Piece written by Nkosilathi Dube, Trive Financial Market Analyst

On 14 July 2023, Wells Fargo & Co (ISIN: US9497461015) reported its second quarter 2023 earnings which beat Wall Street expectations, leading to the share price trading 3% higher in pre-market hours. Earnings of $1.25 per share exceeded expectations by 8.21%, while revenues followed suit, landing 2.08% above forecasts at $20.53B for the quarter.

The steep interest rate environment contributed to the company’s successful quarter as net interest income surged. Among the many positives that could be cherrypicked from the U.S.’ fourth-biggest bank by total assets, average deposits were down 7% to $1.3 trillion, most likely driven by withdrawals made by customers at the height of the banking sector crisis in March 2023. With interest rates still sky-high, the bank’s top line will likely be cushioned from the downside as net interest income remains elevated. Will Wells Fargo’s positive quarter carry over into the next?

Technische Analyse

Wells Fargo’s share price suffered significant losses at the onset of the banking sector crisis as it shed 22.82% in market value during the peak of the crisis. The selloff took the share price into a downtrend as the price crossed below the 100-day moving average to exit an ascending channel pattern which commenced midway through 2022.

The share price has since begun recovering from the selloff, and with the fundamentals pointing towards greener pastures for the quarter, investors could find reason to be more comfortable in the possibility of the stock moving higher. Support was established at the $36.43 per share level and has been respected diligently by the market. Resistance, at $48.84 per share, was established at the year-to-date high just prior to the selloff induced by the banking sector crisis.

With the share price making its way higher, it has come into direct confrontation with the ascending channel pattern. A re-entry into the ascending channel pattern could be one of the market’s prospects. A high volume breakout above the 61.80% Fibonacci Retracement Golden Ratio could indicate the presence of substantial demand for the stock. Optimistic investors could therefore be in contention to see the price through to the resistance level at $48.84 per share.

Fundamentalanalyse

The increase in client interest payments boosted Wells Fargo’s profit during the second quarter. Compared to the same period a year prior, net income increased to $4.94B ($1.25 per share), up from $3.14B ($0.75 per share).

In the second quarter, Wells Fargo’s net interest income increased 29% to $13.16B. Banks have gained by charging customers more for borrowing money since the Federal Reserve raised interest rates to rein in inflation. After keeping the policy rate constant in June, Fed Chair Jerome Powell hinted late last month that the central bank would likely resume its campaign of rate increases. Consumer and small business banking earned around $6.6 billion, a 19% increase from $5.5 billion the previous year.

Late last month, after passing the Fed’s yearly health check with flying colours, the bank hiked its dividend in tandem with competitors. The findings demonstrated that large lenders had sufficient capital to withstand a severe economic crisis.

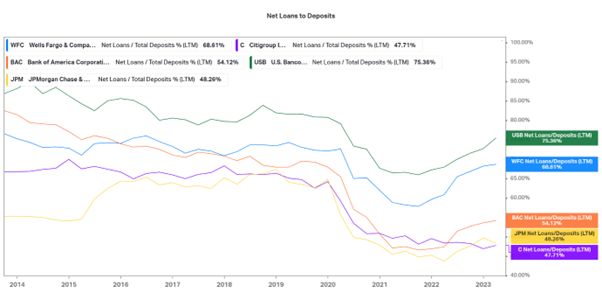

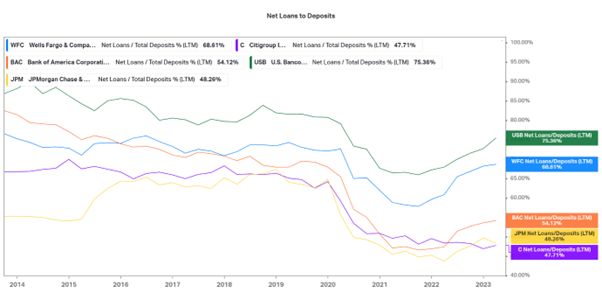

Wells Fargo offers the least protection from risk events among the major U.S. banks based on its Core Tier 1 Capital. With a 10.8× capital ratio, the bank has a sufficient amount of liquid assets on hand to be able to absorb losses without running the danger of failing but is more at risk than its competitors as it has the fewest reserves after U.S. Bancorp (ISIN: US9029733048).

