Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

GameStop Corp (ISIN: US36467W1099) recently unveiled its second-quarter earnings, delivering a performance that surpassed expectations, yet it continues to grapple with losses. Despite Wall Street anticipating a loss per share of $0.14, the company reported a more favourable figure of -$0.03, signalling a notable outperformance. Additionally, revenue exceeded estimates by nearly 2%, reaching an impressive $1.16 billion.

Following a challenging 2022, where the company’s stock witnessed a 50% dip in market value due to market preferences shifting towards safe havens amid rising interest rates, GameStop experienced a remarkable turnaround this year. A profitable final quarter in fiscal year 2022 propelled the share price to nearly match its previous year’s losses.

However, the stock’s momentum faltered as first and second-quarter results showed losses per share, causing a dent in investor confidence. This setback ultimately nullified the gains achieved earlier this year, resulting in a modest year-to-date growth of only 1.57%, much lower than the broader stock market, represented by the S&P500’s 16.30% growth.

Source: Trive – Koyfin, Nkosilathi Dube

Technische Analyse

GameStop’s tumultuous price journey reflects the volatility seen in the meme stock craze of 2021. At its peak, the stock surged to $120.75 per share. However, since then, it has plummeted, now trading at an 84% discount from its peak, largely attributed to concerns over its financial performance.

Technical analysis highlights a significant development, with the formation of a falling wedge pattern, which triggered a sharp decline. The stock found a foothold at $15.58 per share, a level validated by a robust rally indicating strong demand. Despite this, upward momentum was thwarted at $27.65 per share, leading to another downturn.

The breach below the 61.80% Fibonacci Retracement level intensified the downward pressure, edging the share price closer to the crucial support level. Optimistic investors have defended this level historically, and this could open the door to a potential reversal, with eyes on the $27.65 per share mark if momentum shifts favourably.

However, underlying business weakness, reflected in subdued earnings, could impede confidence. A breach beneath the support level on high volumes may signal eroding trust in the stock, exposing it to further downside risks. In this case, the next point of interest will likely be the swing low of $10.00 per share, which formed prior to the meme stock rally.

Fundamentalanalyse

GameStop Corp has navigated a dynamic quarter with noteworthy shifts in its performance. The company’s sales surged from $1.136 billion to $1.164 billion compared to the previous year, reflecting a commendable 2% increase. Notably, this growth was propelled by a major software launch and robust sales of new gaming hardware, particularly consoles, on a global scale. However, there was a dip in the sales of collectable items like apparel, toys, and cards.

One striking development was the stark contrast in sales trends between international markets, led by Europe, which saw an upswing, and the U.S., where sales experienced a 4.2% decline. This highlights the shifting dynamics of the gaming industry, with evolving preferences.

GameStop’s strategic efforts in managing expenses bore fruit, as selling, general, and administrative costs decreased by 8%, making up 27.7% of net sales compared to the previous year’s 34.1%. This disciplined approach significantly contributed to a noteworthy improvement in net loss, which plummeted from $108.7 million to $2.8 million.

Despite the challenges posed by the evolving landscape of video game acquisition, GameStop’s financial position strengthened considerably. The company closed the quarter with an impressive $1.195 billion in cash, cash equivalents, and marketable securities. This solid financial footing provides a stable foundation for future growth and strategic initiatives.

Furthermore, GameStop’s prudent financial strategy is evident in its limited long-term debt, which is confined to a low-interest, unsecured term loan associated with the French government’s COVID-19 response. This approach safeguards the company’s financial flexibility and minimizes interest-related financial strain.

Looking ahead, GameStop faces the imperative task of adapting to the changing gaming landscape, with a growing emphasis on digital distribution and mobile gaming. Balancing this with its traditional strengths in physical gaming sales and collectables will be key to its sustained success.

After discounting for future cash flows, a fair value of $19.46 per share was derived.

