Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Amazon.com Inc. (ISIN: US0231351067), the e-commerce behemoth, recently experienced a shift in its stock performance trajectory after six consecutive months of gains. September witnessed a 7.89% decline in Amazon’s share price, a departure from its earlier upward momentum fuelled by stellar quarterly results and a tech stock buying frenzy.

Amazon’s past quarter earnings report revealed earnings of $0.65 per share, surpassing Wall Street’s expectations by an impressive 83.66%. Furthermore, the company generated a staggering $134.38 billion in revenue, exceeding projections by 2.20%. This robust financial performance was instrumental in driving earlier gains.

In a strategic move, Amazon recently earmarked $4 billion for investment in the artificial intelligence (AI) sector, specifically in Anthropic, a generative AI specialist. This investment underscores Amazon’s unwavering commitment to AI technology and innovation within the tech sector.

However, despite these achievements, Amazon encountered headwinds in September due to regulatory pressures. The Federal Trade Commission (FTC) charged the company with anti-competitive practices, alleging that it harmed consumers with higher prices, as part of broader efforts to address Big Tech’s dominance in the online landscape.

Técnicos

In 2023, Amazon’s stock charted a new course, breaking free from a year-long downtrend. The exit from the descending channel pattern, coupled with a resurgence above the 100-day moving average, signalled a potential shift in sentiment. A robust support level emerged at $81.44 per share, solidified by a strong upward surge.

However, the rally met resistance at $145.16 per share, a point previously marked by a significant selloff in August 2022. This reversal prompts investors to scrutinize Fibonacci Retracement levels for potential support zones. The $113.78 per share level, aligning with the 50% Fibonacci Retracement, could offer an intermediate foothold if selling pressure persists.

Should the stock breach this level on substantial volume, it may signal continued selling, with the $81.44 per share mark beckoning as an attractive point for bargain hunters. On the flip side, optimistic investors will likely have their sights set on the $146.16 per share level, should momentum favour their cause.

Fundamentales

Amazon’s second-quarter results showcased robust growth, with revenue surging by 11% to an impressive $134.4 billion. This was driven by strong performances across all segments, notably in Amazon Web Services (AWS), which saw a 12% year-on-year growth, contributing significantly to overall expansion. The North American and International segments also posted solid double-digit growth. Amazon’s advertising services played a key role, witnessing a noteworthy 22% increase, boosting revenues to $10.7 billion compared to the previous year.

Source: Trive – Amazon.com Inc, Nkosilathi Dube

Strategic cost-cutting measures implemented in the previous year paid off, reflected in the soaring operating income, more than doubling to $7.68 billion. AWS played a significant role, accounting for 70% of the operating income. Amazon’s net income also saw a remarkable turnaround, posting a profit of $6.75 billion compared to a $2.03 billion loss the previous year, primarily attributed to a valuation markdown of $3.9 billion in its stake in Rivian. A significant headcount reduction of 4% to 1.46 million highlights the company’s focus on profitability and efficiency.

Amazon’s optimistic guidance for the current quarter underscores its positive outlook. Sales are projected to grow between 9% to 13% year-on-year, reaching an impressive range of $138.0 billion to $143.0 billion. Operating income is also expected to experience substantial growth, with projections ranging from $5.5 billion to $8.5 billion.

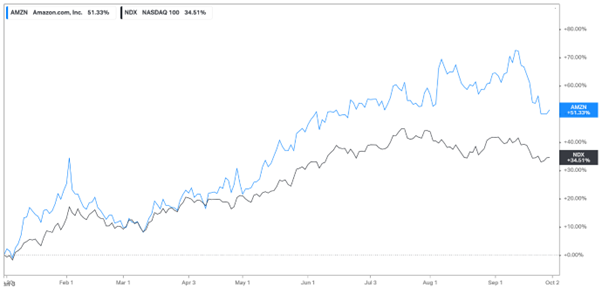

Amazon’s share price has outperformed the NASDAQ100 index, with an impressive year-to-date gain of 51.33%, compared to the NDX’s 34.51% growth. The stock’s positive correlation with the index underlines its significance as the third-largest company by market capitalization, comprising just under 6% of the index’s weighting. This robust performance reflects Amazon’s resilience and dominance in the tech sector, making it an appealing choice for investors seeking strong returns in the current market climate.

Source: Trive – Koyfin, Nkosilathi Dube

However, Amazon’s profitability metrics, such as Earnings Before Interest and Tax margin and Net Income Margin, lag behind other mega tech stocks listed on NASDAQ. This is attributed to the company’s strategic low-pricing approach, which bolsters market share but leads to narrower margins compared to its tech peers.

While this strategy may create barriers to competition, investors seeking higher profitability levels might be deterred by the company’s comparatively lower margins. Additionally, Amazon’s Return on Equity (ROE) faces challenges compared to its tech counterparts due to its low pricing strategy, with an ROE of 8.71%. This warrants careful consideration for investors seeking higher returns on their equity investments.

Source: Trive – Koyfin, Nkosilathi Dube

The FTC asserts that Amazon’s consistent unlawful practices hinder fair competition, granting it monopolistic authority to raise prices, diminish quality, and impede innovation for consumers and businesses. The lawsuit encompasses Amazon’s dominance in online superstores and marketplace services, spotlighting alleged tactics like anti-discounting policies, coercive “Prime” eligibility criteria, and search result biasing. These allegations signal a critical examination of Amazon’s market influence and its impact on competition and consumer welfare. This lawsuit could negatively affect its share price if fines are imposed that could materially impact the company’s costs and earnings.

After discounting for future cash flows, a fair value of $154.72 per share was derived.

Resumen

Despite regulatory challenges, Amazon’s strategic investments in AI and robust earnings report bolstered its market positioning. While profitability metrics may trail peers, Amazon’s dominant market presence and innovative strides make it a compelling choice for investors seeking growth in the tech sector. The recent FTC lawsuit introduces a potential risk factor that could impact the company’s performance and share price.

Sources: Amazon.com Inc, Reuters, CNBC, TradingView, Koyfin