Wells Fargo, one of the largest banks in the industry, ranks second in its class behind U.S. Bancorp, with a net interest to average assets margin of 2.4×. Regarding earnings efficiency, the bank is among the best at producing interest income from its asset base, making it one of the top banks to invest in from a revenue-generating perspective.

A more significant loan to deposits ratio would benefit Wells Fargo’s operations since it allocates more assets to create income as it is among the leaders in producing net interest income on its asset base. Only U.S. Bancorp has more loans to deposits, making Wells Fargo one of the industry leaders in this area. Given its larger allocation of loans to assets, its top line and earnings may be more appealing than those of its rivals due to its higher income-generating efficiency.

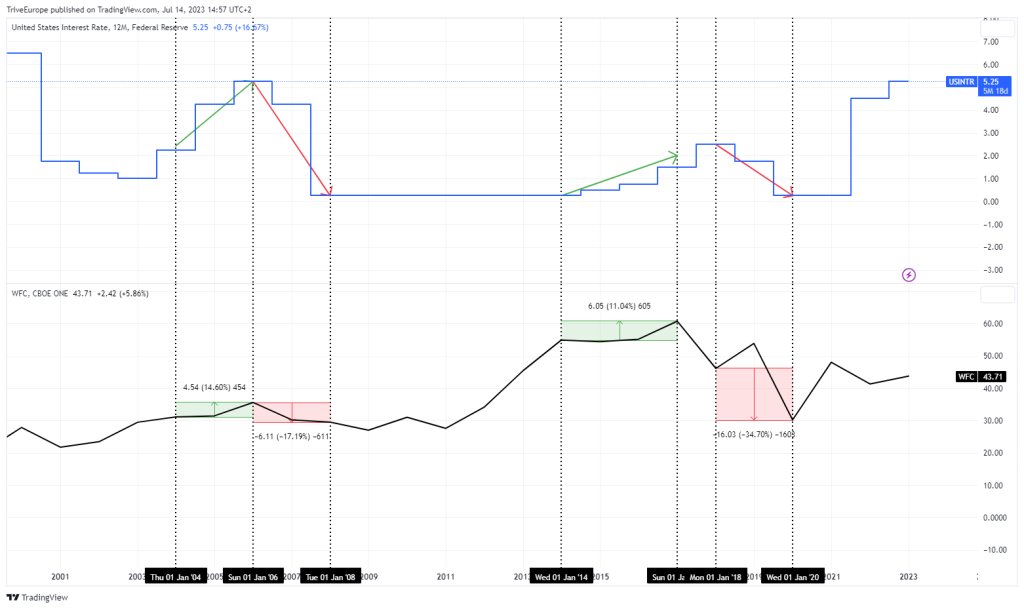

Wells Fargo has a strong positive correlation to U.S. interest rates as the price moves in tandem with the interest rate direction, as illustrated above. When interest rates rise (e.g. the 2004 to 2006 period), the share price follows, as revenues and earnings receive a boost from the bank’s core business, interest income. Likewise, when interest rates decline (e.g. 2006 to 2008 period), the share price takes a knock as interest income takes a hit.

After discounting for future cash flows, a fair value of $56.00 per share was derived.

Wells Fargo increased its forecast for net interest income for the full year, noting that it now expects the measure to increase by 14% in 2023 rather than the previously anticipated 10%.

Zusammenfassung

Since interest rates are at their highest levels since 2006, Wells Fargo is potentially in a favourable environment that could promote revenue growth in the medium term. The company’s positive correlation to interest rates will likely keep its share price elevated, with the likelihood of it closing down on its $56.00 per share fair value.

Sources: Wells Fargo & Co, Reuters, CNBC, Bankrate, Financial Times, Federal Reserve, CBOE, Insider Intelligence, TradingView, Koyfin