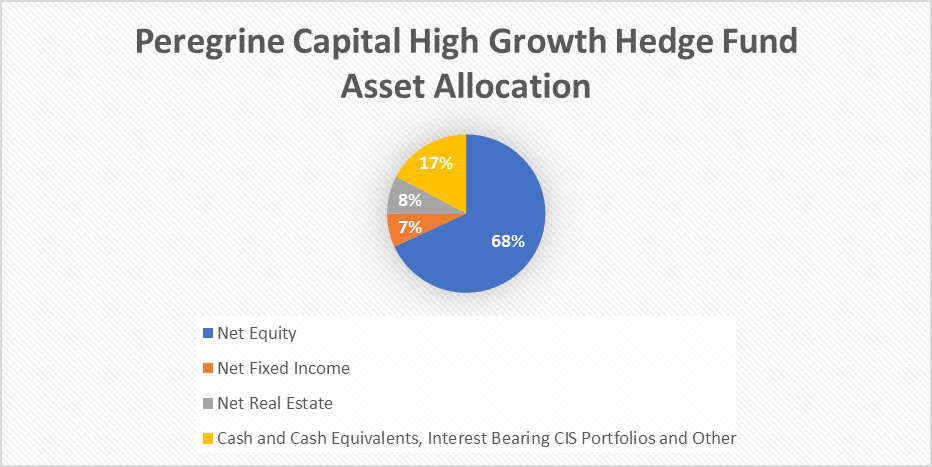

One of the most vital yet often underrated principles of investing is diversification. Too often, investors associate the growth of a portfolio with investments in high-growth assets. However, these assets often come with a higher level of risk, which could be counterproductive as the risk of losses gets amplified. Growing your investment requires exposure to various asset classes, such as commodities, stocks, bonds, and real estate, to enhance your returns. Diversifying your portfolio allows you to reap the benefits of growth in specific sectors while shielding your investment from the adverse effects of a single investment on your overall portfolio. The pie chart below shows the asset allocation of a high-growth fund from Peregrine Capital, highlighting the fact that exposure to lower-growth asset classes such as fixed income and cash remains essential, even with a portfolio objective of high growth. A large allocation to fixed-income and interest-bearing investments plays just as much of a role in the portfolio’s expansion as the high-growth equity allocation.

Secondly, it is vital to take a long-term approach. The stock market historically has an upward trend. By avoiding the psychology inherent in shorter-term market fluctuations and volatility, an investor can make long-term investments in quality assets to grow in value over more extended time periods. The graph below demonstrates this factor. The S&P 500 has been trending up enormously over the last twenty years. While multiple investors panic-sold assets in the Covid-19 downturn, the long-term investor would have pared the losses and benefitted from the eventual recovery. Of course, past performance does not guarantee future outcomes. Still, a longer time horizon gives investors a higher chance of growing their portfolio in line with the historical trend characteristics of the stock market rather than engaging in short-term volatility.

Another way to minimise the impact of short-term volatility on the growth of your investment portfolio is by using Dollar Cost Averaging. With this strategy, instead of executing your entire investment into a stock or ETF at a single price, an investor can buy in at regular intervals, regardless of the price. In this case, even when the market moves against you, instead of realising a loss by selling off your investment, you can buy in at more attractive valuations to benefit from the potential reversal in the market.

Another often overlooked principle in investing is compound interest. You can start earning interest on higher principal amounts by reinvesting the interest you earn on your investment portfolio. In this case, your interest will also start earning interest, which compounds your returns in the long term. Investors like Warren Buffet have taken full advantage of this principle, harnessing its benefits through long-term investments in dividend-paying companies. Through reinvesting the dividends, his investments have compounded in value, showcasing the growth potential of this underrated phenomenon. The path to growing your investment portfolio may be challenging. However, an investor can adopt certain principles and strategies to increase their chances of a high-growth investment journey. Most importantly, investors can take a long-term approach while taking advantage of diversification and compound interest principles to accelerate their growth while minimizing their risk exposure. However, nothing is given in the stock market, and an investor should always be up to date with the latest developments in the market to ensure they make the most informed investment decisions by identifying high-quality assets and rebalancing their portfolio correctly to meet their financial goals and objectives.