Source: Trive – Koyfin, Nkosilathi Dube

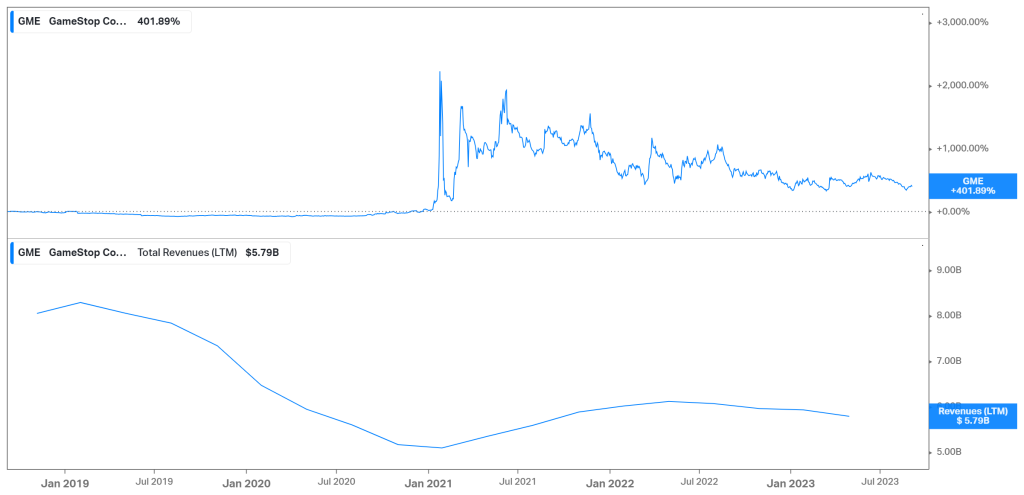

GameStop’s financial narrative unveils an intriguing paradox. While revenue has witnessed a notable decline from its 2019 peak, the share price remains buoyant above the period of higher revenue generation. However, as the meme stock fervour subsided and confidence in the company’s financials waned, investors adjusted their valuations, leading to a share price correction. Notably, despite the challenges, there’s a glimmer of hope as revenue shows signs of a rebound from the dip observed in 2021.

Source: Trive – Koyfin, Nkosilathi Dube

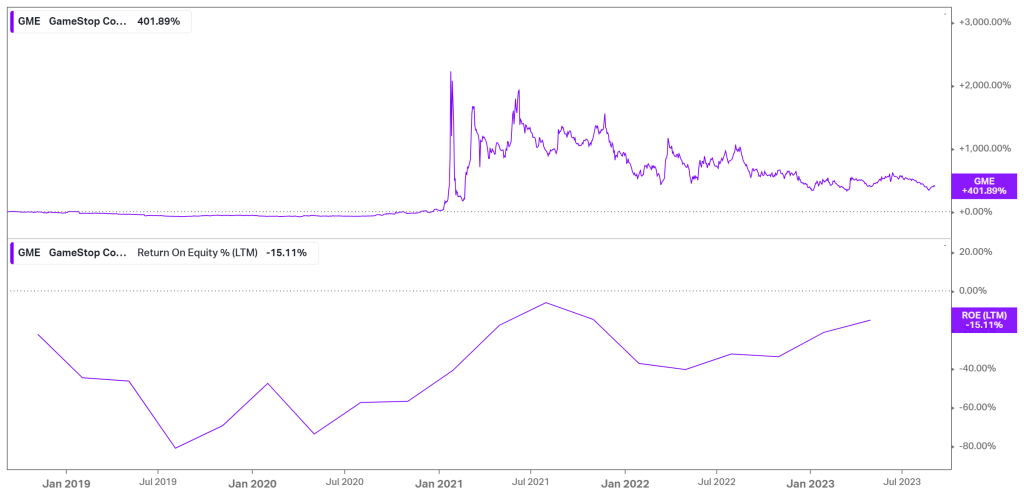

Over the past five years, GameStop has made commendable strides in shoring up its profitability. The company has successfully narrowed its losses by bolstering sales and implementing effective cost-management strategies. However, the Return on Equity (ROE) still stands at -15.11% for the latest twelve months, indicating room for further improvement. In light of this, coupled with the fading enthusiasm around meme stock investing, GameStop’s share price has been more aligned with its financial performance, showcasing a steady decline.

Zusammenfassung

In conclusion, GameStop’s Q2 performance is marked by positive strides in sales, cost management, and financial positioning. It reflects a resilient response to industry shifts and sets the stage for a strategic repositioning in the ever-evolving gaming market. However, given the weakness in the consumer discretionary sector, driven by steep inflation and interest rates, GameStop’s fair value of $19.47 per share could prove a steep hill to climb.

Sources: Gamestop Corp, Reuters, CNBC, Dow Jones & Company, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with Trive Financial Services Malta Limited. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.