Piece by Mfanafuthi Mhlongo, Trive Financial Market Analyst

Welcome to the digital realm where pixels meet investment and entertainment takes on a whole new level. Video games have evolved from mere pastimes to a multi-billion-dollar industry that has captured the hearts of millions around the world.

The Gaming Boom: Riding the Wave of Explosive Growth

As the demand for interactive entertainment skyrockets, the video game industry has become a dynamic force to reckon with. Bolstered by technological advancements, such as virtual reality, augmented reality, and cloud gaming, video game companies are experiencing a surge in revenue and global reach.

The gaming industry proved its stellar power in 2022, with the global video game market reaching an estimated supernova-like $220.79 billion market capitalization and being projected to achieve a meteoric compound annual growth rate (CAGR) of 12.9% in the next eight years to an impressive $583.69 billion by 2030.

The Digital Playground: Key Players in the Gaming Universe

The video game industry is home to an array of influential companies, each with its own unique strengths and market positioning. From the established giants to the innovative disruptors, let’s explore some key players shaping the gaming universe:

Electronic Arts Inc. (NASDAQ: EA): As one of the powerhouses in the gaming industry, Electronic Arts boasts a robust portfolio featuring fan-favourite franchises like “FIFA” and “Madden NFL.” By combining innovative gameplay mechanics with captivating storytelling, EA has established a strong player base and solid financial performance, consistently outpacing market expectations.

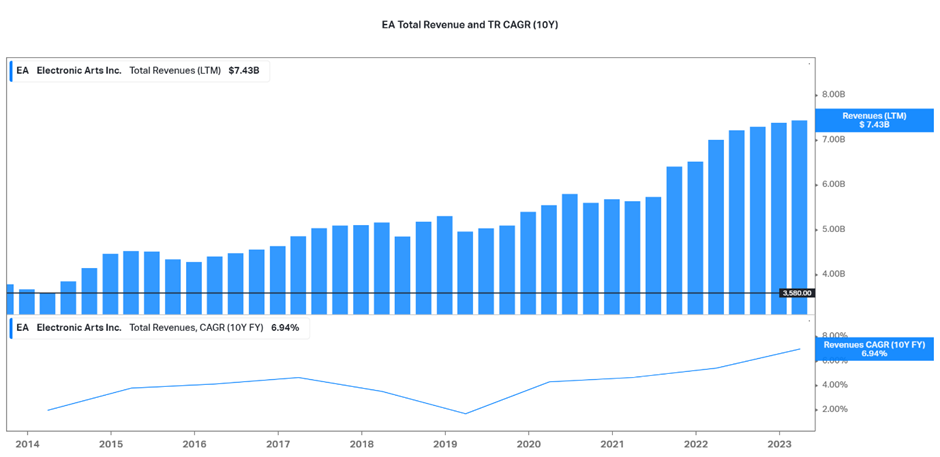

EA has demonstrated impressive growth, with total revenue experiencing an incredible 104% increase to $7.3 billion in 2023Q1, compared to $3.58 billion in 2014Q1. Its cumulative annual growth rate of 6.94% over the past decade also reflects its success in the dynamic video game industry.

Source: TradingView, Trive Financial Services Malta Limited

Activision Blizzard, Inc. (NASDAQ: ATVI): With a formidable lineup of legendary titles such as “Call of Duty” and “World of Warcraft,” Activision Blizzard has mastered the art of captivating players and creating immersive gaming experiences. The company’s strategic focus on expanding its esports ecosystem and enhancing player engagement has propelled its stock to new heights.

Activision Blizzard has also achieved remarkable financial success, with total revenue skyrocketing to an impressive $8.14 billion in 2023Q1 from $4.37 billion in 2014Q1. Furthermore, boasting a net income margin of 22.82%, the company demonstrates strong profitability and effective cost management.

Source: TradingView, Trive Financial Services Malta Limited

Take-Two Interactive Software, Inc. (NASDAQ: TTWO): Take-Two Interactive stands out as a true game-changer, renowned for its iconic titles, including the critically acclaimed “Grand Theft Auto” series. The company’s commitment to pushing creative boundaries and delivering immersive narratives has propelled its stock to meteoric heights, enticing investors with its strong growth trajectory.

TTWO has also seen impressive growth, with total revenue increasing by 195.58% from 2018Q3 ($1.81 billion) to 2023Q1 ($5.35 billion). With a cumulative annual growth rate of 24.44% over the past five years, the company’s consistent expansion is evident. Additionally, boasting a gross profit margin of 51.35%, Take-Two showcases strong profitability and effective cost management strategies.

Source: TradingView, Trive Financial Services Malta Limited

Nintendo Co., Ltd. (OTCMKTS: NTDOY): A household name in the gaming industry, Nintendo has captured generations of players with its iconic characters and innovative consoles. With successful franchises like “Mario Bros”, “The Legend of Zelda”, and “Pokémon”, Nintendo’s ability to combine nostalgia with innovation has solidified its position as a major player in the market.

Nintendo has seen a remarkable turnaround in the past decade, with total revenue increasing by 280.15%, surging to ¥1,601.68 billion in 2023Q1 from ¥571.73 billion in 2014Q1. Moreover, the company has achieved significant improvements in its profitability, with positive EBIT margins of 31.49% in 2023Q1 compared to -8.12% in 2014Q1. Similarly, Nintendo’s net income margin has increased to 27.02% in 2023Q1 from -4.06% in 2014Q1, indicating enhanced financial performance and effective cost management strategies.

Source: TradingView, Trive Financial Services Malta Limited

Power Players: A Decade of Unmatched Performance

Over the past ten years, some of the top video game companies have seen their stock prices soar, delivering massive returns for investors. Electronic Arts (EA) is the poster child for the video game stock market. Over the past ten years, EA’s stock has achieved an incredible total return of 464.92%. This is significantly higher than the returns of the S&P 500 Index (176.05%) and the Nasdaq 100 Index (418.13%).

Take-Two’s and Activision Blizzard’s stock returns for the same period have been a mesmerizing 852.34% and 520.71%, respectively, while Nintendo’s return of 329.51% trumped the S&P 500 but fell short of the Nasdaq 100’s spectacular return.

Source: TradingView, Trive Financial Services Malta Limited

Zusammenfassung

In the world of investing, video game company stocks offer an enticing opportunity to participate in the rapidly growing and ever-evolving gaming industry. With explosive revenue growth, a wide range of influential players, and powerful drivers such as digital transformation and the rise of e–sports, video game stocks seem to being considered by investors seeking exposure to this dynamic sector.

Quellen: TradingView, KoyFin, Investopedia, GWI, Grand View Research, Morning Star, Nasdaq, Market Business News

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.